WTI Crude - Consolidating Sideways

rhboskres

Publish date: Tue, 22 Feb 2022, 10:10 AM

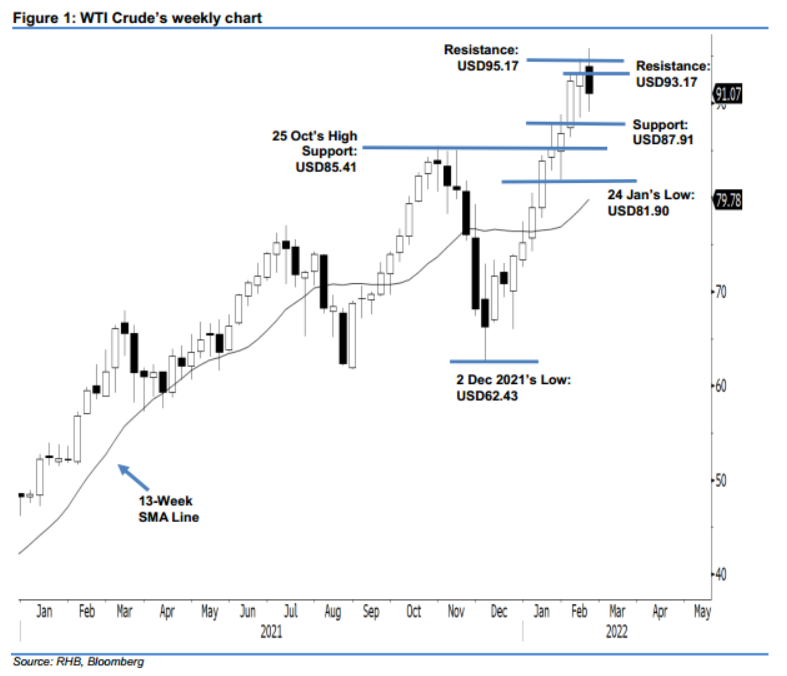

Maintain long positions. As seen in the weekly chart, the WTI Crude is pausing its upward momentum, and consolidating sideways just below the USD93.17 resistance level. We observe that since establishing the low of USD62.43 on 2 Dec 2021, the commodity has been trending higher for the past 10 consecutive weeks. The upward momentum strengthened when it crossed above the 13-week SMA line during the week that began on 7 Jan. With the bulls still in control, we expect the commodity to resume its upward movement once the consolidation is over. In the event that the WTI Crude undergoes further correction, we expect strong buying activity to occur between the USD87.91 and USD85.41 support levels. For now, we keep our bullish trading bias.

We advise traders to keep the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage downside risks, the trailing-stop is placed at USD87.91.

Based on the lower time frame or daily chart, the immediate support stays at USD87.91 – 19 Jan’s high – followed by USD85.41 or the high of 25 Oct 2021. Conversely, the first resistance is pegged at USD93.17 (4 Feb’s high), followed by USD95.17, which was 15 Feb’s high.

Source: RHB Securities Research - 22 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024