MMSV, Potential Bottom Up ??

secret1q

Publish date: Fri, 08 Jul 2016, 04:19 PM

MMS Ventures Berhad ("MMSV") was incorporated in Malaysia under the Companies Act, 1965 on 29 March 2004 as a private limited company. MMSV was converted into a public limited company and assumed its present name on 19 October 2004.

MMSV was established as the investment holding company of MMSV Group in conjunction with the listing of MMSV on the ACE Market (Formerly known as MESDAQ Market). Currently, MMSV has 2 subsidiary companies namely Micro Modular System Sdn Bhd ("MMS") and Evolusys Technologies (Malaysia) Sdn Bhd ("Evolusys"). MMS is involved in the design and manufacture of LED and Semiconductor Industrial Automation Systems and Machinery. Evolusys is involved in the software development.

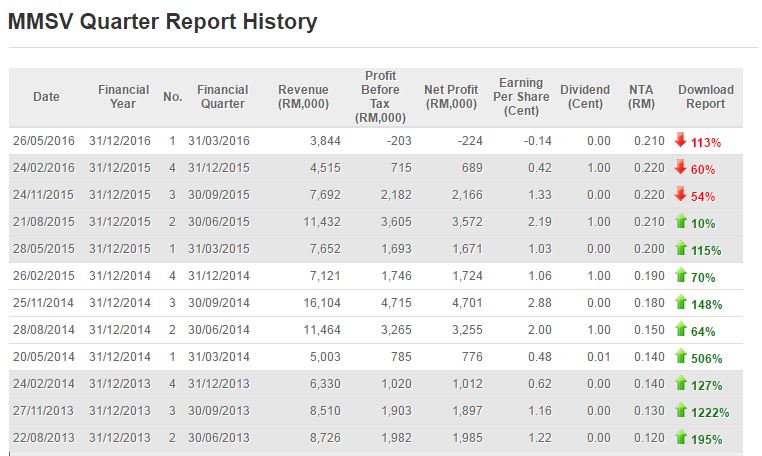

After few consercutive non favorable quarter report , the stock price of MMSV is drop from the higest price of RM0.89 around mid May 2015 to Tuesday (5.7.16) closing at RM0.515. It represent a 42% drop from the peak price.

The most recent quarter report show a net loss of earning and reported a loss per share of 0.14 sen.

In the note of explaination in the quarter report, it stated that the current quarter poor performance mainly due to 2 main reasons:

1. decrease in sales of machines to the manufacturers of both LED and Semiconductor industries. The effect of cautious spending in their capital expenditure by these manufacturers in the past few months due to the uncertain global economic condition has spilt over to the first quarter of current year and reflected as a general phenomenon within the industry.

2. The decrease in other operating income and increase in other operating expenses were caused by the forex loss arising from the weakened US Dollar against the RM between the time sales were booked and when they were realised. A significant portion of the Group’s sales was denominated in the US Currency.

In summary, the 2 main reason is decrease in sales/ demand and also Forex factor.

However, under the current year prospects, it stated the below statement :

" Our continuous and relentless marketing effort has finally paid off. Even-though our first quarter’s result was weak, the Directors are confident that the prospect for the rest of the current financial year will remain good and profitable. A few weeks before the end of last quarter, the Group has secured a good number of orders from customers for various types of machines which should augur well for the Group. "

The company management had make a confident statement that the upcoming demand problem shall been solved as secured a good number of orders in hand currently and forex matter shall not be a issue as the USD against MYR is generally higher in Q2 compare to Q1 for 2016.

Based on the news earlier by Nanyang , it stated that the revenue expected to increase by 20% for the 1st half of 2016.

2016 1st half revenue is at RM19.084 Mil, 20% increase in revenue will make the revenue to acheive RM22.9 Mil by 1st half 2016.

From here we can expect the Q2 2016 revenue is RM22.9 Mil minus Q1 2016 revenue which is RM3.844 Mil which will become RM19.056 Mil of revenue for the Q2 revenue which is a bit too good to believe that it is true because the best quarter revenue the company ever acheived is only RM16 Mil per quarter. It in the other word means that it is possible for the company to record another historical quarter result in coming Q2 2016.

If we stay optimistic, 19 Mil revenue, then the EPS probably will close to 3 sen in Q2 2016, then imaging how will be the share price react for a historical high quarter performance. Possible it will rebound and go back to near new high point again, probably YES will be the answer.

Technically it is at near bottom of RM0.45 of recent low price. Today the share price is rebound to RM0.55 at the time I am writing now. Will it be another round of rally after market digest the bad result and in 1st Quarter which release in end of May? People make around 1 month to digest the bad result and good prospect, it is enough time of digest??

How is the risk and reward if buy in now

Risk: 1st support (RM048 , 12.7% loss) , go back to recent low (RM0.45 , 18% loss)

Reward : Fibo (161.8% - RM0.56 , 1.8%), (261.8% - RM0.63 , 14.5%), (423% - RM0.745 , 35.4%), (recent high - RM0.89 , 61.8%)

Let see on next Monday how the share price of MMSV will react :)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on What Stock To Buy ?

Created by secret1q | Dec 20, 2018