WTI Crude: Mild Profit-Taking Near the Immediate Resistance

rhboskres

Publish date: Wed, 23 Feb 2022, 05:07 PM

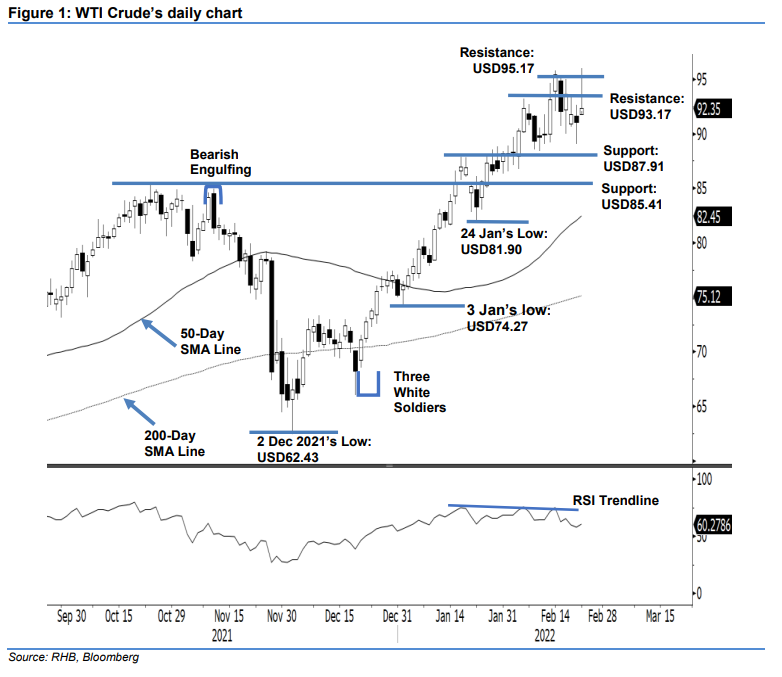

Maintain long positions. The WTI Crude’s upside movement lessened to a smaller gain of USD1.28 yesterday after it was blocked by the immediate resistance on profit-taking. The commodity initially started off at USD91.75. It then progressed higher to test the session high at USD96.00. However, the WTI Crude failed to contain the bullish momentum, paring the intraday gains and closing at USD92.35. The RSI indicator is trending lower now, suggesting the commodity may move sideways for consolidations. Based on recent price actions, we observed that strong support has formed at USD87.91. As long as the WTI Crude continues to trade above the immediate support, we think the upside risk remains. The commodity may retest the resistance in the near future post consolidations. Breaching the higher hurdle of USD95.17 will lead the black gold towards the USD100.00 mark. At this stage, we continue to stay with the bullish trading bias.

Traders should retain the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage the downside risks, the trailing-stop threshold is pegged at USD87.91, ie the high of 19 Jan.

The immediate support remains at USD87.91 – 19 Jan’s high – and is followed by USD85.41 or 25 Oct’s high. The resistance level is sighted at USD93.17 – 4 Feb’s high – and followed by USD95.17, ie the high of 15 Feb.

Source: RHB Securities Research - 23 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024