Hang Seng Index Futures: the Momentum Remains Weak

rhboskres

Publish date: Thu, 24 Feb 2022, 05:24 PM

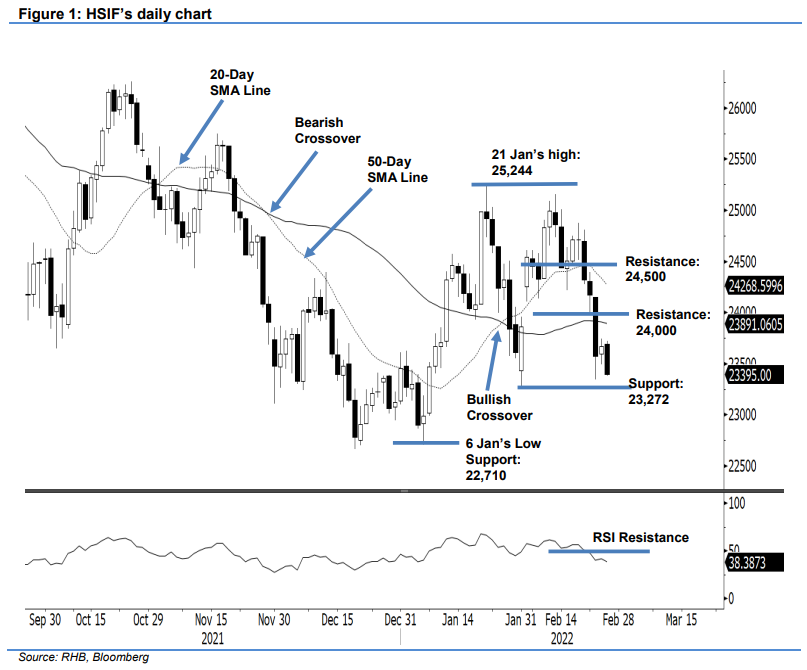

Maintain short positions. The HSIF momentum remained weak yesterday and has yet to establish a meaningful interim base. The index rebounded by 97 pts to end the day session at 23,671 pts – it did retreat 276 pts during the evening session and last traded at 23,395 pts. The latest negative price action suggests the negative momentum remains in play and that the HSIF is heading lower to test the 23,272-pt support. Breaching the immediate threshold may send the index towards the YTD low or 22,710 pts. In the event the HSIF stages a technical rebound, it may test the nearest overhead resistance near the 50-day SMA line. With the RSI trending below the 50% threshold – indicating that the bears still have a technical advantage – we are keeping to our negative trading bias.

Traders should stay with the short positions initiated at 24,323 pts or the close of 18 Feb’s day session. To mitigate the trading risks, the stop-loss threshold is set at 24,500 pts.

The immediate support is marked at 23,272 pts – 31 Jan’s low – and then 22,710 pts or the low of 6 Jan. Meanwhile, the first resistance is glued to the 24,000-pt psychological level with a higher hurdle at the 24,500-pt whole number.

Source: RHB Securities Research - 24 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024