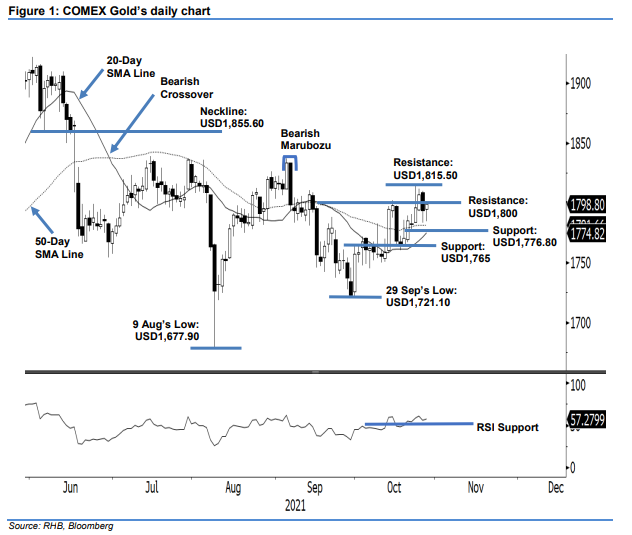

COMEX Gold - Consolidating Above the 50-Day SMA Line

rhboskres

Publish date: Thu, 28 Oct 2021, 05:05 PM

Maintain long positions. The COMEX Gold bounced off the 50-day SMA line yesterday, edging USD5.40 higher to settle at USD1,798.80. The commodity started the session at USD1,795 and initially experienced weakness during this early session, falling to the USD1,784.30 session low. Strong buying interest near the moving average line lifted the COMEX Gold higher to touch the USD1,801 intraday high. During the US trading session, it retraced again to the day low amid sudden selling pressure, but the moving average line lent out support and the COMEX Gold rebounded to close in positive territory. The latest price action reaffirms our view that the 50-day SMA line will act as strong downside support. As long as the commodity trades above the moving average line, it may resume its upward movement once the consolidation is over. Hence, we make no changes to our positive trading bias.

Traders should hold on to the long positions initiated at USD1,784.90, ie the closing level of 20 Oct. For tradingrisk management, the stop-loss threshold is fixed at USD1,760.

The immediate support exists at USD1,776.80 – 21 Oct’s low – and is followed by the USD1,765 whole number. On the upside, the first resistance is set at USD1,800. The subsequent resistance is at USD1,815.50, or the high of 22 Oct.

Source: RHB Securities Research - 28 Oct 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024