Bidding goodbye to Teo Seng

shinado

Publish date: Tue, 23 Feb 2016, 10:54 PM

Today, I have finally sold off Teo Seng & Teo Seng-WA for RM 1.30 & RM 0.475 respectively after reviewing the latest quarter report. I was foolish though. I could have sold them a few months ago for higher returns but I choose to hold on to them for a bit longer. I call this the 'Love your stock' symptom.

As many seasoned investors should have known, we must never fall in love with any stocks that we invest in. When fundamentals deteriorate, we should make a selling decision. And today, I sell based on the following:

- A weak ringgit is not good for business as ingredients for prices of chicken feed is quoted in USD (mainly corn & soybean). Although prices are considered low compared to these few years, weak ringgit means business have to fork out more to purchase them in USD.

- Local egg prices are controlled by the Government. Current egg prices are still considered low and will affect profits.

- In the egg/poultry business, there is no huge business moat (i.e branding recognition). Yes, there is brand recognition for home consumers, but when you eat outside, you never hear people ordering 'Telur Separuh Masak Nutri-Plus' at mamaks or restaurants.

I do not know how long Ringgit will continue to weaken but I doubt it can return to RM3.30 vs 1USD in the near future. Therefore, Teo Seng's profits will continue to be hit hard and it will be challenging for profits to be on par with pre-2015 levels. Having said that, it is still possible that I may re-visit this stock years down the road when fundamentals are better.

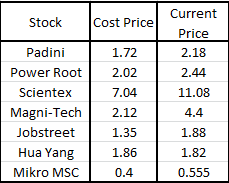

My current portfolio looks like this:

As of now, I will redouble my effort to screen and select for a potentially undervalued and fundamentally strong stock to invest into in the next few days or weeks.

Note: My profits from selling off Teo Seng & Teo Seng-WA amount to 109.3% & 5.6% respectively (dividends included). I have been holding Teo Seng since June 2014 and Teo Seng-WA since February 2015.

Disclaimer: This article represents my personal views on Teo Seng and egg/poultry business as a whole. It does not constitute a BUY/HOLD/SELL call. Please do your own research beforehand. Thank you.

shinado

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Fundamental Investing

Discussions

We need to learn from each other. Never fall in love with the stocks u buy.

2016-02-23 23:16

Think of it this way shinado.

You still make a whooping 109.3% & 5.6% regardless and not a loss - even if you fell in love with your stock, a common syndrome we all have.

That's not bad an investment I'd say, not bad at all.

By the way, I recalled in Cold Eye's book he mentioned, cyclical stocks can also be a good investment, provided if you know WHEN TO BUY.

2016-02-24 05:31

Ezra_Investor agree. The art of Buying is equally as important as the art of Selling.

2016-02-24 09:09

Hi Shinado, do check out Aemulus, high growth company for the next 2-3 years.

Also, any thoughts on the property sector? Time to buy to gain most of the upswing?

2016-02-24 22:30

Hi Galvin Wong, I think I will pass on Aemulus. It is fairly new listed company and the latest Q report shows a loss. I will give it a few years before I even consider it. I usually go for companies already listed for at least 5 years just to be safe.

As for the property sector, I expect it will remain subdued especially in the Klang Valley. In my personal opinion, companies that build affordable houses will stand to gain more compared to others as the demand for these houses remain strong. The only problem will be the loan rejection rate, in which I read from an article is quite high in Klang Valley.

So, if you are really looking to invest in the property sector, perhaps look for companies that build affordable houses. I have one in my portfolio, Huayang, although it is more for dividend play (DY 7%).

Cheers.

2016-02-25 08:20

Hi shinado ,

I found your 3 reason to sell intriguing.All 3 reason already exist before u buy teo seng.It does not exist after u bought the share.

2016-02-25 10:54

nearownkira, actually reason no.1 was not there when I buy. Ringgit was much stronger back then. But I agree reason 2 & 3 already exist then. Back then, I thought Teo Seng's profit will not be highly affected by the local egg prices as they also export to Singapore market. It was some time after I bought that I realized their export accounts only roughly 30% of their egg production while the rest goes to the local market.

You can say that it's a learning process for me. I should have done more extensive research before consider buying in the first place.

2016-02-25 13:20

@jamesliew, technically I didn't buy jobstreet in the market at 1.35. Rather, that is the price traded after the special dividend payback to shareholders. 27cents per share ex dividend and adjusted to consolidation of 5 shares to 1, the price is 1.35. Why do I consider it as cost instead of 'free'? Because I could have sold the shares at 27 cents higher in the market pre ex-dividend. That can be considered as a cost to me.

2016-03-01 00:46

RosmahMansur

such a wonderful portfolio and profits u hv!

2016-02-23 23:06