WTI Crude: Struggling to Climb Higher

rhboskres

Publish date: Thu, 24 Feb 2022, 05:23 PM

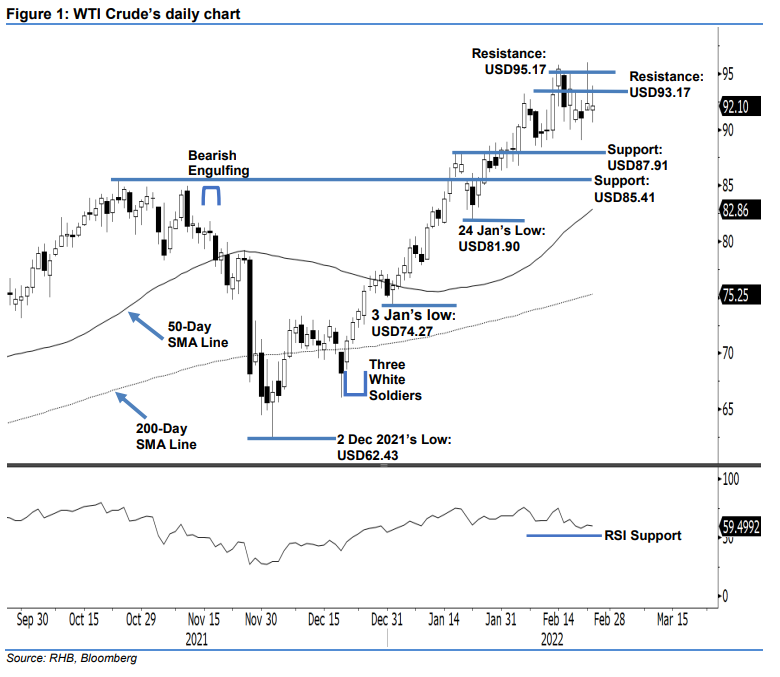

Maintain long positions. The WTI Crude re-attempted to climb higher yesterday but failed after strong intraday profit-taking took place – it closed USD0.25 lower at USD92.10. The commodity began slightly lower at USD91.74 and whipsawed to then touch the USD90.64 day’s low during the late Asian trading session. Strong buying interest kicked in to uplift the WTI Crude higher towards the USD93.90 day’s high before strong profit-taking came in to drag it strongly towards the close – just above the opening level. The latest small white body candlestick with long upper shadow depicts the receding of the bullish momentum as of late. Nevertheless, as long as the commodity continues to trade above the immediate support of USD87.91, the bears have yet to take control. Hence, we think the WTI Crude will consolidate in a sideways movement in the coming sessions before the return of the bulls. As such, we continue to stay with a positive trading bias.

Traders should retain the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage the downside risks, the trailing-stop threshold is set at USD87.91, ie the high of 19 Jan.

The immediate support remains at USD87.91 – 19 Jan’s high – and is followed by USD85.41 or 25 Oct’s high. The resistance level is sighted at USD93.17 – 4 Feb’s high – and followed by USD95.17, which was the high of 15 Feb.

Source: RHB Securities Research - 24 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024