COMEX Gold - The Bullish Momentum Accelerates

rhboskres

Publish date: Mon, 16 Aug 2021, 09:54 AM

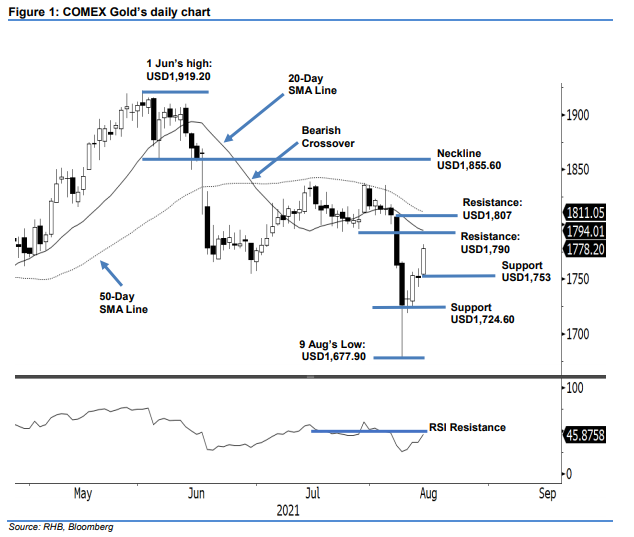

Stop-loss level triggered; initiate long positions. The COMEX Gold’s bullish momentum accelerated last Friday, surging USD26.40 to close at USD1,778.20. The commodity started the session at USD1,754.40 but touched the USD1,753 session low after this start – it then jumped to test the USD1,781.90 session high prior to the close. The latest session printed a long white candlestick and, evidently, the bulls were in control. As the bullish momentum accelerates, the yellow metal may extend its upward movement to test USD1,790 – a level near to the 20-day SMA line. Since the stop-loss level has been breached, we shift to a positive trading bias.

We closed out the short positions initiated at USD1,763.10, or the close of 6 Aug, after the stop loss was triggered at USD1,770. Conversely, we initiate long positions at the closing level of 13 Aug, ie USD1,778.20. To mitigate the trading risks, an initial stop-loss threshold is set at USD1,724.60.

The immediate support level is revised to USD1,753 – 13 Aug’s low – and followed by USD1,724.60, ie the low of 11 Aug. The nearest resistance is eyed at the USD1,790 whole number and followed by USD1,807, or 6 Aug’s high.

Source: RHB Securities Research - 16 Aug 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024