FKLI - Mild Rebound But Momentum Remains Weak

rhboskres

Publish date: Wed, 11 Aug 2021, 04:49 PM

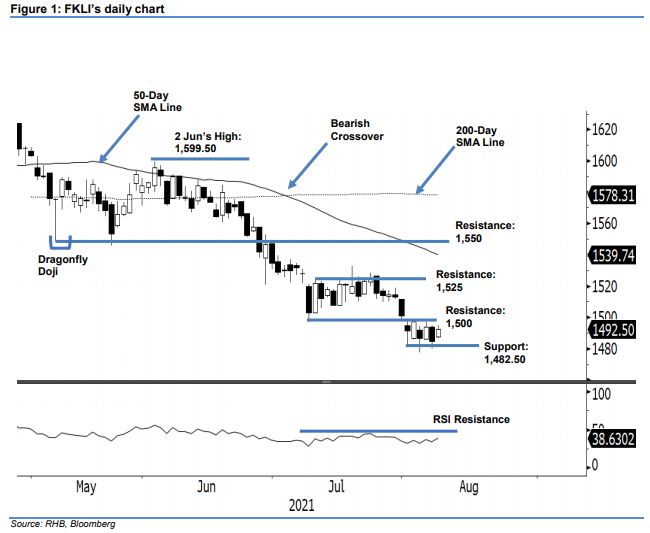

Maintain short positions. On Monday, the FKLI saw the bears taking a breather on the eve of a public holiday, rebounding 8 pts to settle at 1,492.50 pts. The index saw selling pressure susbside, allowing for a strong opening on Monday’s session as it gapped up to start at 1,487.50 pts. After touching the day’s low of 1,486.50 pts, it progressed upwards to test the day’s high of 1,495 pts. It then moved sideways for rest of the session before closing at 1,492.50 pts. The index is struggling near the support level, managing to only stage a mild rebound. However, looking at the RSI indicator, which is still trending below the 50% level and moving horizontally, this suggests the underlying strength of the index remains neutral. Unless it breaks above the 1,500-pt psychological level, sentiment will remain weak and thus, more consolidation is needed. As of now, we are keeping to our negative trading bias.

We advise traders to maintain their short positions, which we initiated at 1,569.50 pts, or 11 Jun’s close. To manage trading risks, the trailing-stop is placed at 1,508 pts.

The immediate support remains unchanged at 1,482.50 pts – the low of 2 Aug, followed by the lower support of 1,449 pts or the low of Nov 2020. Meanwhile, the immediate resistance is sighted at the 1,500-pt psychological level, followed by the higher hurdle of 1,525 pts or 9 Jul’s high.

Source: RHB Securities Research - 11 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024