WTI Crude : Attempting to Print Above the USD100.00 Level

rhboskres

Publish date: Fri, 25 Feb 2022, 04:59 PM

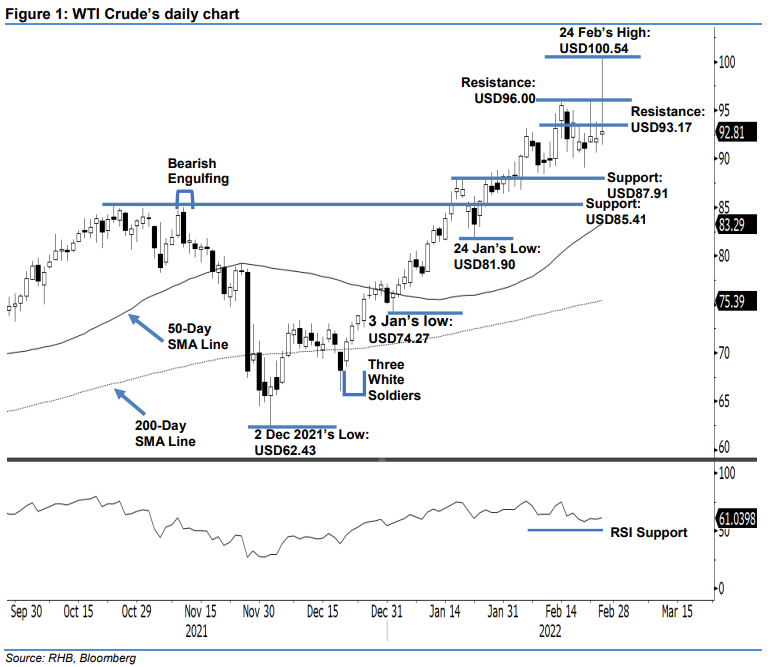

Maintain long positions. The WTI Crude re-attempted to surpass its recent high yesterday, albeit shortlived. It retraced strongly from the strong intraday high towards the opening level as it closed only USD0.71 higher at USD92.81. The commodity opened at USD92.52 and boosted towards hitting the intraday high of USD100.54 during the European trading session. After struggling to move higher, strong selling pressure kicked in during the US trading session that saw the WTI Crude fall sharply towards the close – touching the day’s low of USD91.45 before closing. The neutral body candlestick with long upper shadow depicts the temptation of the bulls to propel the commodity above the USD100.00 threshold, although it did not sustain until the end of the session. Nevertheless, the latest session – which still closed with a mild positive tone that was USD0.71 higher – shows the selling momentum has not outpaced the buying pressure yet. Hence, we think the WTI Crude will continue to consolidate in a sideways movement in the coming sessions before re-attempting to propel higher. As such, we stick with our positive trading bias.

Traders should retain the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage the downside risks, the trailing-stop threshold is set at USD87.91, ie the high of 19 Jan.

The immediate support remains at USD87.91 – 19 Jan’s high – and is followed by USD85.41 or 25 Oct’s high. The resistance level is sighted at USD93.17 – 4 Feb’s high – and followed by USD96.00, ie the high of 22 Feb.

Source: RHB Securities Research - 25 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024