Hang Seng Index Futures - Negative Momentum Still in Play

rhboskres

Publish date: Tue, 22 Feb 2022, 10:09 AM

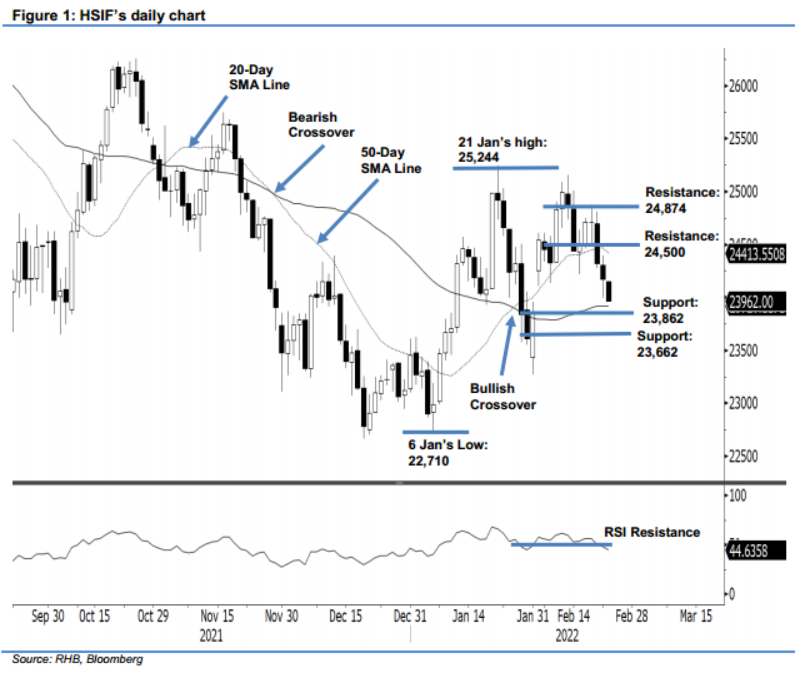

Maintain short positions. The HSIF continued to see selling pressure on Monday, retreating 155 pts to settle at 24,168 pts. After opening at 24,133 pts, it oscillated between 24,231 pts and 23,997 pts before closing in negative territory. Sentiment remained negative in the evening session, where the index lost another 206 pts and was last traded at 23,962 pts. Based on the latest price action, the bears are still gripping the index firmly, and therefore, we expect it to test the 50-day SMA line. A breach of the moving average line may attract further downward momentum. Meanwhile, the index needs to regain its position above the 20-day SMA line or 24,500-pt level to resume an upward trajectory. As the correction is still ongoing, we maintain our negative trading bias.

We recommend that traders retain the short positions initiated at 24,323 pts or the close of 18 Feb’s day session. To mitigate trading risks, the initial stop-loss is fixed at 24,874 pts.

The nearest support is shifted lower to 23,862 pts – 31 Jan’s close – and then 23,662 pts, or 12 Jan’s low. The immediate resistance is pegged at 24,500 pts, and the subsequent resistance at 24,874 pts or the high of 18 Feb.

Source: RHB Securities Research - 22 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024