E-Mini Dow - Bulls Bounce Off Immediate Support Level

rhboskres

Publish date: Wed, 04 Aug 2021, 04:51 PM

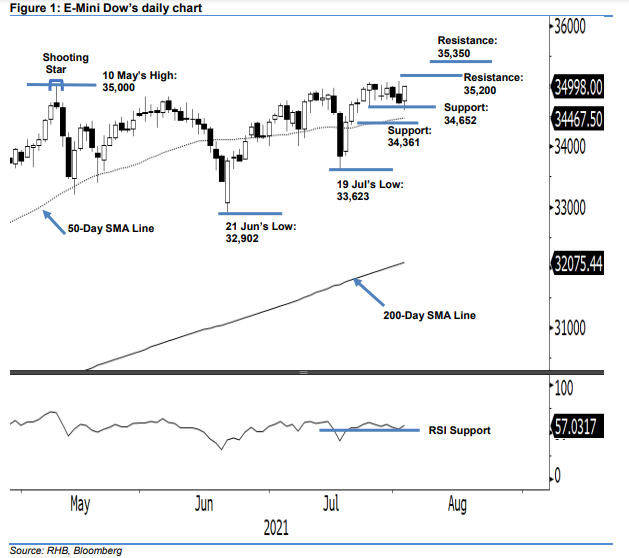

Maintain long positions. Yesterday, the E-Mini Dow bounced off strongly from its immediate support level, rising 277 pts to close at 34,998 pts. The index started Tuesday’s session at 34,765 pts, and gradually moved upwards. However, strong selling pressure emerged later during the European trading hours, bringing the index to the day’s low of 34,602 pts. Towards the end of the US trading hours, it bounced off sharply, hitting the day’s high of 35,009 pts before closing. The bullish candlestick printed on the chart indicates that bullish momentum is poised to propel the index higher, after forming a “higher low” interim base. With the RSI rounding above the 50% level, we expect bullish momentum to follow through in the next session. Unless momentum reverses, and the stop-loss level is breached, we will keep to our positive trading bias.

Traders should stick to the long positions initiated at 34,709 pts, or the closing level of 22 Jul. To mitigate trading risks, the stop-loss is pegged at 34,694 pts or 2 Aug’s low.

The immediate support level is marked at 34,652 pts, or 26 Jul’s low, followed by 34,361 pts, which was 21 Jul’s low. The resistance levels are set at 35,200 pts and 35,350 pts – both at possible new highs.

Source: RHB Securities Research - 4 Aug 2021