Follow Kim's Stockwatch!

SIMEPROP - TO BE NEXT PROPERTY STAR!

sparta

Publish date: Wed, 20 Dec 2017, 03:26 AM

WANT TO BE A SPARTAN?

Click here https://www.telegram.me/kimstock for more details.

DATE: 20 DECEMBER 2017

----------------------------------------------------------

THE STOCK : SIMEPROP

SIME Darby Property Berhad (SD Property)

----------------------------------------------------------

Current Price : RM1.43

Target Price : RM1.55 (TP1) & RM1.80 (TP2)

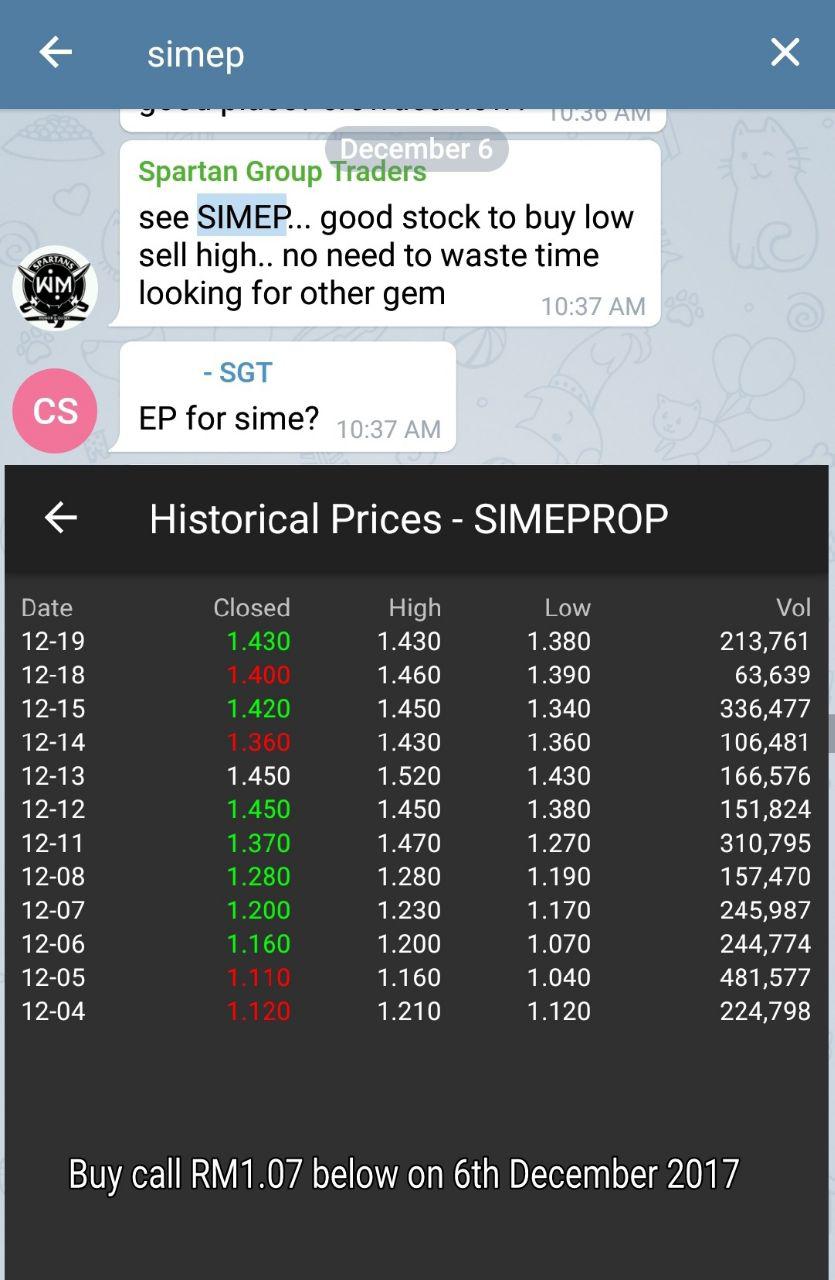

This stock we alerted it since RM1.07 on 6th December and today we keep follow and release our target.

----------------------------------------------------------

WHAT KIM SAY?

----------------------------------------------------------

"As the largest landbank among property developers in Malaysia 2017..sure currently price still cheap and I am expects they have to benefit from the upcoming high-speed rail (HSR) project and development of Malaysia Vision Valley (MVV) given its strategically located landbank". - Kim Spartan

---------------------------------------------------------

THE PROFILE

---------------------------------------------------------

Sime Darby Property was created through the integration of the property arms under the former Golden Hope Plantations Berhad, Kumpulan Guthrie Berhad, and Sime Darby Berhad. Our four-decade narrative exemplifies our belief in building a brighter future and reflects our commitment to meet the ever-evolving property needs of a developing Malaysia.

On the back of a successful 45-year track record of developing sustainable communities, we have to date built 23 active townships where generations of Malaysians live, work, and play in environments that are environmentally sensitive and supported by extensive facilities and infrastructure.

Apart from its 20,763 acres of landbank spanning from Selangor to Johor, Sime Darby Property also has assets and operations across the Asia Pacific region and the United Kingdom. Sime Darby Property’s global presence brings the best of Malaysian property development and management expertise to the world, while the best of the world’s technologies, ideas, and practices to Malaysia.

INTERNATIONAL PRESENCE

CORPORATE STRUCTURE

---------------------------------------------------------

THE KEYNOTE

---------------------------------------------------------

DECEMBER 2017

SIMEPROP - Sime Darby announced the suspension on its shares on Nov 21, three days before it announced the listing reference prices for its demerged plantation and property businesses, at RM5.59 for SD Plantation and RM1.50 for SD Property, while the reference price for Sime Darby was set at RM1.85.

SIMEPROP - Sime Darby announced the suspension on its shares on Nov 21, three days before it announced the listing reference prices for its demerged plantation and property businesses, at RM5.59 for SD Plantation and RM1.50 for SD Property, while the reference price for Sime Darby was set at RM1.85.

SIMEPROP - The prices were based on the allocation range of 60% to 68% for SD Plantation and a range of 16% to 19% for SD Property, as set out in the circular to shareholders of Sime Darby dated Nov 4, and the closing price of Sime Darby shares of RM8.94 on Nov 24.

SIMEPROP - The listings of SD Plantation and SD Property as separate entities from the holding company Sime Darby was to unlock sustainable value for the group and its investors.

SIMEPROP - Tan Sri Abdul Wahid Omar (TSAWO) said real value creation is not yet, it is about the future. We don’t look at individual pricing of the entities, rather the combined pricing of the three entities. The opening price of the three entities combined is RM9.30, which is a 4% increase from [its combined reference price of RM8.94]".

SIMEPROP - Tan Sri Abdul Wahid Omar (TSAWO) said SD Property would be looking to monetize its landbank with three approaches. Three keys as follows :-

- Firstly, for the landbank within our core development areas, we will develop it ourselves.

- Firstly, for the landbank within our core development areas, we will develop it ourselves.

- Secondly, in areas where we do not have the necessary reach, we may partner with other parties that can add value.

- Thirdly, with such a huge landbank there's no way we can do developments simultaneously at one time, so there will be [parcels] we would look at monetizing so that it can [be] developed by other developers".

- Thirdly, with such a huge landbank there's no way we can do developments simultaneously at one time, so there will be [parcels] we would look at monetizing so that it can [be] developed by other developers".

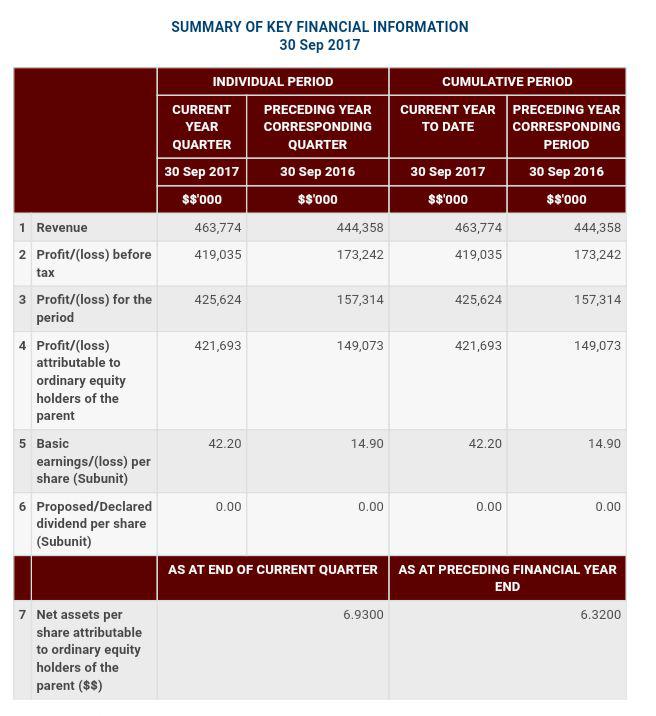

SIMEPROP - Tan Sri Abdul Wahid Omar (TSAWO) said SD Property will be starting its new journey as a listed pure play on a strong financial footing, with shareholders fund of RM9.65 billion and a low gearing level of 12%.

---------------------------------------------------------

THE FINANCIAL

---------------------------------------------------------

Shareholder Information

Shareholding Structure as at 30 November 2017

PNB - 52.39%

EPF - 11.12%

KWAP - 5.51%

Foreign Shareholding - 15.13%

Others - 15.85%

Regards,

Kim Stockwatch

Telegram : https://www.telegram.me/kimstock (Real live time trading)

Or Join Elite Spartan Group Traders (SGT)

More articles on Follow Kim's Stockwatch!

MY GEMS GOING TO SKYROCKET!!! - DATA CENTER'S NEED RENEWABLE ENERGY PRODUCER

Created by sparta | Jul 12, 2024

THIS ANOTHER GEMS READY TO SKYROCKET!!! - MAJOR DEVELOPER IN PENANG

Created by sparta | May 08, 2024

THIS STOCK READY TO SKYROCKET!!! - THE POWER & WATER SUPPLY SERVICES

Created by sparta | May 07, 2024