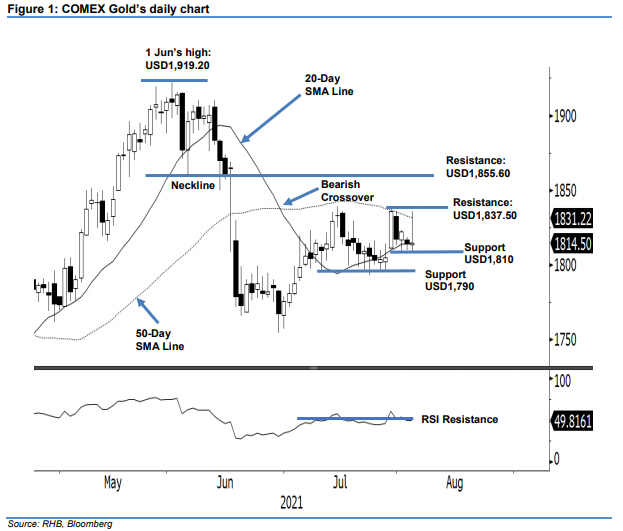

COMEX Gold - Falling Back on the 20-Day SMA Line Again

rhboskres

Publish date: Thu, 05 Aug 2021, 09:23 AM

Maintain long positions. The COMEX Gold’s bulls attempted to stage a rally, but the momentum was shortlived, as it fell back to the 20-day SMA line. It then settled Wednesday session’s at USD1,814.50. It initially started at USD1,813.70 and, early in the US trading hours, jumped to test the USD1,835.90 intraday high. However, the momentum lacked a follow-though, and it fell to to the USD1,808.30 day low before the close. The latest session showed the bears still had the upper hand or a technical advantage, with the 50-day SMA line acting as an overhead resistance. Hence, we expect more consolidations along the 20-day SMA line, ie above the immediate support level. In the event the negative momentum accelerates, the USD1,790 level will be the last line of defence for the bullish structure. As of now, we keep to our positive trading bias until the stop-loss mark is triggered.

We recommend traders keep to the long positions initiated at USD1,794.20, or 6 Jul’s close. To manage the downside risks, the stop-loss threshold is fixed at USD1,790.

The immediate support level remains unchanged at USD1,810, followed by the lower support level at USD1,790. On the upside, the immediate resistance remains at USD1,837.50, or 29 Jul’s high – this is and followed by USD1,855.60, ie the neckline that formed on 4 Jun.

Source: RHB Securities Research - 5 Aug 2021