COMEX Gold: Strong Rebound to Test the Immediate Resistance

rhboskres

Publish date: Fri, 01 Oct 2021, 08:40 AM

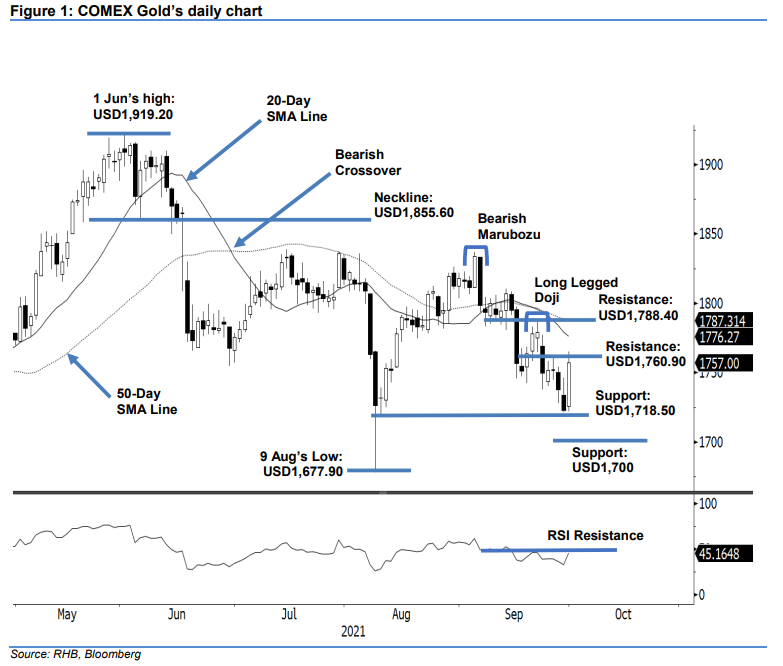

Maintain short positions. The COMEX Gold saw a strong rebound yesterday, rising USD34.10 to settle at USD1,757. The commodity initially opened at USD1,726 and moved sideways during its early session. After finding the session low at USD1,721.80, it saw strong demand during the US trading hours, jumping higher to test the USD1,765 session high before closing at USD1,757. With the long white candlestick, the bulls are at an advantage vis-à-vis the bears. With the re-emergence of the positive momentum, the bulls are eyeing to test the USD1,760.90 immediate resistance again in the immediate session. Breaching this threshold may deem the recent correction as over and that the yellow metal is ready to stage an upside movement again. Before that happens, however, we retain our negative trading bias.

Traders should maintain the short positions initiated at USD1,756.70, or the closing level of 16 Sep. To manage the trading risks, the stop-loss point is adjusted to USD1,765.

The immediate support is marked at USD1,718.50 – 10 Aug’s low – and followed by the USD1,700 round figure. The nearest resistance remains at USD1,760.90 – 27 Sep’s high – and followed by USD1,788.40, ie the high of 22 Sep.

Source: RHB Securities Research - 1 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024