FKLI - Retest The Immediate Support

rhboskres

Publish date: Mon, 09 Aug 2021, 09:17 AM

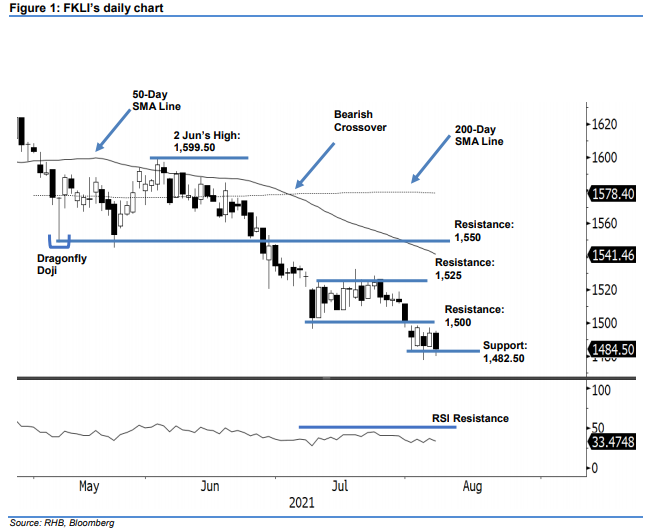

Maintain short positions. Last Friday, the FKLI saw the bearish momentum erase Thursday session’s gains, falling 9.50 pts to settle at 1,484.50 pts. The index initially started Friday’s session at 1,494 pts. After the opening, it briefly tested the day’s high of 1,495 pts but then progressed downwards, reaching the day’s low of 1,480 pts before closing at 1,484.50 pts – forming a bearish candlestick. During the previous session, despite the index managing to bounce off the interim support near the 1,482.50-pt level and attempting to move higher, the bears muscled up and decided to take profits before the weekend. As the latest bearish candlestick has engulfed the previous bullish candlestick, we may see the negative momentum follow through in the coming sessions. If the nearest support level gives way, expect a deeper downside correction. At this juncture, we stick to our negative trading bias.

Traders are recommended to hold on to their short positions, which were initiated at 1,569.50 pts, or 11 Jun’s close. To manage trading risks, the trailing-stop is fixed at 1,508 pts.

The immediate support remains at 1,482.50 pts – the low of 2 Aug, followed by the lower support of 1,449 pts or the low of Nov 2020. On the upside, the immediate resistance is pegged at the 1,500-pt psychological level, followed by 1,525 pts or 9 Jul’s high.

Source: RHB Securities Research - 9 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024