WTI Crude: Profit-Taking From the Top Begins

rhboskres

Publish date: Thu, 07 Oct 2021, 08:30 AM

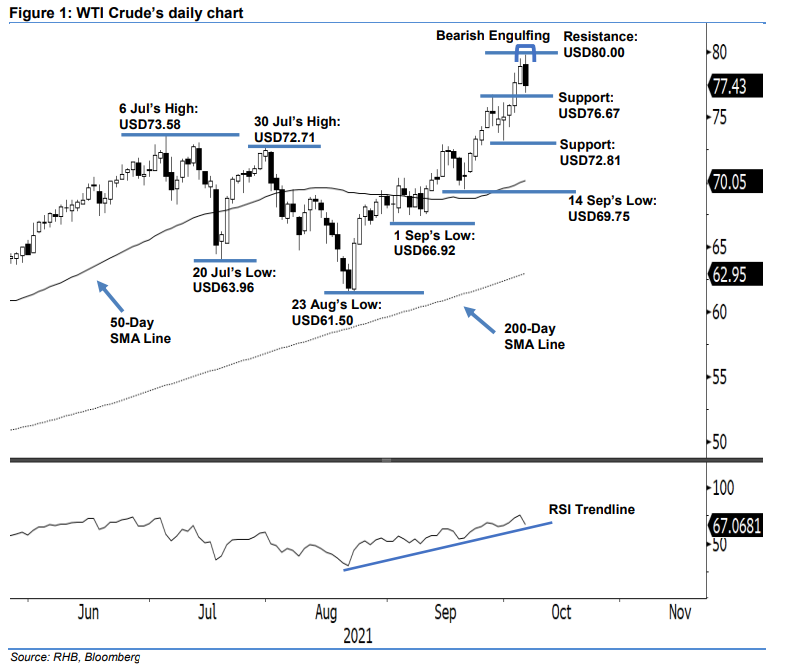

Keep long positions. After rallying for five sessions in a row, the WTI Crude finally took profit yesterday, declining USD1.50 to close at USD77.43 – below Tuesday’s opening. The commodity started neutral, at USD79.04, before attempting to move higher, towards the day’s USD79.78 high during the Asian trading session. However, the upward movement was short lived. Selling pressure emerged, moving the index south until the end of the session. It hit the day’s low of USD76.83 before the close. The long black body candlestick, which closed below the previous session’s opening – drawing a “bearish engulfing” pattern – suggests that momentum has changed to negative from the peak. Hence, we expect a strong correction in the coming sessions. Backed by a sharp decline in RSI strength, which breached below the 70% level yesterday, this increases the odds of bearish momentum commencing ahead. As the previous trailing-stop was not triggered, we maintain our bullish trading bias, while moving the trailing-stop higher to USD76.67, which is the immediate support.

Traders should remain in the long positions initiated at USD67.54, or the closing level of 24 Aug. To manage risks, the trailing-stop threshold is revised higher to USD76.67 – the immediate support level.

The support levels are fixed at USD76.67 – 28 Sep’s high – and USD72.81, or 24 Sep’s low. The immediate resistance level is fixed at USD80.00. Movement above this level will likely see the index hit the USD90.00 threshold.

Source: RHB Securities Research - 7 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024