E-Mini Dow - Intraday Profit-Taking From the Top

rhboskres

Publish date: Mon, 16 Aug 2021, 09:53 AM

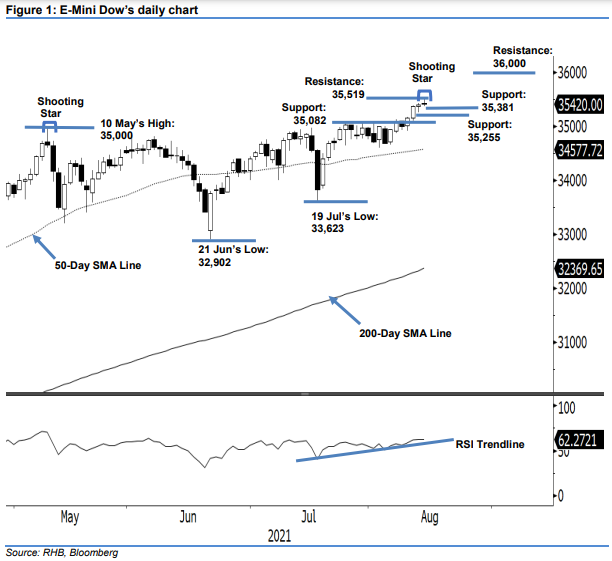

Maintain long positions. The E-Mini Dow settled 18 pts higher at 35,420 pts last Friday despite profit-taking activities near the day’s high. The index initially started with a positive tone at 35,429 pts, then moved slightly lower during the early session before gradually moving higher to print the intra-day high of 35,519 pts – this was just before the US trading hours started. However, momentum was short-lived after it reversed direction southwards, which saw it touch the 35,381-pt day low before a mild rebound towards its close. The black body Shooting Star candlestick pattern signals a potential bearish reversal in the coming sessions. The medium-term direction above the recent 35,082-pt breakout point remains bullish – supported by the positive strength of the RSI above the 60% level. Since the short-term bearish reversal is imminent, we set our trailing stop at the latest session low to take opportunity during profit-taking activities. We retain our positive trading bias until the trailing-stop mark is breached.

Traders should stick to the long positions initiated at 35,091 pts, or the closing level of 6 Aug. To manage the trading risks, the trailing-stop mark is set at 35,381 pts – 13 Aug’s low – or the latest immediate support.

The immediate support level is lock-stepped to 35,381 pts – 13 Aug’s low – and followed by 35,255 pts, ie 12 Aug’s low. The resistance levels are pegged at 35,519 pts – 13 Aug’s high – and the 36,000-pt round number.

Source: RHB Securities Research - 16 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024