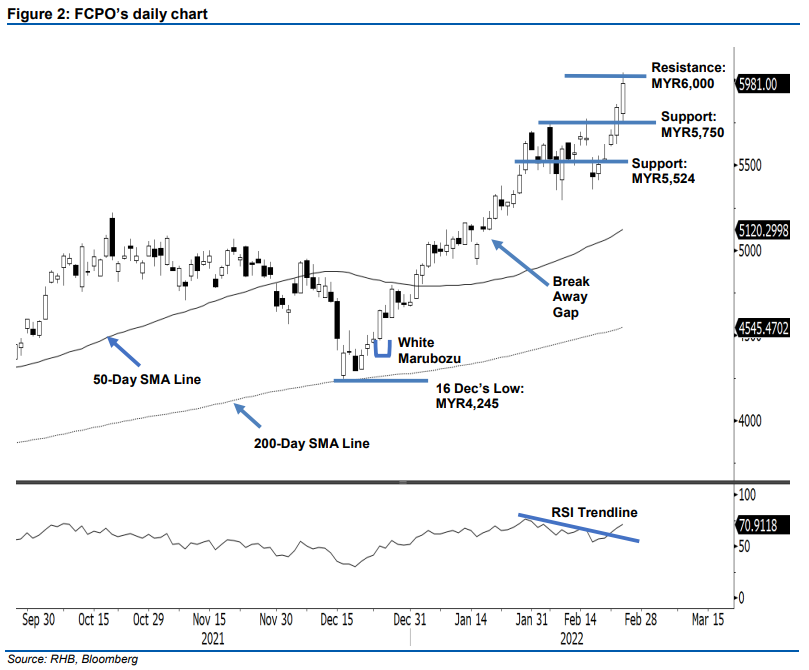

FCPO: Eyeing To Cross MYR6,000 Level

rhboskres

Publish date: Thu, 24 Feb 2022, 05:26 PM

Maintain long positions. The FCPO continue its upside movement for the fifth consecutive session, jumping MYR142.00 to close at MYR5,982. The commodity initially started off at MYR5,802. It then gapped up during morning session, progressed towards MYR6,043 day high before the close – printed a long bullish candlestick. The price action confirmed that the bulls remains in control, setting sight to cross above the MYR6,000 threshold. If it managed to break above the physchological level, it may scale higher to test the higher hurdle of MYR6,160. In the event the commodities resort to profit taking activities, MYR5,750 will provide an immediate support. For now, we continue to hold on bullish trading bias.

We advise traders to keep the long positions initiated at MYR5,675, or the close of 21 Feb. To protect the downside risks, the stop-loss is placed at MYR5,500.

The immediate support is adjusted higher to MYR5,750 – 23 Feb’s low – followed by MYR5,524 or the low of 18 Feb. On the upside, the immediate resistance will be MYR6,000, then MYR6,160.

Source: RHB Securities Research - 24 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024