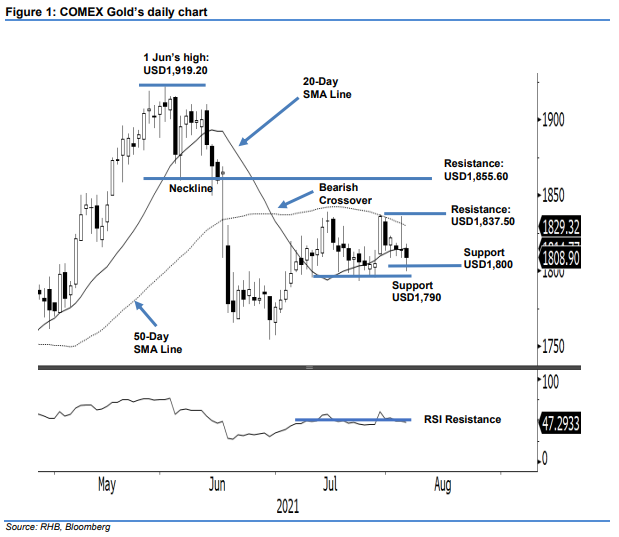

COMEX Gold - Falling Below the 20-Day SMA Line

rhboskres

Publish date: Fri, 06 Aug 2021, 05:18 PM

Maintain long positions. The COMEX Gold struggled to stay afloat above the 20-day SMA line as the selling pressure gained strength. It fell USD5.60 yesterday to settle at USD1,808.90 – a level below the short-term moving average. The commodity initially started Thursday’s session at USD1,814.90. Despite touching the USD1,817.90 sesson high, strong selling pressure emerged during the US trading hours, dragging the yellow metal sharply to the USD1,799.70 session low. Mild buying interest near 1,800 pts lifted the COMEX Gold to close higher at USD1,808.90. We observed the negative momentum growing as the RSI fell below the 50% threshold. If the strong support at USD1,790 gives way, sentiment will be dented and we should see a major correction. At this juncture, the COMEX Gold may attempt to consolidate near 1,800 pts and we stick to the positive trading bias until the stop-loss mark is breached.

We recommend traders keep to the long positions initiated at USD1,794.20, or 6 Jul’s close. To manage the downside risks, the stop-loss threshold is fixed at USD1,790.

The immediate support level is revised at USD1,800 and followed by USD1,790. The immediate resistance is pegged at USD1,837.50 – 29 Jul’s high – and followed by USD1,855.60, or the low on 4 Jun.

Source: RHB Securities Research - 6 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024