WTI Crude - The Negative Momentum Accelerates

rhboskres

Publish date: Thu, 05 Aug 2021, 09:24 AM

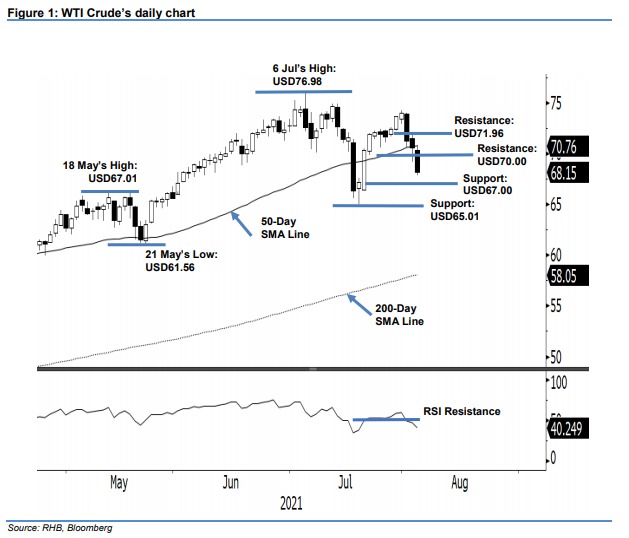

Maintain short positions. The WTI Crude saw a sharp correction yesterday, plunging USD2.41 to settle at USD68.15. The commodity started Wednesday’s session at USD70.32 and rose marginally to test the intraday high at USD70.81. However, sentiment turned bearish again during the European trading hours, where the WTI Crude fell to the USD67.85 session low and remained sideways until its close. After three consecutive sessions of losses, the negative momentum is accelerating – we may see follow-through action testing the next support at USD67.00. Meanwhile, as the commodity is trading further away from the 50-day SMA line, we expect mild buying pressure to emerge near the immediate support level. As of now, we maintain our negative trading bias.

We recommend traders shift to the short positions initiated at USD70.56, or the closing level of 3 Aug. For risk management, the stop-loss threshold is revised to the USD73.00 whole number.

The support levels are revised lower to the USD67.00 whole number and USD65.01, which was 20 Jul’s low. The immediate resistance level is set at the USD70.00 psychological level, followed by USD71.96 – the high of 3 Aug.

Source: RHB Securities Research - 5 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024