FKLI: Bears Are Taking The Lead

rhboskres

Publish date: Fri, 25 Feb 2022, 05:00 PM

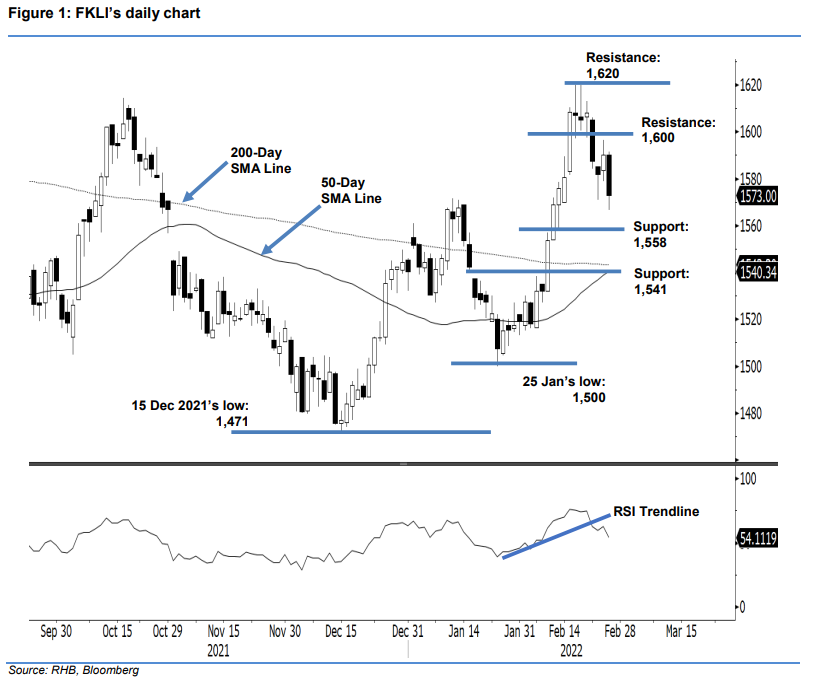

Trailing-stop triggered; initiate short positions. The FKLI underwent strong selling pressure yesterday, and shed 17 pts to close at 1,573 pts – breached the previous support of 1,581.50 pts. The benchmark index initially opened at 1,590 pts. Soon after the morning session began, sentiment turned negative where the index plunged to the day’s low of 1,566.50 pts, and closed at 1,573 pts. The latest price action has negated the bullish candlestick formed on 15 Feb. The long bearish candlestick also shows that the bears have overwhelmed the bulls. With the RSI pointing downwards, the negative momentum is in play now. Expect the negative momentum to follow through to test the 1,558-pt level. Since the trailing-stop has been triggered, we shift our trading bias to a negative one.

We closed out the long positions initiated at 1,527.50 pts, or the close of 3 Feb as the trailing-stop of 1,581.50 pts has been triggered. Conversely, investors can initiate short positions at the closing level of 24 Feb, or 1,573 pts. To mitigate the trading risks, the initial stop-loss is set at 1,606 pts.

The immediate support is now at 1,558 pts – 11 Feb’s low – followed by 1,541 pts (17 Jan’s low). Meanwhile, the upside resistance remains at the 1,600-pt psychological level, followed by 1,620 pts or the high of 17 Feb.

Source: RHB Securities Research - 25 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024