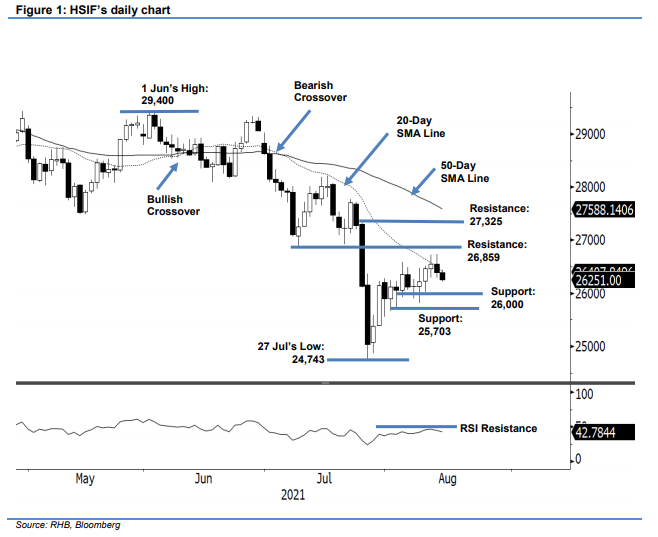

Hang Seng Index Futures - Bullish Momentum Capped by the 20-Day SMA Line

rhboskres

Publish date: Fri, 13 Aug 2021, 05:47 PM

Maintain long positions. The HSIF upside movement was capped by the 20-day SMA line, declining 157 pts to settle the day session at 26,388 pts. The index initially started Thursday’s session with positive sentiment, opening at 26,520 pts and rising to the 26,618-pt day high. However, the wall of the 20-day SMA line proved too strong for the HSIF – it retraced to the 26,295-pt day low before the close. Further profit taking was witnessed during the evening session, dragging the index to a 137-pt retreat. It last traded at 26,251 pts. As of now, the HSIF has still managed to retain its position above 26,000 pts and we expect this threshold to withhold in the coming sessions. Neverthelss, if the RSI continues to stay below the 50% level and selling pressure accelerates, expect more downside movements once the 25,800-pt stop-loss is breached. Before that happens, we contine to hold on to our positive trading bias.

We recommend traders maintain the long positions initiated at 26,175 pts, or the close of 28 Jul’s evening session. To manage the downside risks, the stop-loss threshold is set at 25,800 pts.

The immediate support remains at the 26,000-pt psychological level, followed by 25,703 pts, ie 3 Aug’s low. The nearest resistance remains at 26,859 pts – 9 Jul’s low – followed by 27,325 pts, or 26 Jul’s high.

Source: RHB Securities Research - 13 Aug 2021