Hartalega Holdings Bhd - all about NGC

ss20_20

Publish date: Mon, 22 Sep 2014, 01:52 PM

Next Generation Integrated Glove Manufracturing Complex (NGC) - too good to be true...but it's true!

HLIB research | 03 April 2015

Simple way to calculate share price of Hartalega in 2020

[old post - Questions on Industry Over-capacity, capex, future market cap and dividend policy and the reply from Hartalega - 2012-10-30 from investalks ]

Capacity additions by major rubber glove manufacturers (billion pieces)

Company 2012 through 2013

Topglove 6.8

Supermax 4.0

Kossan 4.0

Hartalega 3.7

Latexx Partners 3.0

Total installed nitrile capacity 21.5

Total nitrile capacity assumed 80% CU 17.2

We take the top five rubber glove companies because Malaysia is the largest producer of rubber gloves contributing 65% of global rubber glove demand and home to the top 5 rubber glove makers in the world.

The information above is extracted from page 6 of CLSA Report dated 9 April 2012 at page 6.

We believe that this capacity will come to fruition and impact the industry in calendar year 2013 when commissioning of these production lines is completed. Assuming that the new production capacity is 100% nitrile and at 17.2 billion pieces before year end 2013, the global demand must at least equate to this amount to ensure there is no overcapacity or oversupply of nitrile gloves.

According to MREPC (Malaysia Rubber Export Promotion Council) Report 2011, the year 2011 saw approximately 150 billion gloves consumed globally and export of nitrile gloves grew about 29% from year 2010 to 2011. Of the 150 billion pieces consumed globally, about 40% of it is nitrile ie about 60 billion pieces were nitrile gloves and the remaining balance is predominantly latex rubber gloves.

The growth trend of nitrile is expected to continue to grow at least 20% for the next two years. Assuming the conservative growth rate of 20% for both 2012 and 2013, we can expect nitrile gloves to grow almost another 24 billion pieces demand in these two years.

Therefore, we can safely forecast that conservative forecast of additional global demand of 24 billion pieces will be resilient enough to absorb the additional capacity of 17.2 billion pieces for years 2012-2013.

Sometime in May 2012, prices of both latex and nitrile raw materials retreated sharply about 30% down on average and the US Dollar has improved from an average rate of RM3.06 to RM3.15. The more reasonable pricing of raw materials and favourable US Dollar bodes well for the rubber glove industry and this is reflected in a re-rating of the sector in Bursa Saham Malaysia. According to industry players in a recent meeting in MARGMA (Malaysian Association of Rubber Glove Manufacturers), the sector is envisaged to grow at least 10% to 15% this year due to the more favourable macro-environment.

Our clients demand exceeds our ability to supply due to factory constraint and we have had to re-allocate sales. As a result, we have added two additional lines to our 10 production lines at our existing Plant 5 and will be commissioning the 1st production line at Plant 6 by September-October 2012 which will add additional 10 production lines by June 2013. Plant 6 costs about RM180m and is internally funded and is expected to generate net profits of RM70m plus (not accounting for dividends payable) on completion.

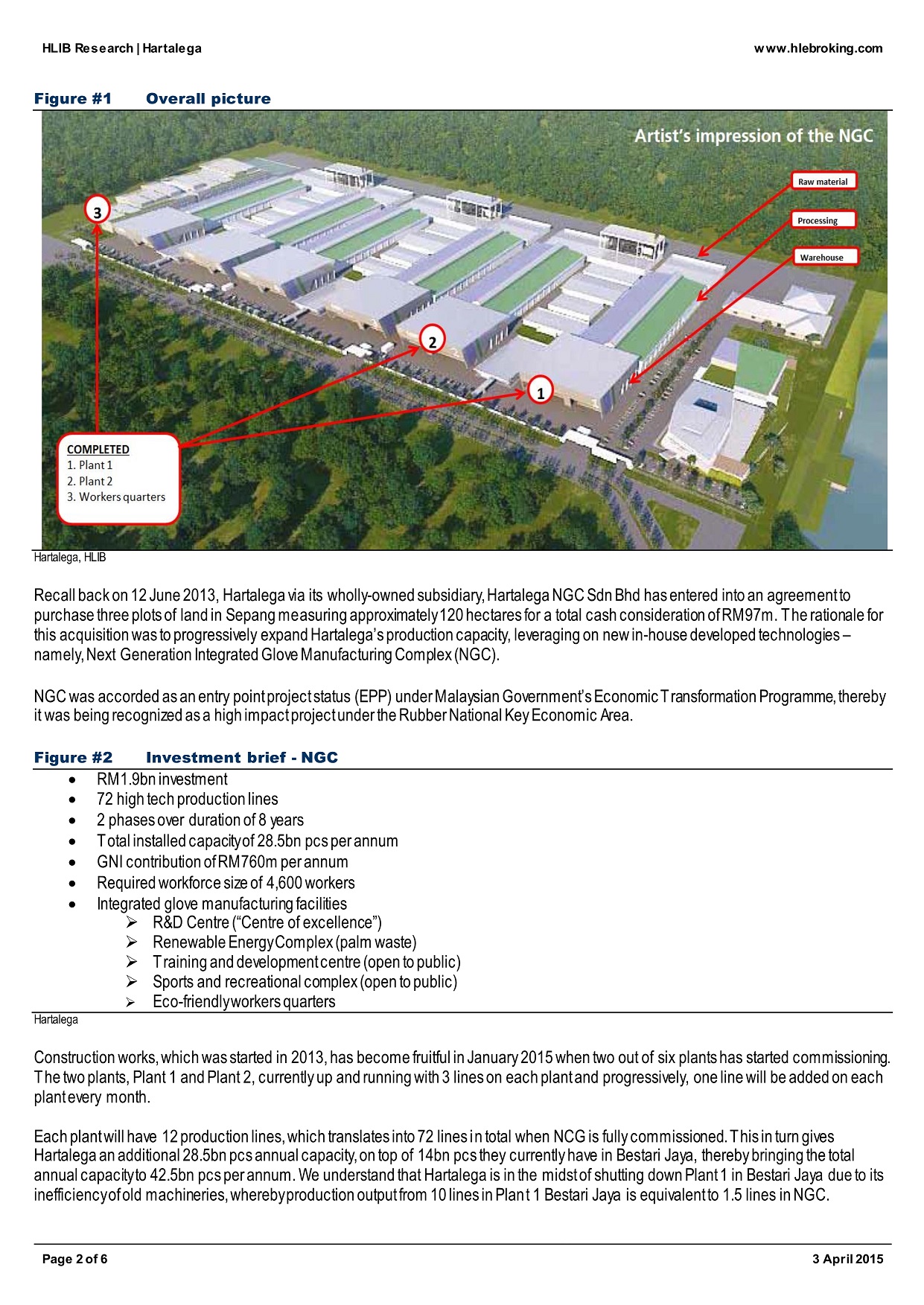

The proof of the pudding is in the eating and as a testimony to our conviction that demand growth still exceeds capacity growth, we at Hartalega will be expanding our capacity almost four times in the next 6 to 8 years (to complete by 2018-2020) in our new expansion program at Sepang called Hartalega NGC which will begin between December 2012 to May 2013. Our objective is to expedite the expansion program but this will depend on other factors like recruitment of the necessary labour. We have set aside a budget to recruit ahead of time and this is indicative of our seriousness of intent and total conviction that the global demand is resilient to absorb capacity from our major expansion program.

We planned this long term expansion plan three years ahead when we implemented our Human Resource Transformation program to improve productivity and attract and retain talent back in 2010. Coupled with our detailed market studies and listening attentively to customer demand and market trends, we decided that the market was ripe for a sustained expansion plan.

The recent maneuvers by our peers would only put us on the defensive with no new capacity to meet market burgeoning needs. We therefore find it imperative to launch Hartalega NGC to consolidate our position as market leader and counter production capacity increase by our peers.

The following states the estimated capex requirements of Hartalega NGC:

We will build 7 plants of 10 lines each at a cost of about RM180m per plant. The land will cost about RM100m while the infrastructure will cost about RM180m.

We will have a frontloaded capex of about RM375m for 2013 assuming land cost of RM100m, RM180m for plant 7 and RM100m for infrastructure.

Thereafter, we will incur another RM275m for 2014 assuming RM180m for plant 8 and RM100m for infrastructure.

The following years will incur RM180m for building each plant per year.

So the summary of our capex plan going forward is:

2013 = total 380m ie 180m Plant 7, 100m infrastructure, 100m land

2014 = total 280m ie 180m Plant 8, 100m infrastructure

2015 = total 180m ie 180m Plant 9

2016 = total 180m ie 180m Plant 10

2017 = total 180m ie 180m Plant 11

2018 = total 180m ie 180m Plant 12

2019 = total 180m ie 180m Plant 13

Total = 1560m

This will be funded by the following:

2013 = 100m land loan, 163m cash in bank, 110m net cash flow from Plant 1-5 (after deducting dividends payable of RM90m), 30m net cash Plant 6 cash flow contribution of RM30m plus after deducting dividends, assumed 2/3rds exercise 74m warrants @ RM4.41 strike price since the share price is quoting at premium is RM204m = RM607m

The funding of RM607m (2013) is enough to fund the capex requirement of RM380m (2013) and the progressive profit contributions from building the Plants will be enough to pay for the building of Plants 8 to 12 when completed.

Typically, we calculate the following formula to estimate net profit from each plant ie:

40,000 pieces per hour x 24 hours x 30 days x 12 months x 10 production lines x 0.85 CU

= 2.9376 billion pieces per annum per Plant x RM110 per 1,000 pieces x 0.22% profit margin

= RM71m net profit per Plant

We estimate that when we complete Plant 6 right through Plant 13 (8 additional Plants), we will obtain a profit of RM 71m x 8 Plants = RM568m

We add this RM568m net profit to our current net profit of RM200m from five existing Plants = RM768m net profit

Assuming our PE is 16 times (which is 2 points higher than rubber glove sectorial average of 14 times), we can obtain a hypothetical market share price of:

16 PE x RM768m/731m number of shares = RM16.80 share price

The forecasted market capitalization of Hartalega is therefore RM16.80 market price x 731m number of shares = RM12.2 billion which is 3.7 times current Hartalega market capitalization of RM3.28 billion assuming share price of RM4.50

We will maintain our dividend policy of minimum pay-out of 45% and am in position to maintain the minimum dividend pay-out despite our expansion program capex.

- 2012-10-30

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-23

HARTA2024-11-22

HARTA2024-11-21

HARTA2024-11-21

HARTA2024-11-21

HARTA2024-11-14

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-13

HARTA2024-11-12

HARTA2024-11-12

HARTA2024-11-12

HARTA