FKLI: Bouncing Off The Immediate Support

rhboskres

Publish date: Thu, 24 Feb 2022, 05:26 PM

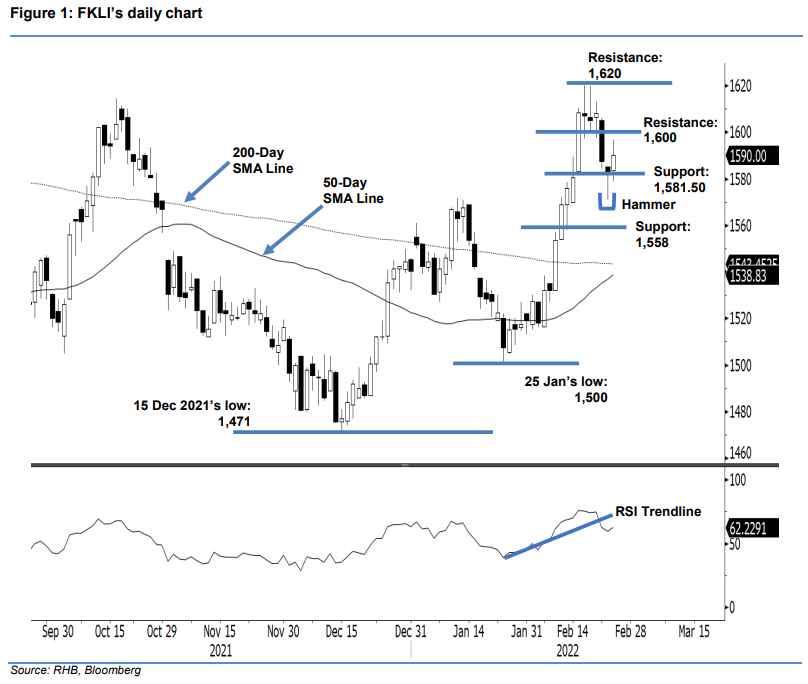

Maintain long positions. Following a Hammer pattern formed near the support, the FKLI rebounded 8 pts and closed at 1,590 pts. The benchmark index opened at 1,583.50 pts. After setting a foothold at the day’s low of 1,579 pts, the index jumped to print the day’s high of 1,596.50 pts. It then pared the intraday gains and closed at 1,590 pts. The RSI is rounding up, indicating that the bullish momentum is gaining pace again. Meanwhile, the index also formed a strong support at the 1,581.50-pt level. If it continues to trade above this level, the positive momentum may lift it higher to test the 1,600-pt level. In the event it breaks past the psychological level, this will attract further buying pressure and propel it upwards further. For now, we maintain a positive trading bias until the trailing-stop is breached.

Traders should retain the long positions initiated at 1,527.50 pts, or the close of 3 Feb. To mitigate the trading risks, the trailing-stop is fixed at 1,581.50 pts.

The immediate support remains at 1,581.50 pts (15 Feb’s low), followed by 1,558 pts (11 Feb’s low). Conversely, the nearest resistance is still at the 1,600-pt psychological level, followed by 1,620 pts or the high of 17 Feb.

Source: RHB Securities Research - 24 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024