Many people always say trading is gambling, investing is the right thing to do. Personally, I think those who come out with trading = gambling don’t really understand the real meaning of investment & trading. Gambling or not is the mindset, not the method you apply in the stock market.

One main reason why many perceive trading as gambling is because they are not able to make consistent profits in short term trade. Always switching their mindset from trader mindset to investor mindset based on their portfolio returns.

The process always starts with the mindset of making a fast profit from the stock market. When their portfolio turns into losses, they start to hold their shares and hope “Time” will turn their losses into profit.

The majority of the retail participants in the stock market went through the above process and many are still trapped in this cycle. Which they are gambling in the stock market.

Gamble definition : (from Oxford Language)

“take risky action in the hope of a desired result.”

Many “investors” might not agree with me that they are gambling. Because investing sounded much more sophisticated, elegant, & “atas” (high-end). I mentioned retail participants hold their shares and hope that the “Time” will turn their losses into profit.

Based on the definition of Gamble, you are losing money without an exit plan (risky) and you hope that your shares will turn into profit in the future. Basically, you are applying a gambling method to buy stocks. Even though you are holding it long term.

If you are applying this method in the stock market, please do not perceive trading as a form of gambling. Failing to have profitable trades in the stock market doesn’t mean the method is wrong. Don’t blame the method but blame yourself for not spending more time understanding better.

A true trader or an investor always has a proper exit strategy (cut loss) not just hope for your desired exit plan will happen in the future. We understand losing in the stock market is normal & we know our risk management.

Long Term investment & Short Term trading are the same

Investing long term or trading short term is the same to us, both are looking for capital gained. We invest long term in stock because we find the team, business, & the share price management (main point) is good & the stock price will increase along the way.

We trade short term because we are at the right timing & opportunity to enter into stock for capital gain. We will not enter if we miss the timing & take it as a long term investment. Because these opportunities happen for a short period of time only. It is not suitable to hold for the long term.

If you want to excel in the stock market, let's understand investment & trading from its roots. Put aside your perception & start to understand it like a blank paper.

Investment definition : (from Oxford Language)

“the action or process of investing money for profit.”

“an act of devoting time, effort, or energy to a particular undertaking with the expectation of a worthwhile result.”

Investment is a big picture of our action or process to bring good in the future. You invest your time in the gym, so you can be healthy for a longer time. Football players invest their time in training, so they can achieve consistent performance in the match. Our parents invest in educating us, so we can survive when we reach adulthood.

Trade definition : (from Oxford Language)

“the action of buying and selling goods and services.”

“a job requiring manual skills and special training.”

Trading is the component of the big picture and it is the driving force to the end goal. Which is the result of our investment.

You hit the gym because you want to be physically healthy. Running on the treadmill, attending a high-intensity interval training class, or lifting weights are the components to achieve your physical fitness.

Trade is an action, skill, or practice of a set of rules continuously until you master it and bring benefits to us consistently.

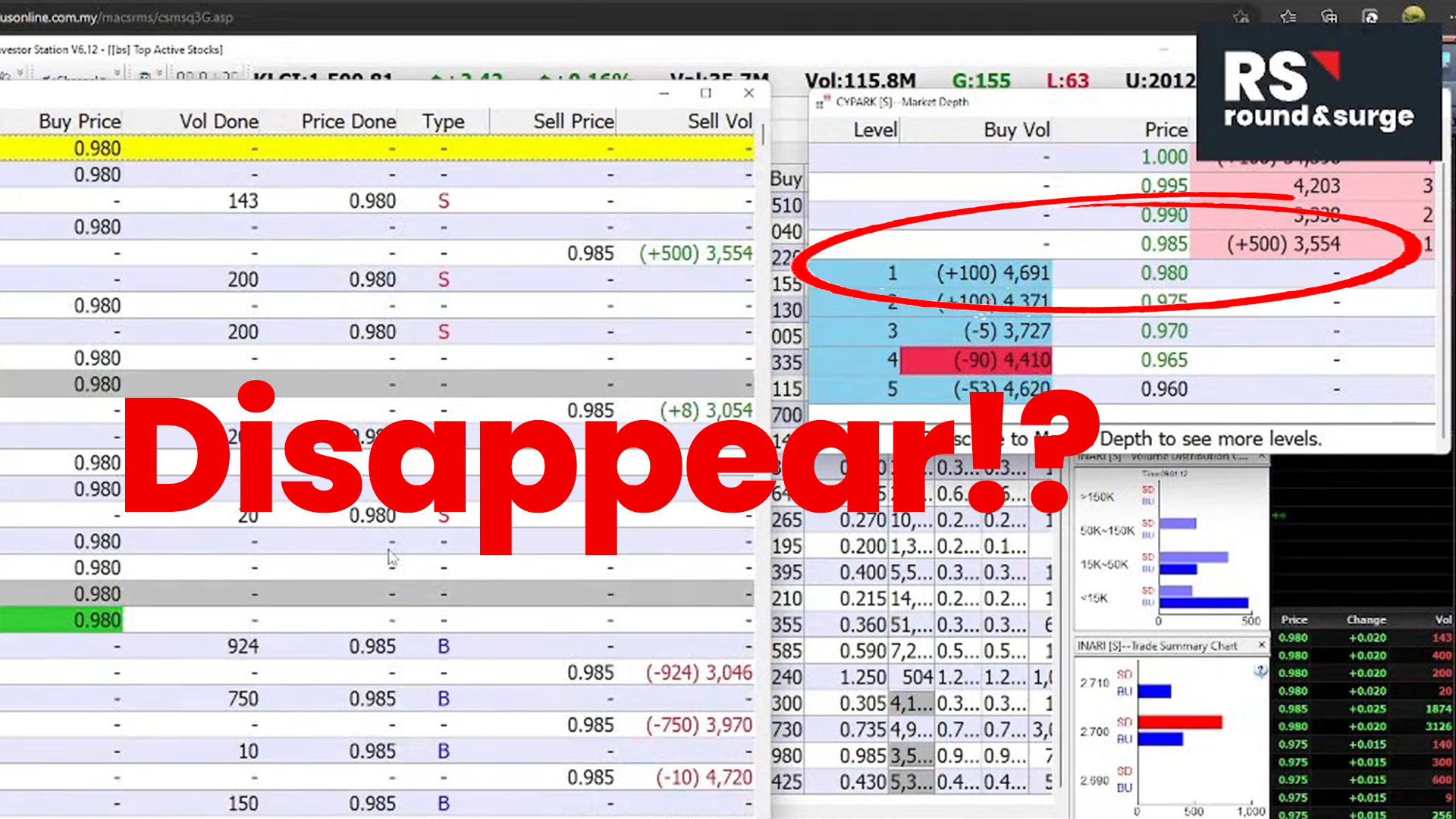

You can invest in your trading skill with time, cost, energy, & effort on practising your entry timing, exit timing, analysis, risk management, & learning from mistakes in order to achieve consistent trading returns in the long run. (can look into our operator analysis, if you are interested in finding out how to follow big boys in the stock market.)

The effort we put in to become a trader will not be less than long term investing. Especially emotional management, we have to follow the market and ignore our greed & fear that will affect our trading plan.

Basically, investment & trading is the same. Our objective is also capital gains (don’t tell me you are looking for dividend investment, even with the stock price down 50%, you still think your dividend can cover the capital losses.), we apply risk management too, we need to find the right timing for entry & exit too. The only difference is the holding time frame, long & short.

Holding time frame doesn’t determine whether you are an investor or trader. Holding a losing stock for a long time doesn’t make you an investor, you are merely a stock collector or playing 1 round of blackjack game that lasts for a few years.

Whether you are an investor or trader is determined by the effort & benefits you gained from long term investment & short term trade CONSISTENTLY.

Hopefully, this article will help you or your investment buddy to realise and break through this cycle. By understanding the meaning of investment & trading better, they can choose the right method to make returns from the stock market.

To those who are willing to invest in their trading skill to achieve long term benefits from trading. You may look at the link below on how we analyze big boys' intentions with the data available in the market. Finding stocks that big boys accumulate and ride with them from the bottom to the top with our Operator Analysis. It is an analysis for short term to midterm trade.

Register with the link below to watch our Operator Analysis video :

https://bit.ly/roundnsurge

Trading Account Opening

They are offering IntraDay trade brokerage rate at 0.05% or RM8 whichever is higher for day trading stocks RM 50,000 & above transacted volume (buy sell the same stocks in the same day). Buy & hold at 0.08%or RM8 whichever is higher.

Open a cash account now at the link below :

As Kelvin’s trading client, you will be exclusively invited to join Kelvin’s weekly webinar and telegram group.

For more inquiry contact him by email: kelvinyap.remisier@gmail.com or 019-5567829

If we have missed out on any important information, feel free to let us know and feel free to share this information out but it will be much appreciated if you can put us as the reference for our effort and respect, thank you in advance!

Find out more about how we track big boys effectively in our Facebook and YouTube Channel :

This blog is for sharing our point of view about the market movement and stocks only. The opinions and information herein are based on available data believed to be reliable and shall not be construed as an offer, invitation or solicitation to buy or sell any securities. Round & Surge and/or its associated persons does not warrant, represent and/or guarantee the accuracy of any opinions and information herein in any manner whatsoever and no reliance upon any parts thereof by anyone shall give rise to any claim whatsoever against Round & Surge. It is not advice or recommendation to buy or sell any financial instrument. Viewers and readers are responsible for your own trading decision. The author of this blog is not liable for any losses incurred from any investment or trading.