E-Mini Dow: Reversing Towards a Downtrend

rhboskres

Publish date: Wed, 29 Sep 2021, 08:35 AM

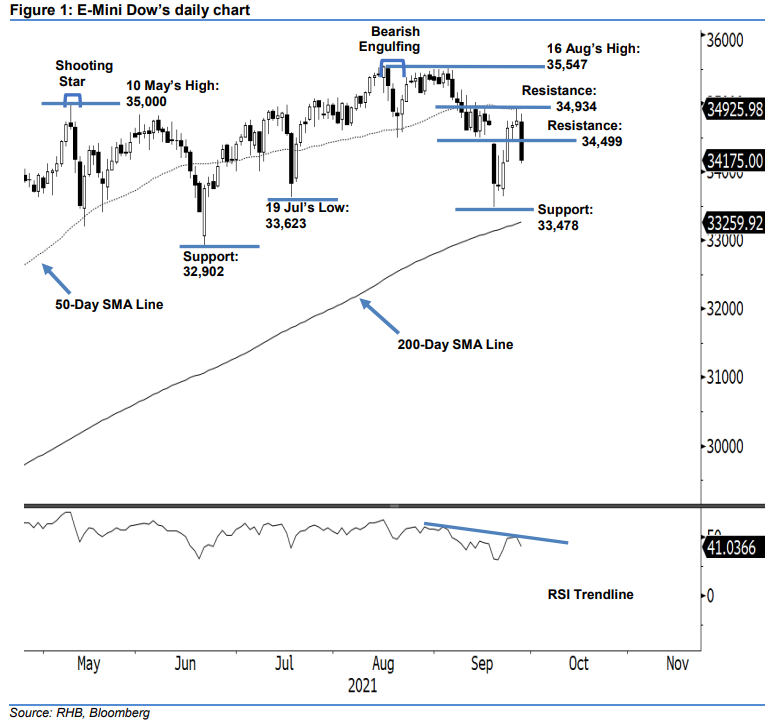

Stop loss triggered; initiate short positions. After failing to move above the 50-day average line, the E-Mini Dow swiftly reversed strongly southwards, which saw it fall 568 pts to settle at 34,175 pts – breaching below the immediate support. It opened weaker at 34,733 pts and then attempted to move higher until the mid-Asian trading session, albeit shortlived – it touched the day’s peak at 34,852 pts before reversing downwards. Selling pressure emerged from the peak to shift southwards to hit the day’s bottom at 34,121 pts before the close. The long black candlestick breached the 34,499-pt immediate support yesterday, signalling the bears were back in the driver’s seat. This is supported by the “lower high” pattern beneath the 50-day average line. Coupled with the weakening RSI near the 40% level, this solidifies the view that the trend change has just begun. As the stop-loss mark is breached, we shift to a bearish trading bias.

We closed out the long positions that were initiated at the closing level of 23 Sep – 34,644 pts – after triggering the 34,499-pt stop-loss. Conversely, we initiate short positions at the closing level of 29 Sep, ie 34,175 pts. To manage risks, the initial stop-loss mark can be placed above the threshold introduced at the 34,934-pt support.

The nearest support level is revised to 33,478 pts – 20 Sep’s low – and then followed by 33,902 pts, or 21 Jun’s low. The resistance levels are changed at 34,499 pts – 15 Sep’s low – and 34,934 pts, ie 27 Sep’s high.

Source: RHB Securities Research - 29 Sept 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024