E-Mini Dow - Negative Momentum in Play

rhboskres

Publish date: Tue, 22 Feb 2022, 10:09 AM

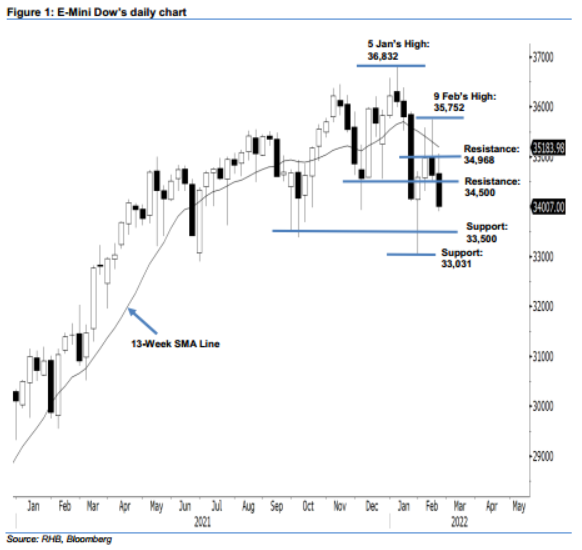

Maintain short positions. Based on the weekly chart, the bears are firmly in control of the E-Mini Dow. The index charted its all-time high of 36,832 pts on 5 Jan, and has been trending lower since then. The downward momentum became evident when the index fell below the 13-week SMA line during the week that ended on 21 Jan. Although it staged a strong rebound from the 33,031-pt level, the counter-trend rebound ended at 35,752 pts – forming a “lower high” if compared to the previous high or the peak of 36,832 pts. If the index continues to trade below the 13-week SMA line, the medium-term trend will likely remain weak, and we can expect further correction or “lower low” bearish patterns ahead. At this stage, we stick to our bearish trading bias.

Traders should hold on to the short positions initiated at the closing level of 11 Feb, or 34,627 pts. For risk management purposes, the stop-loss threshold is set at 34,968 pts.

The first support is revised to the 33,500-pt whole number, followed by 33,031 pts or the low of 24 Jan. Meanwhile, the nearest resistance is seen at 34,500 pts, followed by the higher hurdle of 34,968 pts (the high of 15 Feb).

Source: RHB Securities Research - 22 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024