Hang Seng Index Futures - Consolidating Above the Immediate Support Level

rhboskres

Publish date: Fri, 30 Jul 2021, 05:17 PM

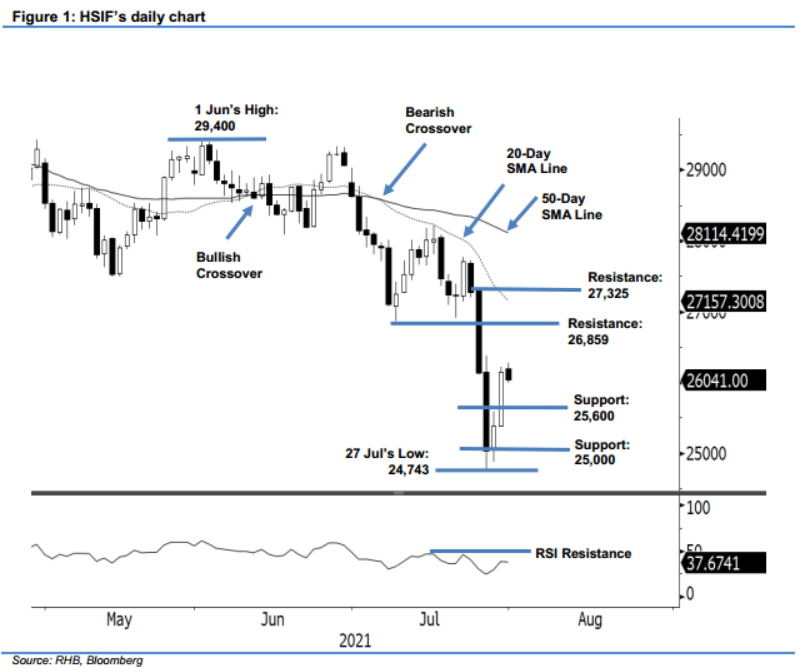

Maintain long positions. The HSIF’s July futures contracts extended the technical rebound yesterday, surging 762 pts to settle the day session at 26,146 pts with a white body candlestick – it printed a second consecutive bullish candlestick after establishing an interim low at 24,743 pts. The July futures contracts expired after that. During the evening session, mild proft-taking sent the HSIF August futures contracts lower – the index last traded at 26,041 pts. The latest technical rebound will continue as long as the HSIF sustains above the 25,600-pt support level. However, since the RSI has yet to cross the 50% threshold, we expect a minor pullback to retest the support level if profit-taking activities extend. As this juncture, we will ride on the bullish momentum and keep to our positive trading bias.

We recommend traders shift to the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To manage the trading risks, the stop-loss level is set higher at 25,300 pts.

The immediate support remains at 25,600 pts, followed by the 25,000-pt psychological level. The immediate resistance level is pegged at 26,859 pts, or the low of 9 Jul, and followed by 27,325 pts – the high of 26 Jul.

Source: RHB Securities Research - 30 Jul 2021

.png)