My stock selection criteria & portfolio

shinado

Publish date: Thu, 12 Nov 2015, 01:10 PM

As promised I will disclose the list of stocks that I'm currently holding in my portfolio for sharing, learning & exchanging ideas. But before that, allow me to explain my stock selection criteria. I find this method suitable to my style of investing and I do not lose any sleep when market crashes. It may not suit your styles or methods. Whichever method or approach to investing you choose to adopt, make sure you are comfortable with it. After all, it's your hard earned money right?

Objective & Expectation:

To invest on fundamental basis for a term of 5 years. I have set a target to gain 100% in profits over these 5 years. I may choose to continue investing or redeem for use beyond 5 years.

Risk Appetite:

Medium to High. I like taking calculated risks without losing much sleep at night. For most of the time, I do not buy into turnaround stocks. "Turnaround stocks seldom turnaround" - Warren Buffet. But my risk appetite may increase over time with better knowledge and insight, therefore, I will "never say never" on this one.

Holding Power/Period:

I will hold on to a stock for long term as long as fundamentals remain intact. I may switch from one stock to another if I find something better.

Benchmark:

I will benchmark my portfolio against the KLCI index FBMKLCI:IND.

My Screening Approach:

In the investing world, there are 2 approach when screening for stocks: Top-down approach or bottoms-up approach. Top-down approach will look into a selected sector and then screen for the best stocks in that sector. Bottoms-up approach will look into a stock regardless of sector, and then only compare with its peers. I am using the bottoms-up approach.

Financial Ratio/Criteria:

- Increasing revenue for the past 5 years. A drop in revenue for 2 consecutive financial years is a big no-no for me.

- Increasing net profits and owner earnings for the past 5 years. A drop in profit for 2 consecutive financial years is also a big no-no to me.

- The company must be able to pay some form of dividend in these 5 years. Whether the dividend yield is high/low or increasing/decreasing is not very important to me. If dividend payout increase over time, that would be great.

- Increasing trend for ROIC & CROIC in the past 5 years regardless of the percentage. If more than 10%, then it's great. More free cash is good for shareholders.

- Company must have a minimum of 5% FCF vs Revenue for the latest financial year.

- Return of average equity (ROAE) should be 15% or above.

- Good gross profit and net profit margins compared to its peers or the industry average. If gross profit margin is high, that means you have the cost advantage over your competitors. If the profit margins increases over time, that would be great.

- Company must have a healthy cash balance in bank. Without sufficient funds, a company may need to take a loan from banks/creditors or issue rights subscription which might dilute share ownership.

- I like companies with manageable debt levels or no debt at all.

- I do not invest into companies or sectors that I do not know much about e.g. Banking/financial/plantation.

- I will have 1-2 stocks in my portfolio that gives high dividend yield. (>5%)

- No China companies. They have a reputation for accounting fraud worldwide. I know not all China companies are bad. But I am not willing to take that risk.

- Check for share buybacks. If company does share buybacks when price is undervalued, that's a good thing. Even better if they cancel treasury shares because it's a good gesture from the management that they are protecting shareholders.

- Check if there is sudden resignation from the management team or audit team. Sometimes it may hint of some trouble on board.

- Best avoid companies whereby directors are constantly buying and selling. It will look more like they are trading for their own benefit rather than invest for the long term.

- The stocks that I have selected or interested in buying must meet most of the criteria above.

Valuation methods:

- Benjamin Graham's growth formula. This method by the father of investing is not popular due to its limitations such as getting a negative value. However, it has worked for me so far. Example of this formula used by Intelligent Investor in his post: http://klse.i3investor.com/blogs/intelligent_investor_notes/57177.jsp

- Whatever intrinsic value I get from the method above, I will put in 40% discount to it. That's my Margin of Safety.

- When the above method fails(negative value), I will use EV/EBIT as a secondary method.

- Why do I not use DCF or reverse DCF or any other method? It's due to my lack of understanding and knowledge about it.

My portfolio:

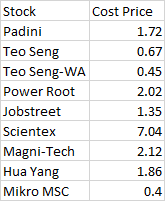

Started in July 2013. Only Padini is from year 2013. Hua Yang and Mikro MSC was added this year while the rest are from year 2014. Cost price for Teo Seng, Jobstreet & Magni is adjusted to bonus share issued & share consolidation.

I shall further discuss my portfolio performance in my next post. Questions, constructive criticisms, thoughts? Do feel free to comment below.

Note: The stocks mentioned above does not constitute a buy/hold/sell call. Please do your own research beforehand. Thank you.

shinado

More articles on Fundamental Investing

Discussions

Hi Ezra_Investor, thank you for your feedback.

I am amazed at how Cold Eye's 5 yardsticks method is simple and effective. As for my method, I know it's complicated but at least I am comfortable with it.

As your suggestion, I might consider it for future use. But first, must learn about DCF.

Posted by Ezra_Investor > Nov 12, 2015 01:27 PM | Report Abuse

Just my 2 cent opinion, actually, no need to be so complicated.

Why? Because complicated does not mean effective. Especially in investing, you'd want to be as simple as possible, otherwise you'll have hard time keeping track of the companies you buy.

I suggest just use Cold Eye's 5 yardsticks, it's a simple but effective method.

If you want, you can add an additional few stuff like DCF and EV/EBIT, and a few, but that's all.

2015-11-12 13:33

Is Benjamin's method (which was written many years ago) still workable nowadays? Also, is the method suitable in Malaysia market, Shinado, can you please share from your experience using this valuation method, anyway, thanks for your valuable write-ups

2015-11-12 14:07

shinado,

Very good investment strategies. Well done.

Your strategies are very safe. Plus they have high probability of meeting your goal of doubling your money in 5 years, or likely better as you have considered many aspects of investing like a businessman.

"Take care of the downside, and the upside will take care of itself."

That is exactly what you are doing, and investors should do, rather than following the greater fool theory.

Just a comment about your Graham growth model. In Graham's time, most stocks did not grow fast at that time. Nowadays, many stocks have high expected growth and Graham's growth model will give you very high intrinsic value with high growth, and often is not justifiable. Try do some sensitivity analysis you will understand what I mean.

Hence I used to advise that this formula is not recommended to value a stock, but merely as a check on how rational the price of a stock is. It was strictly emphasized by Graham too.

2015-11-12 14:25

Hi ksng0307, I'm not sure if anyone is using it over an extensive period in Malaysia market. I do know that this was back-tested in US market using a paper portfolio by Old School Value:

http://www.oldschoolvalue.com/stock-screener.php

Testing period of 1999-2014 gives a total return of 576.45% or annualized return of 12.7%.

I have just been using it for over 2 years. It's not a long time frame, so who am I to say that it's effective? Anyway, I believe that valuation is useless without good fundamentals anyway. So pick a good fundamental company and go with whatever valuation method you like.

Posted by ksng0307 > Nov 12, 2015 02:07 PM | Report Abuse

Is Benjamin's method (which was written many years ago) still workable nowadays? Also, is the method suitable in Malaysia market, Shinado, can you please share from your experience using this valuation method, anyway, thanks for your valuable write-ups

2015-11-12 14:32

For an example of using this formula, let's pick Panasonic. With this formula, I calculate the Intrinsic Value for the next 5 years at RM 19.11. Panasonic is trading at RM 22.10 now. So this means Panasonic is fully valued/over valued. But if I apply Margin of Safety 40%, this becomes RM 11.47. It is telling me that Panasonic is overvalued by a lot!

Another example, I calculated Scientex's intrinsic value for the next 5 years at RM 18.40, and price after Margin of Safety is RM 11.04. It is currently trading at Rm 7.70. It is telling me that Scientex is still undervalued at this moment.

But when I use this formula for a company with negative EPS growth over the 5 years, I get ridiculous value. Example, Fibon. It will tell me that it's valued at only 1 cent. Logically speaking, that's not going to happen.

So there are limitations to this formula. It can only be used for companies that have steady growth.

2015-11-12 14:33

kcchongnz, thank you for comment. I realize this method is considered outdated and therefore also use EV/EBIT to cross check with this formula!

2015-11-12 14:36

Thanks, Shinado. You can try to have a look at Hayashi Noriyuki's book (Unfortunately, it was only translated to Chinese version), in his book, Hayashi is actually using the William O'Neil's method but with some modification. He stressed that a stock price will not go up if it fail to achieve historical high. And of course he has added in his own rank correlation index and selling pressure ratio which helps to know when to exit when market is moving south. Can have a look if you can understand Mandarin. FYI, Hayashi used to be a top fund manager in one of the famous investment bank at Abu Dhabi.

2015-11-12 14:42

ksng0307 I will look into it and maybe Google translate it? Haha. Anyway thanks alot.

2015-11-12 14:57

William O'Neil's method- sounds like it is much more to do with TA rather than FA. i might be wrong ;)

IF a stock price will not go up if it fail to achieve historical high- maybe after formation of double top or triple top and hence the price will go down. but this is just a noise for fundamentalist. for them it is just a matter of time (to create new high) if the foundation is strong enough.

2015-11-13 02:13

azhakha, I really like GDEX & MYEG. They are in my watchlist. However, their valuations are not attractive at this moment. Looking at EV/EBIT or PE, it seems to be expensive at this moment. I will continue to monitor both closely.

Mikro MSC was only added recently and I do not see the need to remove it from my portfolio. As for Padini & Teo Seng, they are up for debate as I have been holding for a while (I still find they have good fundamentals). Thank you.

Posted by azhakha > Nov 13, 2015 12:11 PM | Report Abuse

my 2 cents:

add GDEX & MYEG

remove padini, teo seng & mikro msc

2015-11-13 14:06

Hi shinado. Thanks for the sharing. May I get your telegram or wechat id. So we can create a discussion group there

2015-11-14 08:27

Ezra_Investor

Just my 2 cent opinion, actually, no need to be so complicated.

Why? Because complicated does not mean effective. Especially in investing, you'd want to be as simple as possible, otherwise you'll have hard time keeping track of the companies you buy.

I suggest just use Cold Eye's 5 yardsticks, it's a simple but effective method.

If you want, you can add an additional few stuff like DCF and EV/EBIT, and a few, but that's all.

2015-11-12 13:27