Follow Kim's Stockwatch!

THIS STOCK BECOME A MASSIVE O&G PLAYER SOON!

sparta

Publish date: Wed, 21 Feb 2018, 02:22 AM

WANT TO BE A SPARTAN?

Click here https://www.telegram.me/kimstock for more details.

DATE: 21 FEBRUARY 2018

----------------------------------------------------------

THE STOCK : YINSON

YINSON HOLDINGS BERHAD

----------------------------------------------------------

Current Price : RM4.20

Target Price : 1st - RM4.50

2nd RM5.20

Warrant : YINSON-CQ (0.13c) - TP : 0.25++ (100%)

DONT MISS THIS STOCK AS A GEM!!!

This stock in our radar and expect to move higher in short & mid-term period soon.

----------------------------------------------------------

WHAT KIM SAY?

----------------------------------------------------------

"Will be a massive player in oil and gas (O&G) soon due to its steady financials, lean, focused management team with strong growth prospects and undemanding valuations". - Kim Spartan

---------------------------------------------------------

THE PROFILE

---------------------------------------------------------

As one of the world’s leading Floating, Production, Storage and Offloading (FPSO) service providers, Yinson Holdings (KLSE: “YINSON”) is setting standards in the way offshore oil and gas production is managed through a modern fleet of purpose-built offshore production assets and offshore support vessels with a track record of operational excellence.

The Company’s extensive fleet of Floating, Production, Storage and Offloading (FPSO & FSO) and Offshore Support Vessels (OSV) deliver key equipment, technology, and capacity to meet the world’s demand for energy.

WHAT THEY DO?

- OFFSHORE PRODUCTION

They lease and operate Offshore Production Units and offer Offshore Support Vessels as part of their integrated services. Their expertise lies in developing innovative and cost-effective solutions that meet the needs and demands of the oil and gas industry.

- OSV SERVICES

The OSVs of the 21st century no longer merely carry cargo to and fro. They are becoming increasingly multipurpose, capable of well intervention, cable laying, carrying dangerous cargo, responding to crises such as oil spills or fires, and deploying daughter craft to operate in hazardous conditions or emergencies.

---------------------------------------------------------

THE KEYNOTE

---------------------------------------------------------

YINSON - Issuing RM1.5 billion worth of mudharabah bonds to refinance its outstanding financing facilities and sukuk facilities, and fund its working capital, equity contribution and capital expenditure for new projects.

YINSON - Expecting to finalise the novation agreement of the Layang field in Block SK10 of Sarawak by mid-February. Their proposed JX Nippon contract novation is being presented at the Court of Appeal.

YINSON - TH Heavy Engineering Bhd said it is in the final stages of negotiations with Yinson Energy Sdn Bhd for the latter to take over TH Heavy's floating production storage and offloading (FPSO) vessel charter agreement with JX Nippon Oil & Gas Exploration (Malaysia) Ltd.

YINSON - Has finalised the settlement and amendment agreement with PetroVietnam Technical Services Corp (PTSC) regarding the termination notice for FPSO Lam Son. Yinson will receive a termination fee of US$213.6 million (RM871 million) by Jan 26, 2018.

YINSON - Buying a 49% stake in Anteros Rainbow Offshore Pte Ltd (ARO) from Four Vanguard Servicos E Navegacao LDA (FVSN) for US$9 million (about RM36.75 million).rector (NINED) Tan Sri Abdul Halim Ali will assume the same position in AFB as well.

YINSON - Yinson Holdings Bhd’s 49%-owned joint-venture (JV) unit PTSC Asia Pacific Pte Ltd (PTSC AP) will receive a termination fee of US$213.63 million (RM871.61 million) from PetroVietnam Technical Services Corp (PTSC) by Jan 26, 2018 for cancelling a bareboat charter contract.

---------------------------------------------------------

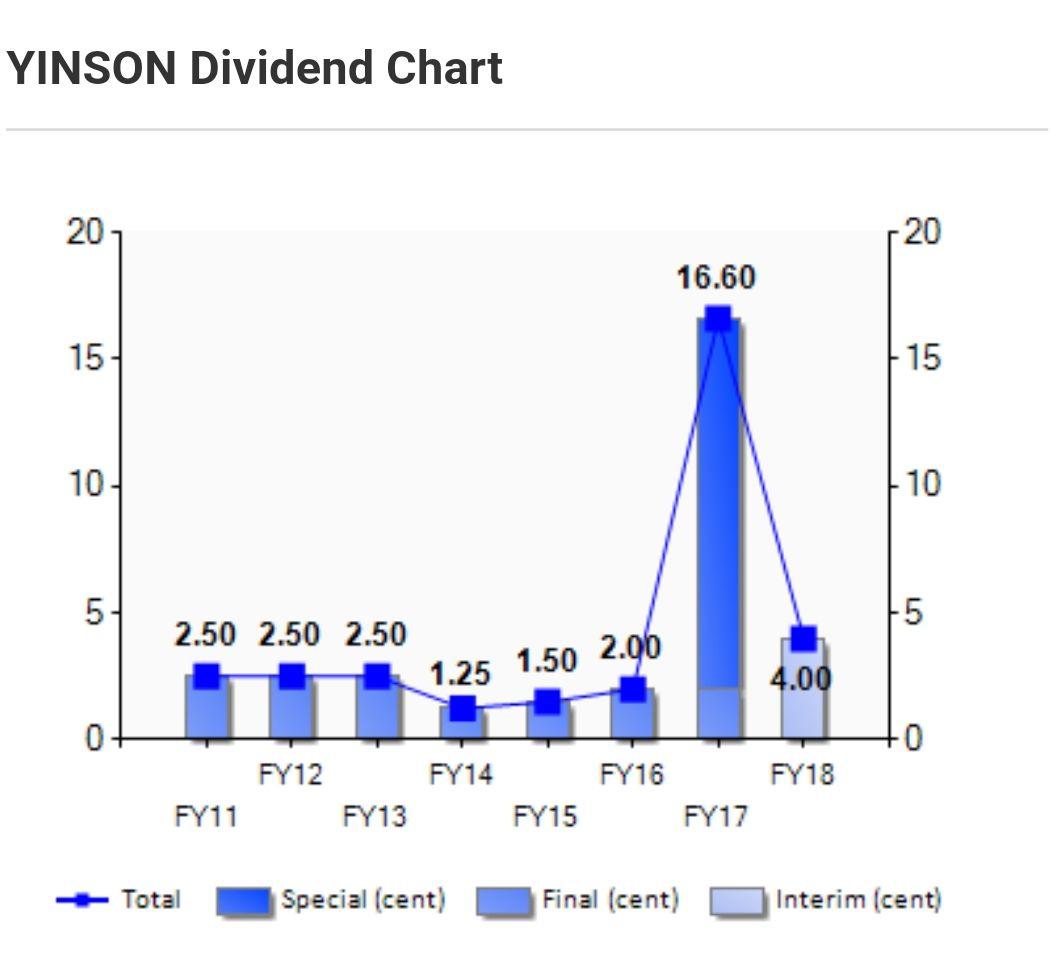

THE FINANCIAL

---------------------------------------------------------

More articles on Follow Kim's Stockwatch!

MY GEMS GOING TO SKYROCKET!!! - DATA CENTER'S NEED RENEWABLE ENERGY PRODUCER

Created by sparta | Jul 12, 2024

THIS ANOTHER GEMS READY TO SKYROCKET!!! - MAJOR DEVELOPER IN PENANG

Created by sparta | May 08, 2024

THIS STOCK READY TO SKYROCKET!!! - THE POWER & WATER SUPPLY SERVICES

Created by sparta | May 07, 2024