E-Mini Dow - Bullish Momentum Remains

rhboskres

Publish date: Wed, 11 Aug 2021, 04:53 PM

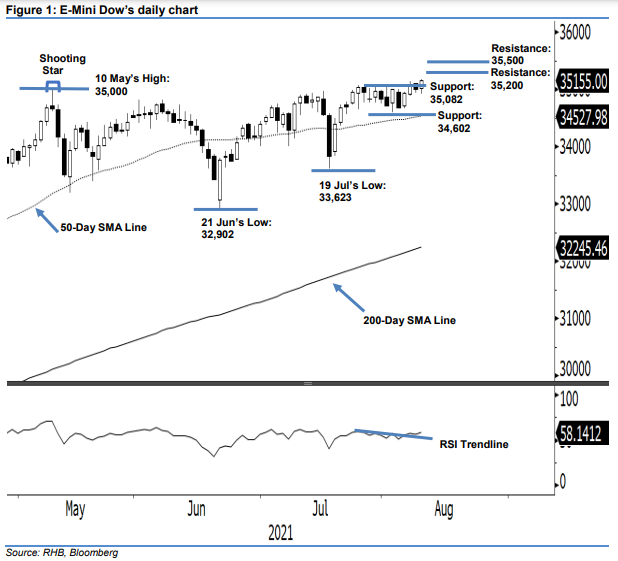

Maintain long positions. Yesterday, the E-Mini Dow bounced from below to above the immediate resistance level, printing a higher level as it rose 157 pts to close at 35,155 pts. The index opened stronger at 35,016 pts and then fell towards the 34,924-pt day low during the Asian trading hours. It then gradually moved higher and hit the day’s peak of 35,176 pts during the US trading session, ahead of the close. The latest bullish candlestick (with a long lower shadow), which breached above the 35,082-pt level, reaffirms the “higher high” pattern – indicating that upward momentum will remain intact. Additionally, the RSI is continuing to point near the 60% level, suggesting that momentum will continue in the immediate term. As such, we stick our positive trading bias.

Traders should stick to the long positions initiated at 35,091 pts, or the closing level of 6 Aug. To manage trading risks, the initial stop-loss level is marked at 34,602 pts, or 3 Aug’s low.

The immediate support level is maintained at 35,082 pts (2 Aug’s high), and then 34,602 pts, or 3 Aug’s low. The resistance levels are pegged at 35,200 pts and 35,500 pts; both are round figures in the uncharted territory.

Source: RHB Securities Research - 11 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024