WTI Crude - Shortlived Intraday Bulls Turn Into Bears

rhboskres

Publish date: Mon, 09 Aug 2021, 09:19 AM

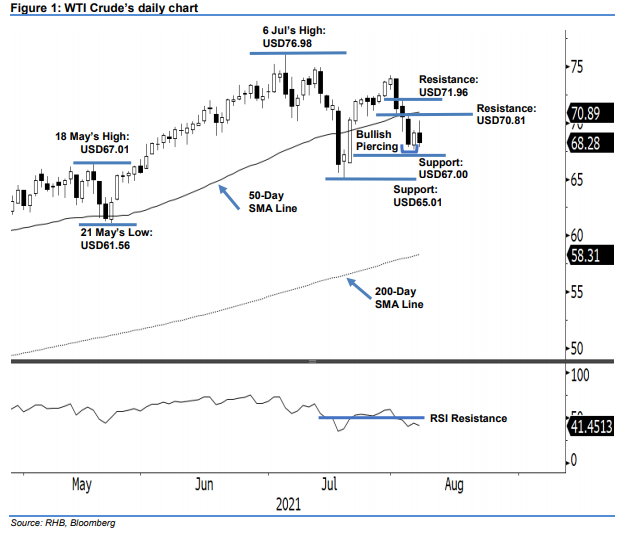

Maintain short positions. The WTI Crude attempted to continue its positive movement last Friday, but this proved shortlived after sharp profit-taking activities pared down all gains. It settled USD0.81 lower at USD68.28. The commodity began in neutral at USD69.14 before climbing gradually towards the European trading session – reaching its USD70.18 intraday top. Strong selling pressure kicked in during the later session, which saw it fall below the USD67.80 opening day low before closing lower. The latest bearish long upper shadow candle has nullified the possible uptrend reversal, indicating the bears are back in control as the WTI Crude heads southwards towards the immediate support level. This is echoed by the weakening RSI, which points lower near the 40% level. As long it maintains below the stop-loss level – below the 50-day SMA line – we stick to our negative trading bias.

We recommend traders maintain the short positions initiated at USD70.56, or the closing level of 3 Aug. For risk management, the stop-loss level is marked at the USD70.81, ie 4 Aug’s high.

The nearest support level is remained at the USD67.00 whole number and then USD65.01, or 20 Jul’s low. The resistance levels are pegged at the USD70.81 – 4 Aug’s high – and USD71.96, ie the high of 3 Aug.

Source: RHB Securities Research - 9 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024