COMEX Gold: Extending Its Downside Movement

rhboskres

Publish date: Wed, 29 Sep 2021, 08:34 AM

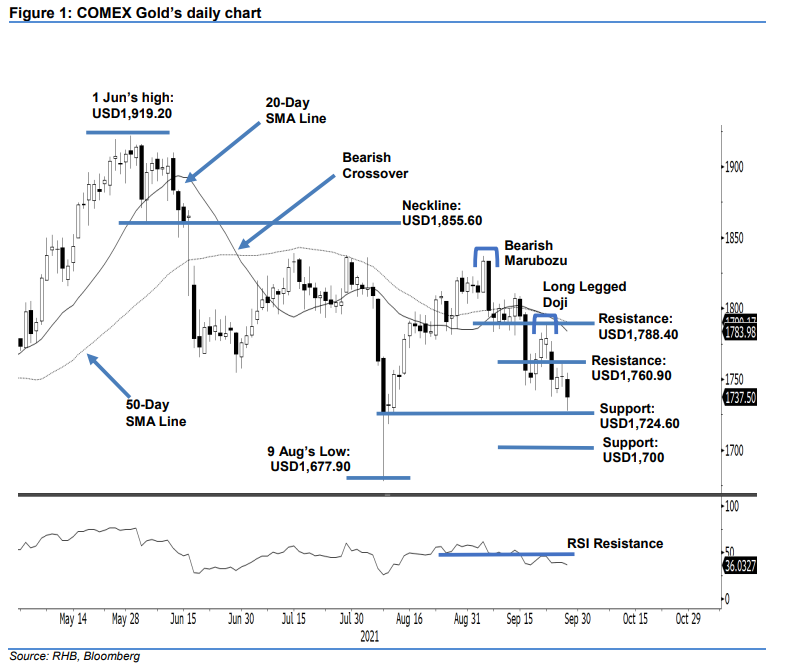

Maintain short positions. The COMEX Gold saw negative momentum accelerate yesterday, plummeting USD14.50 to settle at USD1,737.50. The commodity started at USD1,750 and moved sideways. During the later part of the Asian session, selling pressure intensified, dragging it to the day’s USD1,727.80 low before closing weaker at USD1,737.50. The latest session saw extended downside movement, printing a fresh “lower low” bearish pattern. With the RSI still moving lower, we expect negative momentum to follow through in the coming sessions, with the index retesting the USD1,724.60 immediate support, followed by the USD1,700 psychological level. In the immediate term, USD1,760.90 will act as a strong resistance, and any technical rebound is likely to be met with strong selling pressure. As such, we hold on to our negative trading bias.

Traders are advised to retain the short positions initiated at USD1,756.70, or the closing level of 16 Sep. To mitigate trading risks, the stop-loss is placed at USD1,780.

The immediate support is revised to USD1,724.60 – 11 Aug’s low – followed by the USD1,700 round figure. The nearest resistance is revised to USD1,760.90 – 27 Sep’s high – followed by USD1,788.40, or 22 Sep’s high.

Source: RHB Securities Research - 29 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024