FKLI: Still Trending South

rhboskres

Publish date: Tue, 05 Oct 2021, 08:36 AM

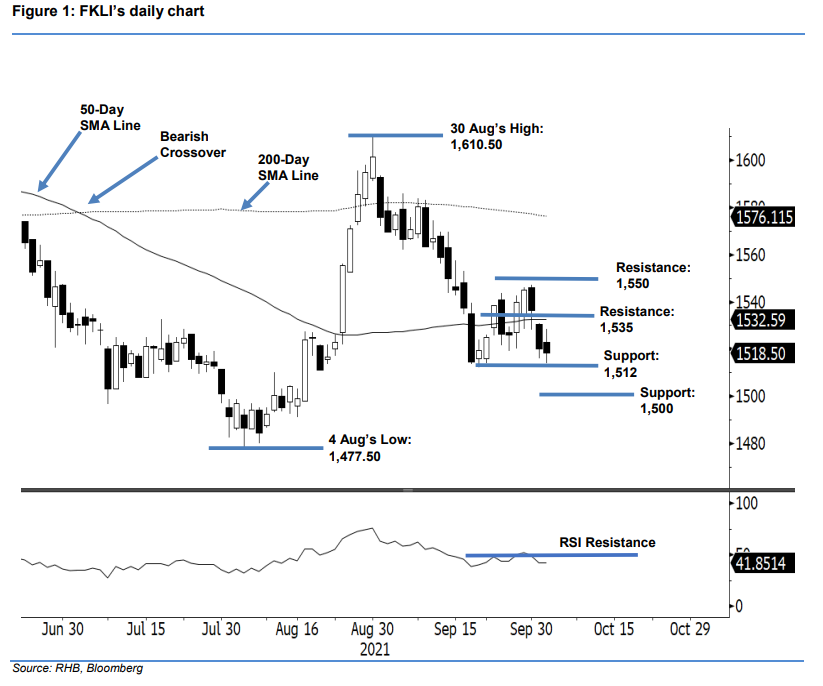

Maintain short positions. The FKLI’s negative momentum continued for a second day, and it shed 1.50 pts to settle at 1,518.50 pts – drifting away from the 50-day SMA line. Yesterday, the benchmark index gapped up at the open at 1,523 pts, and rose to test the day’s high of 1,528.50 pts. However, the brief bullish momentum faltered in the afternoon, and the index retraced to the day’s low of 1,514 pts before the close. The latest session showed that the bears still have an advantage over the bulls. Amidst the RSI falling below the 50% threshold, any intraday rebound may be met with selling pressure. It is very likely the index will see the negative momentum following through to retest Sep’s low of 1,512 pts. Meanwhile, buying interest may emerge again if the index approaches the immediate support. For now, we make no change to our negative trading bias.

We recommend that traders maintain the short positions initiated at 1,520 pts or the closing level of 1 Oct. To curb the trading risks, the initial stop-loss revised to 1,535 pts.

The immediate support is marked at 1,512 pts, the low of 21 Sep, followed by 1,500 pts. Conversely, the immediate resistance remains at 1,535 pts, followed by 1,550 pts.

Source: RHB Securities Research - 5 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024