COMEX Gold: Setting a Foothold Above USD1,900

rhboskres

Publish date: Thu, 24 Feb 2022, 05:23 PM

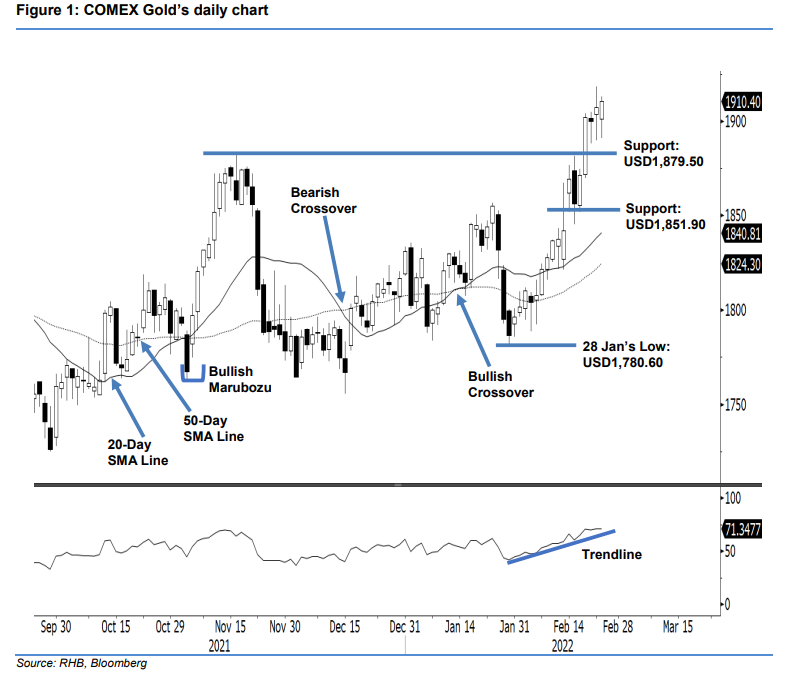

Maintain long positions. The COMEX Gold was undeterred by mild selling pressure on Wednesday, rising USD3.00 to settle stronger at USD1,910.40. The commodity began the session at USD1,901.20. At one point it fell to the USD1,891.10 day low. However, strong demand lifted the COMEX Gold back above the opening price, touching the USD1,912.90 day high before the close. The latest price action showed that the commodity continues to chart a “higher low” bullish pattern. We observe that the RSI is pointing upwards, reaffirming the bullish momentum is still intact. As such, the bulls may set their sights on the USD1,950 level. In the event the selling pressure is extended, the COMEX Gold may find strong support near the USD1,879.50 mark. With the bullish structure still sighted, we keep to our positive trading bias.

We recommend traders hold on to the long positions initiated at USD1,818.50 or the closing level of 11 Jan. For trading-risk management, the trailing-stop threshold is fixed at USD1,851.90, ie 14 Feb’s low.

The immediate support remains unchanged at USD1,879.50 – 16 Nov 2021’s high – and is followed by USD1,851.90. Conversely, the upside resistance is eyed at USD1,950, followed by the USD2,000 round figure.

Source: RHB Securities Research - 24 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024