COMEX Gold: the Bullish Momentum Continues

rhboskres

Publish date: Wed, 23 Feb 2022, 05:05 PM

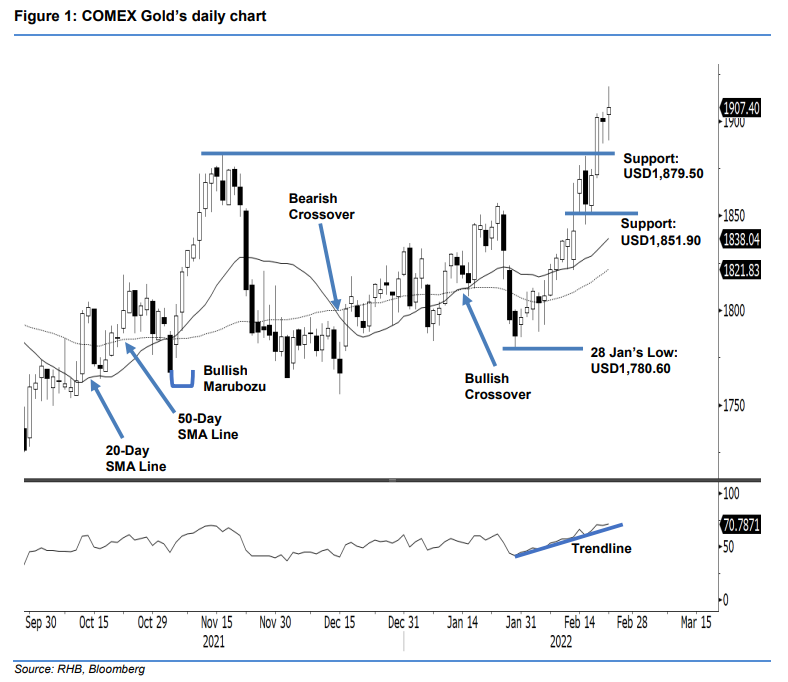

Maintain long positions. The COMEX Gold maintained its bullish posture yesterday, edging higher by USD7.60 and settling at USD1,907.40. After opening at USD1,903.50, it whipsawed between the USD1,918.30 and USD1,889.70 levels before the close. The latest candlestick comes with a long upper shadow, indicating mild profit-taking near the USD1,900 psychological level. Meanwhile, the RSI continues to trend higher above the trendline, suggesting the bullish momentum remains in play. In the event the COMEX Gold pulls back for consolidation, we expect USD1,879.50 to provide strong downside support. As the commodity is still charting a “higher high” bullish pattern, we retain our bullish trading bias.

Traders are recommended to stick with the long positions initiated at USD1,818.50 or the closing level of 11 Jan. To manage the trading risks, the trailing-stop threshold is placed at USD1,851.90, ie 14 Feb’s low.

The immediate support stays at USD1,879.50 – 16 Nov 2021’s high – and is followed by USD1,851.90. Meanwhile, the nearest resistance is eyed at USD1,950, followed by the USD2,000 round figure.

Source: RHB Securities Research - 23 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024