E-Mini Dow: the Bears Are Still in Control

rhboskres

Publish date: Wed, 23 Feb 2022, 05:06 PM

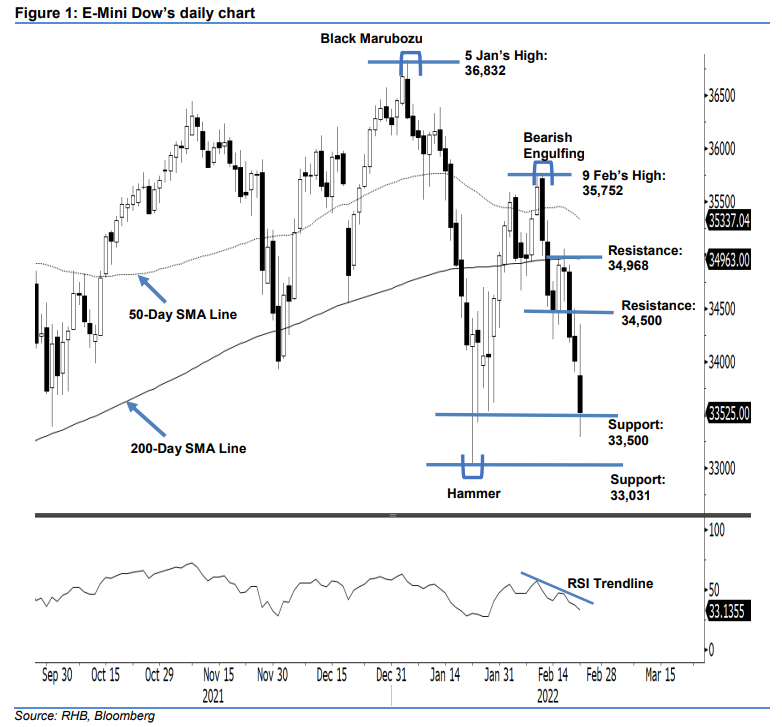

Keep the short positions. The E-Mini Dow continued to see sentiment remaining weak. Yesterday, it fell for the fourth consecutive session, retreating 482 pts and closed at 33,525 pts. After it opened at 33,869 pts, the index did attempt to test the session high at 34,349 pts. However, the intraday gains were erased and selling pressure dragged it towards the 33,292-pt session low before the close. The latest price action showed the E-Mini Dow continues to chart a fresh “lower low” and that the negative momentum remains in play. For the coming sessions, we think the bulls may attempt to defend the YTD low of 33,031 pts. Hence, we expect buying pressure to emerge between 33,500 pts and 33,031 pts. As the index is trading below the 200-day SMA line, we stick to our negative trading bias.

We advice traders to hold on to short positions initiated at the closing level of 11 Feb, ie 34,627 pts. For risk-management purposes, the stop-loss threshold is set at 34,968 pts.

The first support is marked at the 33,500-pt whole number and followed by lower support of 33,031 pts, which was 24 Jan’s low. The immediate resistance remains glued to 34,500 pts and then the higher hurldle of 34,968 pts, which was 15 Feb’s high.

Source: RHB Securities Research - 23 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024