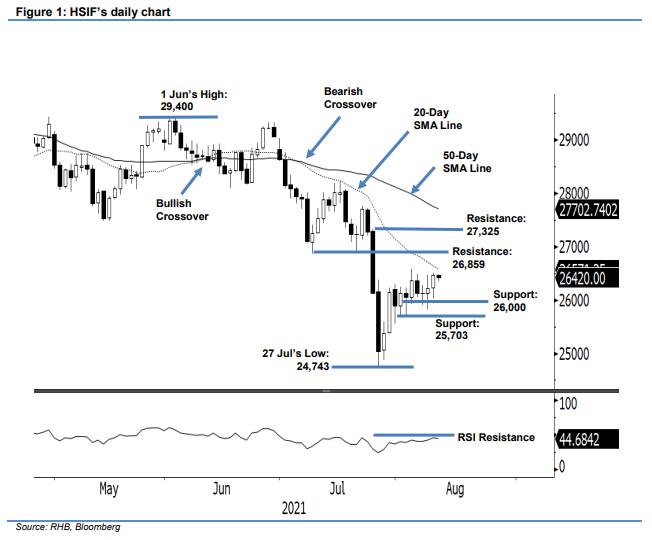

Hang Seng Index Futures - Attempting to Cross the 20-Day SMA Line

rhboskres

Publish date: Wed, 11 Aug 2021, 04:53 PM

Maintain long positions. The HSIF staged a mild rebound yesterday, rising 249 pts to settle the day session at 26,466 pts. It started Tuesday’s session stronger at 26,400 pts. After finding the day session’s low at 26,026 pts, it reversed to test the intraday high of 26,515 pts ahead of the close. Mild profit-taking was seen during the evening session, with the index retracing 46 pts. It was last traded at 26,420 pts. We observe that the profit-taking occurred just before the index attempted to cross the 20-day SMA line. We expect the 26,000-pt level to continue to act as a strong support, absorbing the selling pressure. If the HSIF manages to consolidate above the 26,000-pt level, the recent bullish momentum may bring it higher to cross the overhead resistance. Premised on this, we maintain our positive trading bias.

Traders should stick with the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To limit downside risks, the stop-loss is set at 25,703 pts, or the low of 3 Aug.

The immediate support is established at the 26,000-pt psychological level, followed by 25,703 pts – 3 Aug’s low. On the upside, the immediate resistance is sighted at 26,859 pts – 9 Jul’s low – followed by 27,325 pts, or 26 Jul’s high.

Source: RHB Securities Research - 11 Aug 2021