Follow Kim's Stockwatch!

THIS WORLD'S LARGEST GLOVES MAKER WILL SOAR AND BIG-BOOM!

sparta

Publish date: Sun, 26 Apr 2020, 02:12 AM

Date : 26th April 2020

STOCK : TOP GLOVE CORPORATION BERHAD

Current Price: RM7.17

Target Price: TP1: RM8.30 - TP2 RM9.50

Target Price: TP1: RM8.30 - TP2 RM9.50

Call Warrant: Topglov-C72

Target Price: TP1: 0.40 sen - TP2 0.60

Target Price: TP1: 0.40 sen - TP2 0.60

TOP GLOVE is the world's largest manufacturer of gloves. Founded by Tan Sri Dr Lim Wee Chai and Puan Sri Tong Siew Bee in 1991, it was listed on the Second Board of Bursa Malaysia in March 2001, then promoted within 14 months to the Main Board in May 2002.

Top Glove also manufactures and sells natural rubber, nitrile, and vinyl gloves. It is the world’s largest glove manufacturer with 26% of market share globally and aims to grow its market share to 30% by 2020. Top Glove currently has an annual manufacturing capacity of 64 billion pieces of gloves.

In terms of capacity we saw its market capitalisation (cap) hit a record high near of RM20 billion. In the span of about four and a half months, Top Glove’s market cap has ballooned by about 41.91% or RM5.06 billion, following unprecedented demand spikes in protective medical equipment like rubber gloves amid the relentless spread of the Covid-19 pandemic.

Now we agreed that glovemakers now more valuable than casino, airport operators. Notably, Top Glove’s market cap is now more than two times the market cap of Malaysia Airports Holdings Bhd (MAHB), which stood at RM7.33 billion. MAHB is the operator of all Malaysian airports. It also owns as well as manages an international airport in Turkey.

In fact, Top Glove’s market cap has also topped the RM14.06 billion of KLCC Stapled Group, who is the proud owner of the Petronas Twin Towers, Menara ExxonMobil and several other prominent buildings in the Kuala Lumpur city centre.

TOPGLOVE WILL HAVE A BIG SPIKE THIS MAY

Top Glove will rises again to record high as Covid-19 global death toll near tops 200,000. So

after rising to a record high on expectation that the Covid-19 pandemic, which has killed more than 190,000 people globally, will result in higher demand for rubber gloves as the healthcare sector contends with the rising number of infected individuals. Total Global cases now 2,833,697 and numbers of recovered 807,469. This base on the report at coronavirus.baselab.com

So in my mind and I forsee, from nextweek till end of May. My darling Top Glove Corp Bhd will reach and hit my personel at TP1 (8.30 & TP2 (9.50)

OUR TECHNICAL VIEW

- On 10th Mac 2020, We have recommend the Entry Price (EP) at 6.00 - 6.03

- The price has stable beyond our TP1 6.20 and TP2 6.50.

- By looking at trends and the news global situation Covid-19, We've decided to upgrade our old target price to the new, TP1(8.30) & TP2(9.50)

NEW WAVES READY TO KICK IN

- The new Entry Price (EP) at 7.16

- The new Stop Loss (SL) at 7.03

- 6.75 & 6.83 as a piled and supported.

- 6.75 & 6.83 as a piled and supported.

- The last supported at 5.12

- The stock will go higher once 7.20 channel break and play range 7.25 - 7.28 stable.

- New resistance at 7.29. Once this line break. We will see immediate target at 7.45

- The We assume on 27 April (Monday) the price going to test higher 7.45

- Immediate target 7.45

THE WARRANT ( TOPGLOV-C72 )

- Exercise Value 5.88

- Exercise Ratio 7:1

- Premium 0.355

- Premium 4.95%

- Gearing 4.36

- Maturity 20 Nov, 2020 (6 month)

- Issuer Ambank (M) Berhad

- Target Price: TP1: 0.40 sen - TP2 0.60

WHAT KIM SAY?

"TOMORROW FLY TO RECORD A NEW HIGH AGAIN RM7.45"

- Top Glove last 2 weeks when I noticed that Employees Provident Fund (EPF) or I address them as a big-boys had exit. The news suprisingly me that they has ceased to become a substantial shareholder in Top Glove Corp Bhd after disposing of 3.08 million shares in the rubber glove manufacturer. EPF ceased to be a substantial shareholder in Top Glove on April 7. So I strongly believe this stock will go fly and surge very high to meet their real target and values. Its a time now as Malaysian glovemakers now more valuable than casino and airport operators. So my concern this sector to be benefit from stronger demand arising from the Covid-19 outbreak, and a weaker ringgit against the US dollar.

- The results for for 3 consecutive years will be superb! Monitor very closely.

- Top Glove price start from today onward till end of May. You will see this stock will surge very high to meet our target as above and one day it will cross HARTALEGA price.

- Topglov has set aside a significant capital expenditure budget of RM600 million for its financial year ending 2020.

- Top Glove highlighting to investors that the world’s largest glove manufacturer is still “hungry for growth”.

- Top Glove boss expected the global glove demand is expected to grow 10 per cent annually. They will continue to expand to meet this increase in demand. As we know demand's now more than 100% due to Covid-19 pandemic.

- Top Glove value, we cannot imagine and expect how much the real demand till this December 2020.

- Top Glove is expected to have 38 glove factories from the current 33 factories after spending RM632.17 million in capital outlay in financial year 2019 and RM461.77 million in financial year 2018. This would represent 876 production lines with maximum capacity of 84.1 billion gloves per annum.

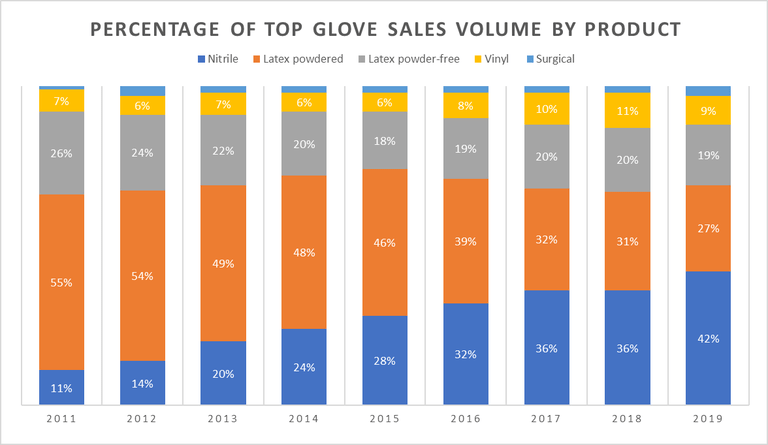

- Top Glove said 80 per cent of capacity expansion in the next few years would mainly be for nitrile gloves, while the remaining is for vinyl and latex gloves. Currently, nitrile gloves were the major contributor to Top Glove’s revenue at 46 per cent, followed by latex (powdered and powder free) and surgical gloves.

14 POINTS ABOUT TOP GLOVE WE LIKE

1. Top Glove derives most of its sales from its export business to 195 countries. It distributes 20% of its gloves of its own brand directly to end users and through an online platform. Original equipment manufacturing (OEM) gloves contributes to 80% of its product portfolio. Its clients come from various sectors ranging from medical to manufacturing and food processing.

2. Top Glove aims to be a Bursa Malaysia Top 20 company by 2020 and Fortune Global 500 company by 2040. Top Glove is currently a constituent of the FTSE Bursa Malaysia KLCI that features the 30 largest companies on Bursa Malaysia. However, Top Glove was accused of compulsory labour, excessive overtime, debt bondage, and passport confiscation by The Guardian, and subsequently denied the allegations. The global market is key to Top Glove’s continued growth and chairman Tan Sri Dr Lim Wee Chai believes it’s important to follow the rules when doing business with the U.S. and Europe.

3. Top Glove foresaw that demand for natural rubber gloves would remain stable when it listed in March 2001 as synthetic gloves could not mimic the high elasticity and tensile strength of natural rubber gloves. Despite this, the demand for nitrile gloves has grown considerably. Nitrile gloves overtook latex-powdered gloves as Top Glove’s best-selling glove in 2017.

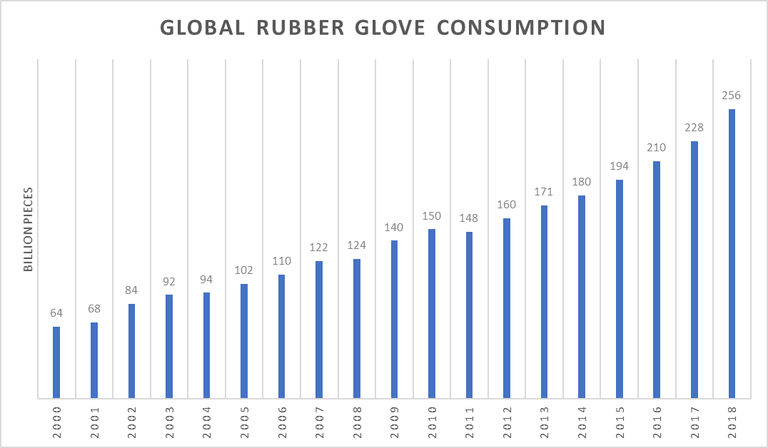

4. The glove industry is a largely resilient one. Gloves are a necessity and cannot be reused for hygiene reasons. Global rubber glove consumption grew at a compound annual growth rate (CAGR) of 8.0% from 2000 to 2018. Demand is expected to grow moving forward due to increasing healthcare standards, growing and aging populations, and increasing usage in the non-medical sectors.

5. Some of the business risks Top Glove faces include fluctuations in raw material prices, foreign exchange rates, and utility costs. In the face of competition, it cannot fully pass on these cost increases to customers. It was estimated by an analyst that Top Glove could only pass on between 50% to 80% of cost increases.

6. Top Glove chairman, Tan Sri Dr Lim Wee Chai, his wife, Puan Sri Tong Siew Bee and his brother, Lim Hooi Sin are among the company’s board of directors. The chairman’s son is also part of the senior management. They collectively own a 35.8% stake in Top Glove as of October 2019. It is good to see the founder and management having some ‘skin in the game’ as this aligns them with shareholder interests.

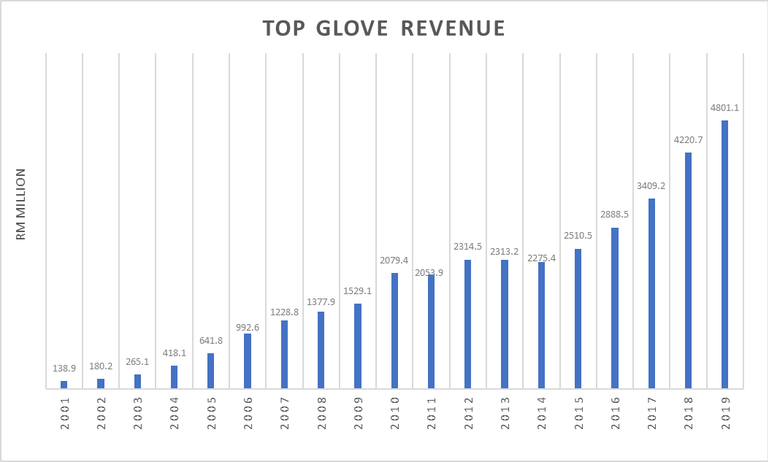

7. Top Glove relies on a two-pronged approach to grow — organic and inorganic growth. In terms of organic growth, its annual manufacturing capacity rose massively from 3.2 billion pieces in 2001 to 64 billion pieces in 2019. For inorganic growth, Top Glove has looked at mergers and acquisitions as well as ventures into related industries ranging from rubber plantations to medical catheters, which the chairman thinks ‘is not rocket science’. The chairman views a company of Top Glove’s size needs to diversify in order to grow further.

8. Top Glove set aside RM30 million to invest in a new condom manufacturing factory to produce OEM and own brand condoms. The rationale for the investment is its attractive profit margins and valuations. In the chairman’s opinion, the condom industry also uses similar raw materials, production processes, and marketing strategies as the glove industry. Top Glove aims to grab a 5% share of the global condom market but will face hurdles as evidenced by Karex Berhad‘s — the world’s largest condom producer with 15% of global market share — recent challenges in condom supply overcapacity and government funding cuts.

9. In April 2018, Top Glove acquired Aspion Sdn Bhd from Adventa Capital Pte Ltd for a total of RM1.4 billion. Of which, RM1.2 billion was settled via a combination of internally generated cash and loans, while the rest was satisfied via a rights issue. Three months later, Top Glove discovered irregularities in Aspion’s balance sheet and claimed that the inventory, plant, and machinery as well as acquisition price were overstated by RM74.4 million and RM640.5 million respectively. As a result, Top Glove sued Adventa Capital and its directors, Low Chin Guan and Wong Chin Toh, for RM714.9 million. Litigation is still ongoing as of December 2019. After the news, Top Glove lost RM3.8 billion or 24.6% of its market capitalisation in one day. An extraordinary general meeting was subsequently held to remove Low from the board of Top Glove. The chairman said Top Glove would be more careful with its future mergers and acquisitions but not be deterred from making additional acquisitions to fuel its growth agenda. In my opinion, Top Glove needs to improve its capital allocation and due diligence in order to preserve shareholder value.

10. Top Glove ended up 2019 in a net debt position of RM2.3 billion. It took on debt to acquire Aspion and fund its ongoing expansions. Its total-debt-to-equity ratio stood at 0.95 as at 31 December 2019. The chairman has stated that Top Glove can still continue to acquire other companies as long as the gearing is below 1.0. A ratio below 0.5 may be more ideal for more conservative investors.

11. Revenue has grown at a CAGR of 21.8% over the past 19 years. In 2019, revenue grew by 13.8% year-on-year because of robust sales growth of nitrile gloves. Revenue has increased every single year except for 2011, 2o13, and 2014. In 2011, the U.S. dollar weakened against the Malaysian ringgit, which impacted Top Glove’s revenue which is reported in U.S. dollars. Top Glove was affected by higher raw material costs the same year. In 2013-2014, the average selling price of gloves fell due to heightened competition which affected revenue.

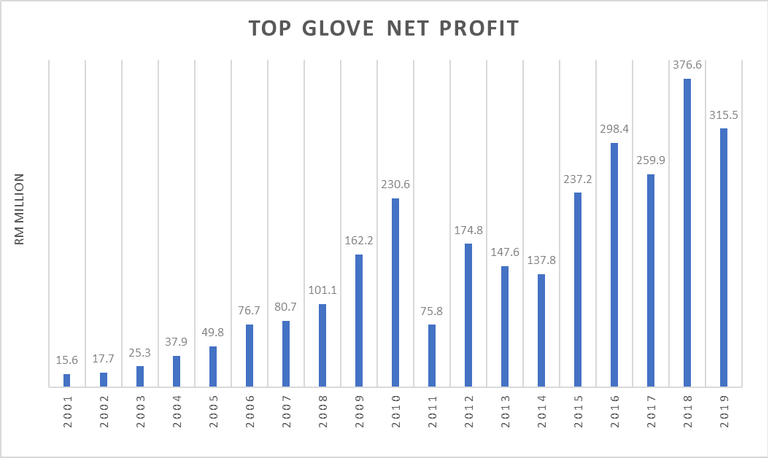

12. Net profit excluding one-off items is slightly choppy over the same period but increased at a CAGR of 18.2%. In 2019, net profit dropped 16.2% year-on-year because of higher rubber prices, competition, and losses in the vinyl segment. The drop in net profit in 2011, 2013, and 2014 was due to the same reasons mentioned above. Higher raw material prices also impacted Top Glove negatively in 2017. It has good quality earnings as its cash-flow-to-net-income ratio is at 1.2 over the past 19 years. Its ROE has averaged at 16.3%, which is above the benchmark of 15.0% we normally look for.

13. Top Glove has the second highest EBITDA margin and the third highest EBIT margin among Malaysian glove manufacturers. The top four companies in the table below are sometimes collectively known as the Big Four by the media. (Malaysia is the largest glove exporter and producer with 63% market share in 2018.)

| Hartalega | 22.9% | 19.4% |

| Top Glove | 13.5% | 9.5% |

| Kossan Rubber | 13.2% | 9.6% |

| Supermax | 11.4% | 8.5% |

| Comfort | 12.0% | 9.0% |

| Careplus | 8.4% | 2.2% |

| Rubberex | 15.2% | 9.4% |

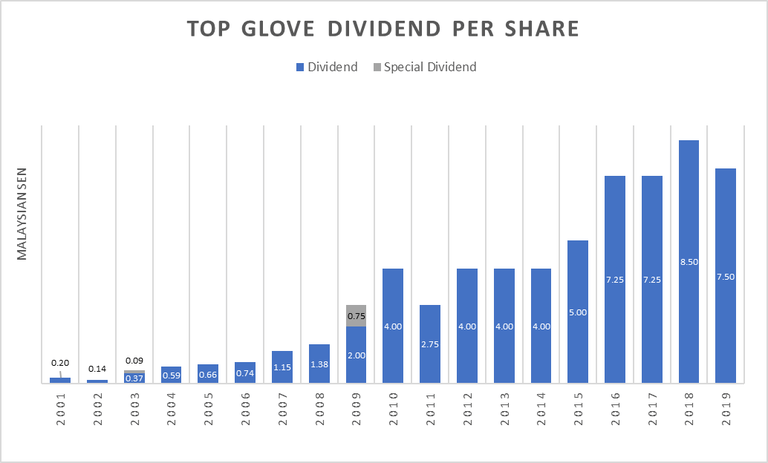

14. Overall, dividend per share has been on an upward trend, which is good news for income investors. Top Glove has a dividend policy of distributing not less than 50% of its net profit to shareholders each year.

WHICH GLOVES ARE BETTER NITRILE OR LATEX?

- Nitrile has a higher puncture resistance than any other glove material.

- Nitrile also has a better chemical resistance than Latex or Vinyl gloves.

- Latex gloves are the most commonly used disposable gloves because they have been the only strong disposable glove material option on the market.

Good luck and stay tuned!

Only the rubber sectors will have a big jump and bright prospect for now!

-= Kim's Group =-

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Follow Kim's Stockwatch!

THIS ANOTHER GEMS READY TO SKYROCKET!!! - MAJOR DEVELOPER IN PENANG

Created by sparta | May 08, 2024

THIS STOCK READY TO SKYROCKET!!! - THE POWER & WATER SUPPLY SERVICES

Created by sparta | May 07, 2024