My portfolio performance

shinado

Publish date: Fri, 13 Nov 2015, 07:23 PM

In my previous post, I have list down my stock selection criteria and the list of stocks that I am currently holding in my portfolio. If you miss out the post, here it is: http://klse.i3investor.com/blogs/shinado/85991.jsp

For this post, I shall talk about my portfolio performance.

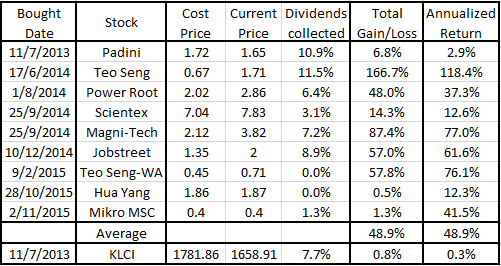

Current prices are as of today (13th Nov).

The table above represents the list of stocks that I am currently holding, their cost price, current price and also the amount of dividends that I have collected so far in percentage to my cost price. I have also included the KLCI in the table as my benchmark. How do I calculate my annualized return for individual stocks? The formula is ((profit or loss) / number of days holding the stock) x 365 days.

You may notice some discrepancy in cost pricing. That is because I have adjusted the prices to bonus share issued, share consolidation & averaging cost (buying in more than once).

I started this portfolio in the year 2013. Padini is currently my longest holding stock and my latest addition is Mikro MSC. Notice that after 855 days, KLCI's total return including dividends only amount to 0.8% or 0.3% annualized.

So far it looks good. But that is just one side of the coin. How I have struggled to understand fundamentals and making bad decisions along the way before getting here is not shown on that table.

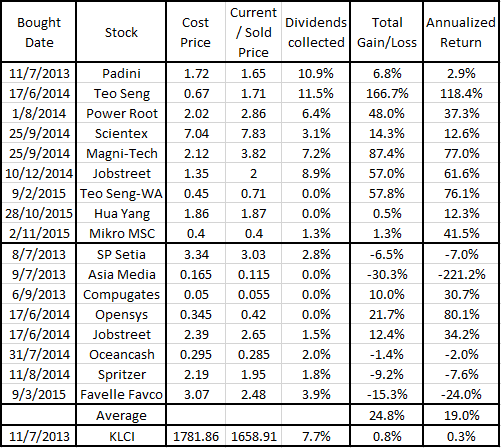

This table below here should accurately present how my portfolio actually performed:

I have included stocks that I have already sold and obtained realized profit/loss. Notice that Asia Media is still the worst performing stock that I ever bought., big thanks to my little or no fundamental knowledge at that time. I have a post on my journey in investing here: http://klse.i3investor.com/blogs/shinado/85706.jsp

Now my average gain is reduced to 24.8% over the course of 855 days (roughly 2 years and four months). Annualized return is 19%. I still think it's quite alright but now I'm slightly skeptical about reaching my target of 100% over the course of 5 years. Only slight less than 2 1/2 years remaining to achieve it.

Year 2014 & 2015 have been an interesting period of time to be investing in the stock market. Remember the market crashed 3 times? Or 2 times, depending on how you see it. Eitherway, I still consider our market remain volatile with the weakening ringgit & low oil prices. But I will not lose sleep over it.

Going forward, I intend to polish up on my fundamental knowledge to better prepare myself when it comes to stock selection. I think it will be interesting to include 1-2 stocks from the Magic Formula sometime later. Or maybe even a NNWC (Net Net Working Capital) stock. But for now, I am holding roughly 6% in cash for emergency purposes.

I hope you enjoy reading my post. Please feel free to comment below on your thoughts, criticism & investing ideas. Thank you.

Note: The stocks mentioned above do not constitute a BUY/HOLD/SELL call. Please do your own research beforehand. Thank you.

shinado

More articles on Fundamental Investing

Discussions

Good effort. I did these when i start investing many many years back. Ok ... what i really want to know is

1. your fund value (including the CASH) at "beginning" and "end" of every year for annual rate calculation..

2. and state the date and how much every time u inject new cash into the fund.

Cheers.

2015-11-14 09:50

BearbearDrop Some dividend return appears high as I am calculating based on dividend yield adjusted to the cost price. It may not be so high if we calculate based on trailing 12 month DY.

leno, that would require some work to do. I did not keep track on when I inject new cash into the fund or how much percentage of cash I hold for that certain year. I only keep track of my current cash holding %, the date I bought/sold a stock and the amount of units. But I would prefer not to disclose it. Cheers.

2015-11-14 10:21

u dun need to disclose it ... but u need to know these for your self. If u haven't done so ... u must start to do it. U can start by now. How much is your stock worth now and how much cash in the fund (meaning Cash in your share account). U dun need to included cash in your saving account. Onli those cash u transfer from saving account into share account. Open a new excel page, and record it down. For eg. 01/11/2015 inject RM 1,000 cash into share account.

2015-11-14 10:51

in another excel page ... u should have a portfolio BALANCE SHEET. In Balance sheet ... u should list down preferably "horizontally" instead or vertically your cash and all the stocks VALUE u own. For eg. Capital : Total Fund Value : Net : %Net : Cash : X-Div : padini : spsetia : opensys : etc.

2015-11-14 11:00

X-Div = dividend that has been x-dated, but not yet received.

Once the dividend received than u must transfer the value of X-Div to Cash section.

2015-11-14 11:01

sometime I will go to the realized p&l section to revise the result, the issues I found is they didn't include the brokerage fee for every purchase and repurchase transaction into the realized p&l calculation may be it taste better for the viewer, so I need to copy them individually into excel sheet and correct them

In the end it is still the cash on hand that matter the most

So remember to keep track record of it every once a while

I prefer to keep it every month end

2015-11-14 11:25

For once I see Leno is well behaved. So good to see a tame cute cat again.

Here let Calvin tell you a stock that will protect you from the erosion of your purchasing power.

Go see GMutual

Last week I visited MAPEX in Johor. I got a nice surprise to note that their iconic Austin 18 Versatile Suites which are commercial soho right at the traffic junction in Mt Austin have already sold over 80%.

A check with GMutual website reveals that even GMutual Bosses are buying these sohos themselves.

Gmutual Bosses are very conservative businessmen who regularly attend OSK-RHB Investment Talks. They also own Dominant Ent.

All GMutual properties are LANDED Houses, Commercial Shops or Industrial factories in Johor and Melaka. (Fortunately no high rise condo).

So at 42 cents with NTA over 80 cents plus Good EPS and dividend GMutual will help all to Grow Mutually.

Grow Mutually?

YES! I and many Johor Buddies Have Mutually Made 5 to 6 figures in Pm Corp. This is what GMutual stands for.

2015-11-14 11:50

like i said ... during early stage .. newbies will tend to do like u do ... i last time also record all this. Now i am in different stage liaw ... hope u one day will reach my stage ... then u will say the same thing like i just did. At my stage ... i no need record so detail all this small small issues mar. It is the bigger picture that i look at. For eg. who care how much i bought or sell LCTH or PMCorp LAST TIME. I onli ask ... what is the current value of LCTH, what is the buy/sell price, what is my current cash, exposure, what is the near term outlook etc. For eg. let said i sold LCTH 13 sen last month ... doesn't mean i will not buy back LCTH at 20 sen.

2015-11-14 12:39

Shinado, thanks for sharing.

I am using I3's "Portfolio" to follow up the performance of my stock investment. You need to key in all the transactions including buy,sell,dividend,bonus,split etc. You can set the commision rate and even GST rate.

The "Snapshot" and "Wealth creation" are the sites that I can view my return either current total return or cumulative return and capital change monthly, quarterly and yearly.

You can view individual stock's all time performance easily and the records are kept though you have sold them.

I find that it is simple to use and save your time in calculation of the stock performance in term of realized and unrealized gain & dividend received too.

2015-11-14 18:11

Good debate on the performance tracking. I would suggest to use a portfolio tools to track it. And, i think i3 portfolio tool is very good.

2015-11-15 09:31

Thank you all for sharing, very informative. I will have a look at the I3 'Portfolio' later.

2015-11-15 10:55

If read shinado and kc chong blogs many people assume they and buy and hold stocks with not much trading. If read other people comments(Leno, ks55) there a lot of trading even in few stocks. Which one is true and which method is better? How about future performance even if past is good?

2015-11-15 11:44

more likely to make $$$ through long term investing, or by short term trading? no right or wrong method...so long happy, make money and harm nobody.

Good luck and all the best everybody!

2015-11-15 19:15

Leno the cat real smart now.

Dr Neoh tells people to buy undervalue shares and wait for prices to move up on its fundamental.

However, once a while Mr Market goes crazy and goreng up a fundamental far above its intrinsic value.

Hmmm?

In that case the goal is achieved very early. So we must seize the opportunity and sell.

Then go and find other undervalue stocks.

This is how Peter Lynch at 39% beats Warren Buffet's 25% yearly performance.

2015-11-15 20:39

Why?

And other questions.

Go and sign up a study course with Kcchongnz and you will get all the answers you need.

2015-11-15 21:14

NOBY

Consider using time weighted returns and XIRR to calculate annualized returns.

http://www.oldschoolvalue.com/blog/investment-tools/calculate-xirr-annualized-returns/

2015-11-13 22:32