FKLI - Pullback From The 1,500-Pt Level

rhboskres

Publish date: Fri, 13 Aug 2021, 05:46 PM

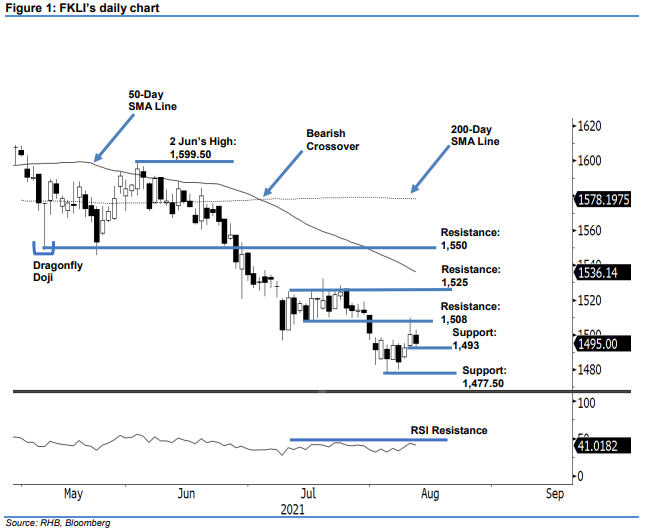

Maintain short positions. The bulls failed to retain the 1,500-pt psychological level, pulling back 5.50 pts to settle at 1,495 pts. The FKLI initially opened flat at 1,500 pts. After a whipsaw movement during the early session, it jumped to test the 1,503-pt session high. However, the positive momentum failed to follow through, and retraced towards the 1,493.50-pt session low before the close. As such, the bearish momentum is gaining strength yesterday. Breaching 1,493 pts may lead the index to resume its downward movement, testing August’s low at 1,477.50 pts. Meanwhile, reclaiming the 1,500-pt threshold will see sentiment improve again. As long as the index is trading below the tralingstop level, the FKLI will continue to print “lower highs” bearish patterns, and thus, we stick to our negative trading bias.

Traders are recommended to stick to their short positions, which we initiated at 1,569.50 pts, or 11 Jun’s close. To manage trading risks, the trailing-stop is fixed at 1,508 pts, ie the immediate resistance level.

The immediate support is marked at 1,493 pts, the low of 11 Aug, followed by the lower support of 1,477.50 pts or the low of 4 Aug. Conversely, the immediate resistance is pegged at 1,508 pts – the low of 14 Jul, then the higher hurldle at 1,525 pts or 9 Jul’s high.

Source: RHB Securities Research - 13 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024