FCPO: Bullish Momentum Extended

rhboskres

Publish date: Tue, 07 Sep 2021, 07:09 PM

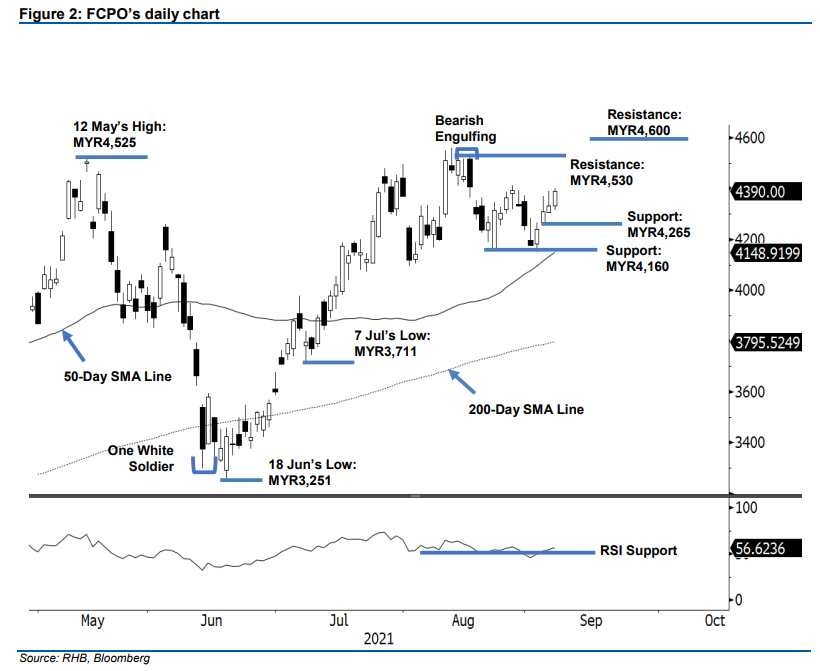

Stop-loss mark triggered; initiate long positions. The FCPO saw the bullish momentum extended yesterday, advancing MYR59.00 to settle at MYR4,390. The commodity began on a positive note, opening stronger at MYR4,331. After touching the MYR4,314 day low, it reversed course northwards and tested the MYR4,400 intraday high before the close. As mentioned in a previous note, breaching the MYR4,350 level will see the FCPO resume its upward movement. Coupled with the RSI pointing upwards, we expect follow-through price action to test the next hurdle at MYR4,530. In the event profit-taking activities arise, the 50-day SMA line will provide strong support. Since the previous stop-loss level has been breached, we are shifting to a positive trading bias.

We closed out the short positions that were initiated at MYR4,238, or the closing level of 19 Aug, after the stop-loss mark at MYR4,350 was triggered. Conversely, we initiate long positions at the closing level of 7 Sep, ie MYR4,390. To mitigate the downside risks, the initial stop-loss threshold is set at MYR4,160.

The first support is marked at MYR4,265 – 3 Sep’s low – and followed by MYR4,160, or the low of 23 Aug. Meanwhile, the nearest resistance is pegged at MYR4,530 – the high 17 Aug – and followed by the MYR4,600 round figure.

Source: RHB Securities Research - 7 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024