WTI Crude - Bears Back in Control

rhboskres

Publish date: Wed, 04 Aug 2021, 04:50 PM

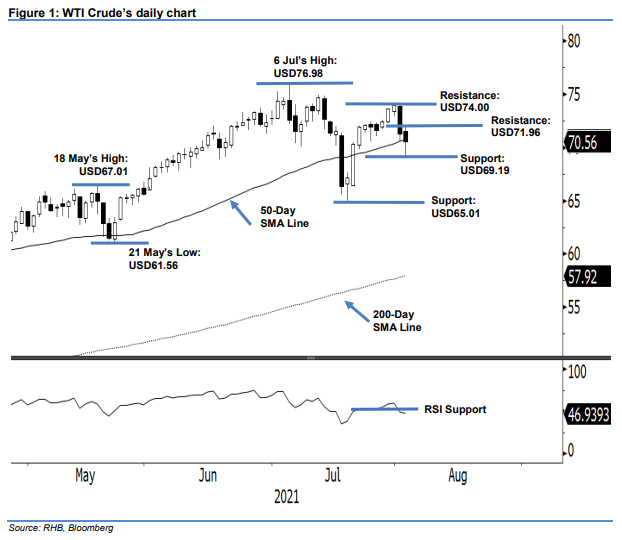

Trailing-stop triggered; initiate short positions. After Tuesday’s deep profit-taking, the WTI Crude continued to see selling pressure yesterday, falling USD0.70 to close at USD70.56. The commodity opened higher at USD71.52, and whipsawed towards the day’s high of USD71.96 before selling pressure brought it lower during the European trading hours to hit the USD69.19-day low. It then bounced off to recoup some of its losses during the US trading hours, but still closed lower. The bearish candlestick with long lower shadow that emerged yesterday – breaching below the 50-day SMA line – still signals that negative momentum will grow in tandem with the RSI falling below the average line. As the trailing-stop was breached, we shift to a negative trading bias.

We closed out the long positions initiated at USD70.30 or the closing level of 21 Jul, after the USD71.08 trailingstop was triggered. Conversely, we initiate short positions at the closing level of 3 Aug. To manage risks, the initial stop-loss is placed above USD74.00.

The support levels are revised lower to USD69.19 (3 Aug’s low) and USD65.01, which was 20 Jul’s low. The immediate resistance level is set at USD71.96, or the high of 3 Aug, followed USD74.00.

Source: RHB Securities Research - 4 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024