FKLI: Immediate Support Remains Intact

rhboskres

Publish date: Wed, 23 Feb 2022, 05:08 PM

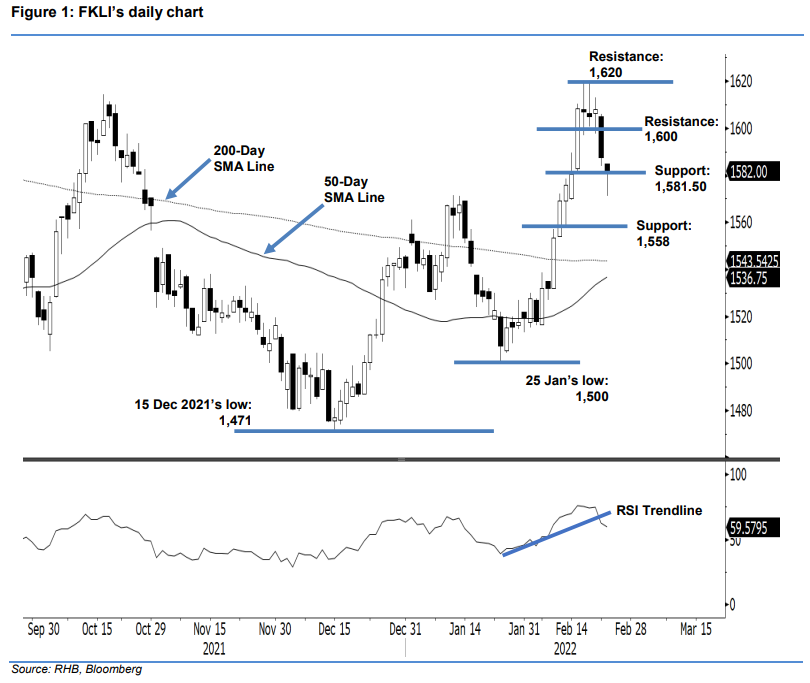

Maintain long positions. Selling pressure on the FKLI was met with strong support from the bulls yesterday, and the index underwent a strong rebound to close at 1,582 pts. It opened at the day’s high of 1,585 pts, and fell to the session’s low of 1,571 pts, before rebounding towards the close. The latest price action reaffirms our view that the 1,581.50-pt level is acting as a strong support. As long as the index stays above this level, it may consolidate sideways and maintain the bullish structure. Otherwise, falling below the immediate threshold may attract further selling pressure and open the door for a downside correction. As the trailing-stop is intact, we maintain a positive trading bias.

We recommend that traders stick to the long positions initiated at 1,527.50 pts, or the close of 3 Feb. To protect the downside risks, the trailing-stop threshold is set at 1,581.50 pts.

The immediate support remains at 1,581.50 pts (15 Feb’s low), followed by 1,558 pts or the low of 11 Feb. On the other hand, the first resistance remains at the 1,600-pt psychological level, followed by 1,620 pts or the high of 17 Feb.

Source: RHB Securities Research - 23 Feb 2022