Hang Seng Index Futures: Breaching the 20-Day SMA Line

rhboskres

Publish date: Wed, 15 Sep 2021, 06:37 PM

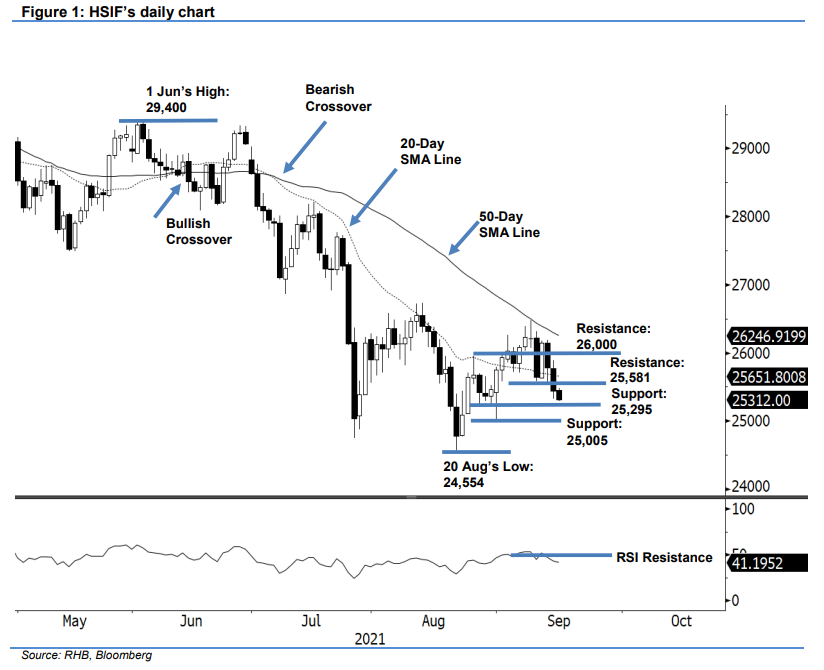

Maintain short positions. The HSIF extended the correction that started on Monday, falling 340 pts to settle the day session at 25,445 pts. Yesterday, it opened weaker at 25,800 pts. After bouncing higher to test the day high of 25,885 pts, market sentiment was jittery again in the afternoon, sending it to the 25,322-pt day low ahead of the close. Tracking the risk-off sentiment of its US peers, the HSIF retreated another 133 pts during the evening session, and was last traded at 25,312 pts. With the RSI dropping further towards the 40% threshold – signifying weak momentum ahead – the index may move south to breach the 25,295-pt immediate support level. As such, we keep our negative trading bias, until the momentum reverses.

Traders should stick to the short positions initiated at 25,646 pts, or the close of 9 Sep’s day session. To manage trading risks, the stop-loss is revised to 26,190 pts.

The nearest support is revised to 25,295 pts – 27 Aug’s low – followed by the lower support at 25,005 pts or 31 Aug’s low. The immediate resistance is revised to 25,581 pts, which was the low of 9 Sep, followed by 26,000 pts.

Source: RHB Securities Research - 15 Sept 2021