Hartalega Holdings Bhd - Reviews & Target Price

ss20_20

Publish date: Mon, 25 May 2015, 04:01 PM

(吉隆坡25日訊)

受馬幣兌美元匯率升破4.20令吉打擊,早前在“強勢美元”主題下備受追捧的手套股週三慘遭拋售,股價全面淪陷,使投資者惶惶不安,擔心強勢美元投資風可能正醞釀轉向。

手套股受惠於強勢美元和產能增加,成了今年馬股的“搶手貨”之一,也是美元投資風下的代表股類,開年至今平均上揚近70%;然而,雖然業績報捷、繼續廣受證券行看好,但隨馬幣近期轉強,手套股股價遂顯得有氣無力,紛紛出現調整。

頂級手套跌36仙

其中,近期氣焰最盛的頂級手套(TOPGLOV,7113,主板工業產品組)就在週三大跌36仙或3.73%;高產尼品(KOSSAN,7153,主板工業產品組)也跌48仙或5.66%;賀特佳(HARTA,5168,主板工業產品組)則跌34仙或5.88%,全數入圍10大下跌榜。

此外,速柏瑪(SUPERMX,7106,主板工業產品組)也下跌9仙或3.7%;康复手套(COMFORT,2127,主板工業產品組)和業績遜色的加護手套(C A R E P L S,0163,創業板工業產品組),也各跌1.28%和5.75%。

無論如何,估值高企和股價今日回調讓投資者擔心手套股已陷入“高處不勝寒”窘境,甚至擔心“強勢美元”再無法獨自撐起手套股估值。

未來6至9個月仍有看頭

《星洲財經》向行內人士查詢後發現,在原料成本低企和美元走強等雙重利好的支持下,手套股未來6至9個月的業績仍有看頭,但由於股價已提前反映利好,出現套利是正常的結果。

“馬幣近期重新站穩,兌美元匯率從4.40令吉下滑至4.20令吉,影響了強勢美元主題股的投資情緒,驅使投資者趁高套利,因此相信若馬幣繼續走強,靠強勢美元撐場的公司股價短期內還有回跌空間,尤其是那些估值偏高和股價累積可觀漲幅的公司。”

數據顯示,馬股手套股今年至今全數報漲,漲幅介於16至113%之間,平均漲幅為70%,明顯跑贏大市,其中漲最兇的是頂級手套,漲最少的則是今年中剛脫離PN17的康复手套。

不過,Arena資本首席執行員黃德明受訪時認為,全球手套需求量持續走高、原料價格疲弱,再加上美元持強,手套業今年表現預計會相當不錯。

他認為,只要馬幣兌美元匯率無法在2016年恢復至3.30令吉水平,手套公司的淨利都不會受太大影響,即使馬幣匯率回揚至3.60至3.80令吉之間,因手套業者的淨利主要由營業額成長帶動。

“美元走強,對手套業者而言只是錦上添花而已。”

輝立資本首席策略員潘力克表示,手套領域的估值雖已有高估跡象,雖然需求走高仍可持續扶持股價,但若未來業績低於市場預期,則可能面對賣壓風險。

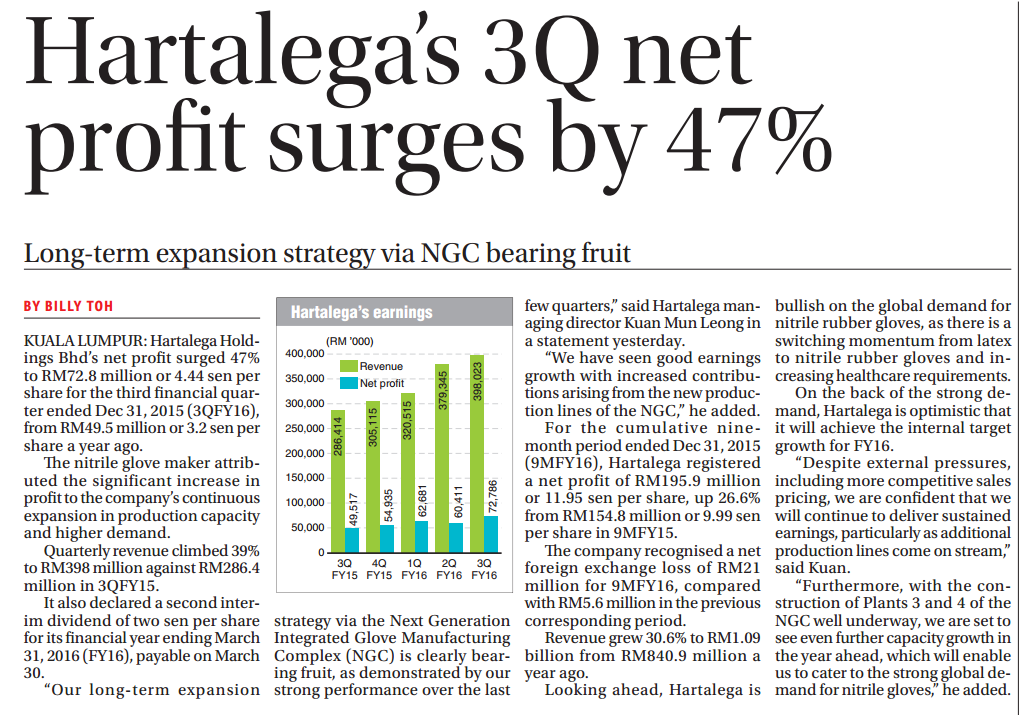

最新一季業績顯示,上月公佈業績的頂級手套單季淨利飆漲123%至1億零311萬9千令吉,創史上最高紀錄。而本月初公佈業績的高產尼品及賀特佳,淨利則各揚60.35%和25.43%,繼續受惠於強勢美元。

不過,加護手套昨日公佈的業績表現平平,雖按年轉虧為盈,但淨利只有32萬3千令吉。

目前,尚未公佈業績的手套股只剩速柏瑪和康复手套,兩家公司料在未來幾天內發佈業績。

Hartalega Holdings - Expecting A Better 2H16

Author: kiasutrader | Publish date: Fri, 6 Nov 2015, 09:32 AM

Period

2Q16 /1H16

Actual vs. Expectations

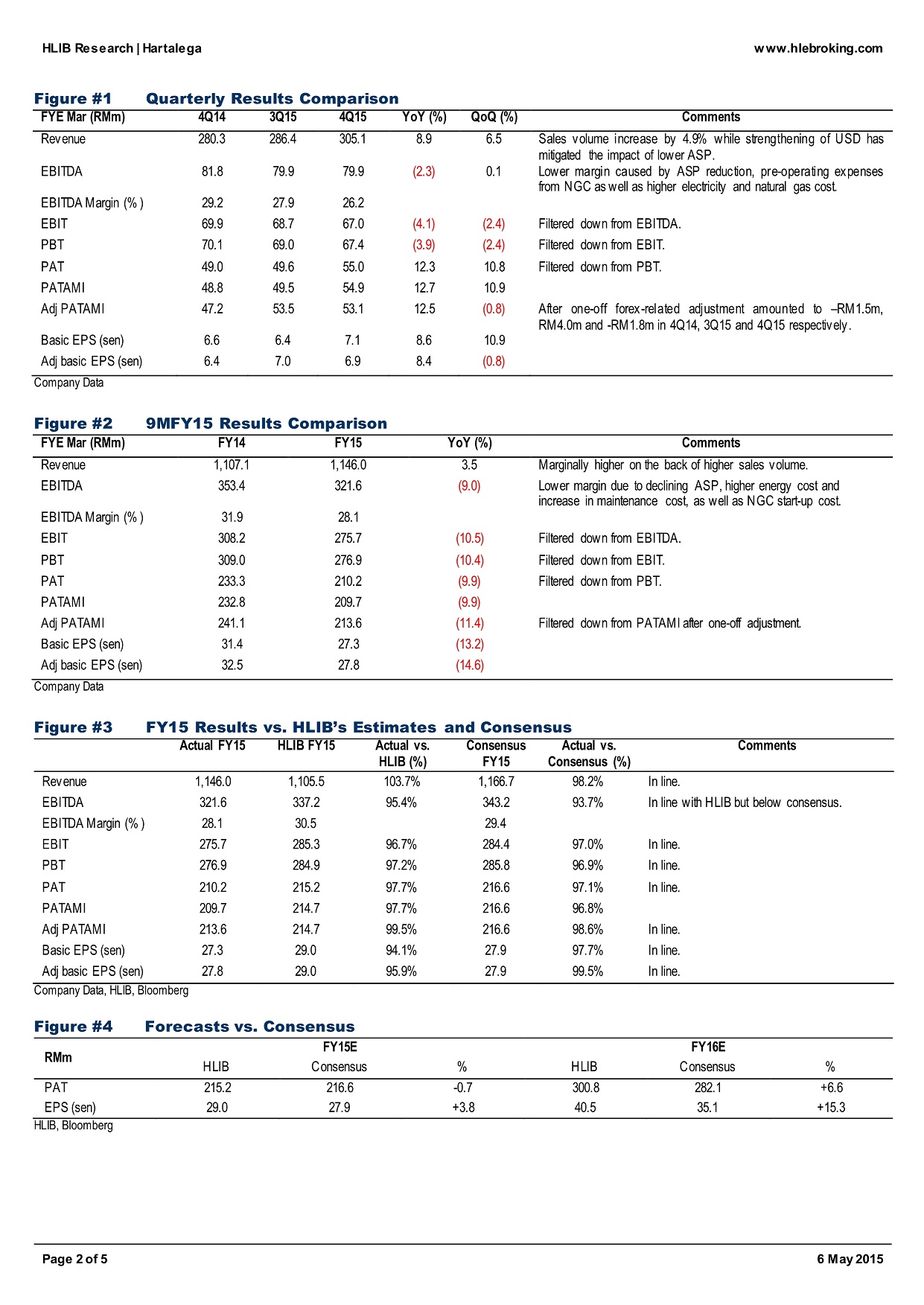

1H16 PATAMI of RM123.1m (+17% YoY) came in at 42% and 45% of our and consensus’ full-year forecasts, respectively. We deemed the results as within expectation as we expect a stronger 2H16 in the absence of low to minimal forex losses in subsequent quarters. In anticipation of a sustained strengthening of the USD/MYR exchange rate, we understand that Hartalega has reverted back to two-month hedging policy from six-month duration previously.

Dividends

A first single-tier interim dividend of 2.0 sen was declared. Key Result

Highlights

QoQ, 2Q16 revenue came in 18% higher due to: (i) stronger sales volume in the nitrile glove segment (+15%) which accounted for 95% of sales, which more than offset lower ASPs (-8%). Overall, higher volume sales were underpinned by commercial operations of NGC in early Jan 2015. Pre-tax profit margin in 2Q16 fell to 19.8% from 24.9% in 1Q16 largely due to fair value loss of RM21.6m on derivatives. However, we understand that these losses will be minimal in subsequent quarters as Hartalega has reverted back to two months hedging policy from six months previously. Consequently, 2Q16 core net profit fell 3.6% to RM60.4m. Excluding the fair value derivative loss, 2Q16 core net profit would have +31% Q/Q with EBITDA margins at 30% (vs. 2Q16’s reported 24% and historical peak of 34%).

YoY, 1H16 revenue rose 26% due to higher sales volume (+30%) which more than offset lower ASPs (- 15%) underpinned by new capacity from NGC. Correspondingly, core net profit rose 17% due to lower effective tax rate of 20% compared to 25% in 1H15. PBT margin was reduced from 24.9% to 20.4% due to recognition of fair value loss on derivatives.

Outlook

Looking ahead, we expect earnings to jump upon the gradual ramp up of the Next Generation Integrated Glove Manufacturing Complex (NGC) (known as Plant 7). We were given to understand that the full commissioning of the first two plants is expected to be delayed by two months. In an effort to mitigate further costs increases, Hartalega has further strengthened its production process to be more efficient. Hence, the delay is due to retrofitting the new plant to incorporate new energy saving device design – a flanking manoeuvre to anticipate and mitigate future energy hikes, causing a slight delay in fully commissioning Plant 1 and 2. Presently, NGC has commissioned 17 lines. Upon full commissioning, the first two plants will add c.8b pieces (+56%) new capacity by 1Q16 and providing the much-needed earnings growth boost in 2H16 and FY17.

Change to Forecasts

No change to our earnings forecasts.

Rating

We like Hartalega for its: (i) highly automated production processes model, (ii) solid improvement in production capacity and reduction in costs leading to better margins compared to its peers, (iii) innovation in producing superior quality nitrile gloves, and (iv) positioning in a booming nitrile segment with a dominant market position. Maintain Outperform and TP of RM6.00 based on unchanged 27x CY17 EPS (slightly above +1.0 SD above its 5-year historical mean average).

Risks to Our Call

Lower-than-expected ASPs.

Source: Kenanga Research - 6 Nov 2015

Hartalega Holdings - The Rolls-Royce of Gloves

Author: kiasutrader | Publish date: Fri, 30 Oct 2015, 10:33 AM

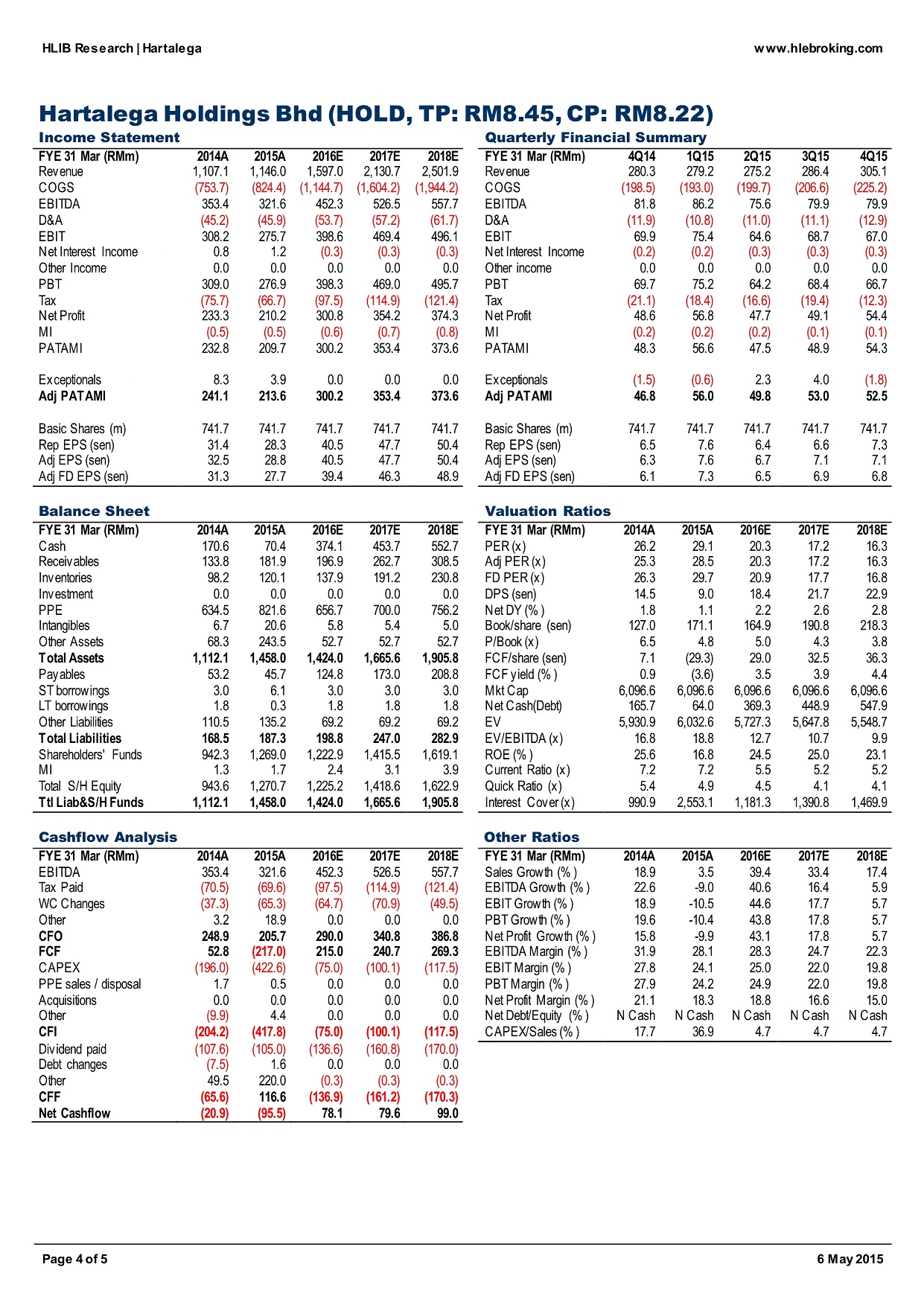

We came away from a company visit to HARTALEGA feeling upbeat over its earnings prospects for 2H16 which is underpinned by: (i) sustained demand growth for rubber gloves despite some minor glitches in 1H16, (ii) efficiencies derived from internal production processes, and (iii) the favourable USD/MYR exchange rate. The key takeaways from the company visit includes: (i) a switch in hedging policy to show a positive impact starting from 3Q16 onwards, (ii) high utilisation rate while longer delivery lead-days indicate solid demand, (iii) two to three months delay in full commercial operations at the two new plants, and (iv) Reinvestment Allowance (RA) under Budget 2016 could boost bottomline. Due to its resilient and defensive earnings, we roll forward our valuation base from CY16 to CY17. Our TP is raised from RM5.30 to RM6.00 based on unchanged 27x CY17 EPS (slightly above +1.0 SD above its 5-year historical mean average).

A few wrinkles in 2Q16 results, but a change in hedging strategy to boost 2H16 earnings. We expect 2Q16 results due in early November to post flat to slightly higher net profit due to volume growth derived from new capacity expansion but this is expected to be negated by forex losses and delayed delivery of quality formers from supplier as the supporting industry plays catch-up with the fast expanding glove industry. We expect Hartalega to report a 2Q16 net profit of between RM60- 70m (average +3.6% QoQ; +23% YoY), which brings 1H16 net profit to RM123m and RM130m which are 45% and 46% of our and consensus full-year net profit forecasts. However, we expect Hartalega to record an average of RM80-90m net profit for each quarter in 2H16 in the absence of low to minimal forex losses in subsequent quarters. In anticipation of a sustain strengthening of the USD/MYR exchange rate, we understand that Hartalega has now reverted back its hedging policy from six months to currently two months.

RA explained, expected to boost Hartalega’s bottomline. Under the recently announced Budget 2016, an extension of the Reinvestment Allowance (RA) (started in 1996 for 15 years which expired in 2012 for Hartalega) to enable manufacturing companies including Hartalega to continue claiming RA for reducing tax provided they continue to invest capex and claim RA on the capex in the three years period 2016-2018. Theoretically, manufacturers can claim up to 60% of their capex but the maximum claimable amount is up to 70% of their statutory income. For illustration purposes, assuming that Hartalega: (i) incurred capex of RM300m and achieve a net profit of RM320m in FY2017 (where they have met the criteria of 36 months in operations), (ii) the statutory income is net profit RM320m + depreciation RM66m and less capital allowance of RM85m equals statutory income of RM301m. The maximum claimable RA is 70% of statutory income (70% x RM301m = RM210.7m) and the RA claimable is 60% of capex (60% x RM300m capex = RM180m which means that the chargeable income is statutory income of RM331m less RM180m = chargeable income of RM151m. Any excess of RA can be carried forward to next year without requiring the need to invest in capex. Based on our back-of-envelope calculation, Hartalega’s FY17 effective tax rate could be lowered to 18% to 19% as compared to our FY17 forecast of 23.5%. A 1% reduction in our effective tax rate would raise our FY17 net profit by 1%.

Capacity expansion plans are on track, raising capacity by 56% to 22bn pieces over the next two years. We were given to understand that the full commissioning of the first two plants is expected to be delayed by two months. In an effort to mitigate further costs increases, Hartalega has further strengthened its production process to be more efficient. Hence, the delay is due to retrofitting of the new plant to incorporate new energy saving device design – a flanking manoeuvre to anticipate and mitigate future energy hikes, causing a slight delay in fully commissioning Plant 1 and 2. Presently, NGC has commissioned 17 lines. Upon full commissioning, the first two plants will add c.8b pieces (+56%) new capacity by 1Q2016 and providing the much-needed earnings growth boost in 2H16 and FY17. Hartalega is relatively confident that capacity for the first plant will be absorbed upon full commissioning. Management has earmarked an estimated capex of RM300m- RM350m per annum for building a new factory and production lines. We have factored this capex guidance into our earnings model. With an estimated operating cashflow averaging RM357m p.a over the next two years and a net cash of RM74m as at 31 Mar 2015, funding is not an issue.

Solid industry demand and longer delivery lead times to underpin growth going forward. Solid industry numbers and longer delivery lead times are indicating that demand will outstrip supply at least over the medium-term. Case in point is 1H15 when the total exports of rubber gloves, synthetic rubber (SR) and latex-based natural rubber (NR) combined rose 10% YoY to 25.9b pairs. Specifically, Malaysia exported 14.4b pairs of SR or nitrile gloves (+29% YoY) and 11.6b pairs of latex gloves (-2.9% YoY) in 1H15. Separately, the Malaysian Rubber Glove Manufacturers Association (MARGMA) has forecasted a 20% export growth for rubber gloves, which is largely on track with volume growth recorded in 1Q and 2Q of CY2015 for rubber glove makers under our coverage. We understand that the robust demand for nitrile has led to longer delivery lead times (the moment order was placed and delivery) which has risen to between 50 to 60 days as compared to 40 to 50 days (9 months ago) including players like Hartalega.

Maintain Outperform, TP raised to RM6.00. Our Target Price is RM6.00 based on unchanged 27x CY17E EPS (slightly above its 5-year historical mean average of 18x). We like Hartalega for its: (i) highly automated production processes model, (ii) solid improvement in its production capacity and reduction in costs leading to better margins compared to its peers, (iii) innovation in producing superior quality nitrile gloves, and (iv) positioning in a booming nitrile segment with a dominant market position. We believe Hartalega should trade at premium valuations for its superior profit margins which are head and shoulders above industry peers as well as its defensive and captive earnings stream.

Source: Kenang Research - 30 Oct 2015

Rubber Gloves - Positive surprise from Budget 2016 OVERWEIGHT

Author: kiasutrader | Publish date: Tue, 27 Oct 2015, 11:05 AM

- We see the rubber glove manufacturers as prime beneficiaries of Budget 2016 in view of the proposal for a Special Reinvestment Allowance (RA) Incentive for companies that have exhausted their eligibility to qualify for RA. The rate of claim is at 60% of qualifying capex and can be set off against 70% of statutory income from year of assessment 2016 to 2018.

- This proposal is particularly significant for the rubber glove players as most had expired their RA incentives (valid for 15 consecutive years from the year of assessment RA is claimed) between 2012 and 2014 considering their long operating history.

- Such an incentive is also timely for the glove manufacturers given their current capex upcycle. Against the backdrop of robust global glove demand (+9% YoY), we understand that the top four glove manufacturers have allocated capex of RM150mil to RM400mil p.a. for the next three years to boost installed capacity by ~11% p.a.

- The reinstatement of RA essentially means that the effective tax rates of glove companies could be lowered, leading to higher earnings moving forward. Historical data show that the effective tax rates for the top four players averaged at 16% prior to the RA expiries vs. the current 23%. Assuming a conservative 4ppts reduction to the forward effective tax rates, i.e. at 19%, we estimate an average earnings upside of 4%-7% p.a. for the rubber glove players.

- This announcement lends further credence to our OVERWEIGHT call on the rubber gloves sector. We expect the sector to enjoy another round of PE re-rating, with its premium valuations justified by its prime position as exporters operating in a defensive sector and the fact that it is one of the few industries in the market that is experiencing positive earnings upgrades from volume growth and margin expansion.

- While other points in the budget referred to potential cost inflations for the glove manufacturers, namely the 11% hike in the Peninsula Malaysia minimum wage from RM900 to RM1,000 and increase in the floor price of SMR20 and cuplumps, we are not too concerned as:- (1) labour costs make up only ~10% of the glove manufacturers’ total operating costs; (2) the industry has a cost pass-through pricing mechanism; (3) there is an eight-month grace period to the implementation date; and (4) usage of imported bulk latex vs. domestic SMR20 as inputs.

- The latest rally of the rubber glove counters last week saw their share prices once again exceeding our fair values (all except Top Glove’s and by 9% on average). This was despite our constant upward revisions (between two to six times) since our sector upgrade in December 2014. Pending further details from the managements and the share price overshoots, which we view as a positive testament to our BUY calls, we are placing our current fair values for Top Glove Corp (RM10.60/share), Kossan Rubber (RM8.40/share), Hartalega Holdings (RM4.70/share) and Supermax Corp (RM2.05/share) under review.

Source: AmeSecurities Research - 26 Oct 2015

HLIB Research | 06 May 2015

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

HARTA2024-11-22

HARTA2024-11-21

HARTA2024-11-21

HARTA2024-11-21

HARTA2024-11-14

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-12

HARTA2024-11-12

HARTA2024-11-12

HARTA