Kossan - World's No 2 Glove Maker Ready for Share Buyback After Rout

ss20_20

Publish date: Sat, 12 Mar 2016, 12:28 PM

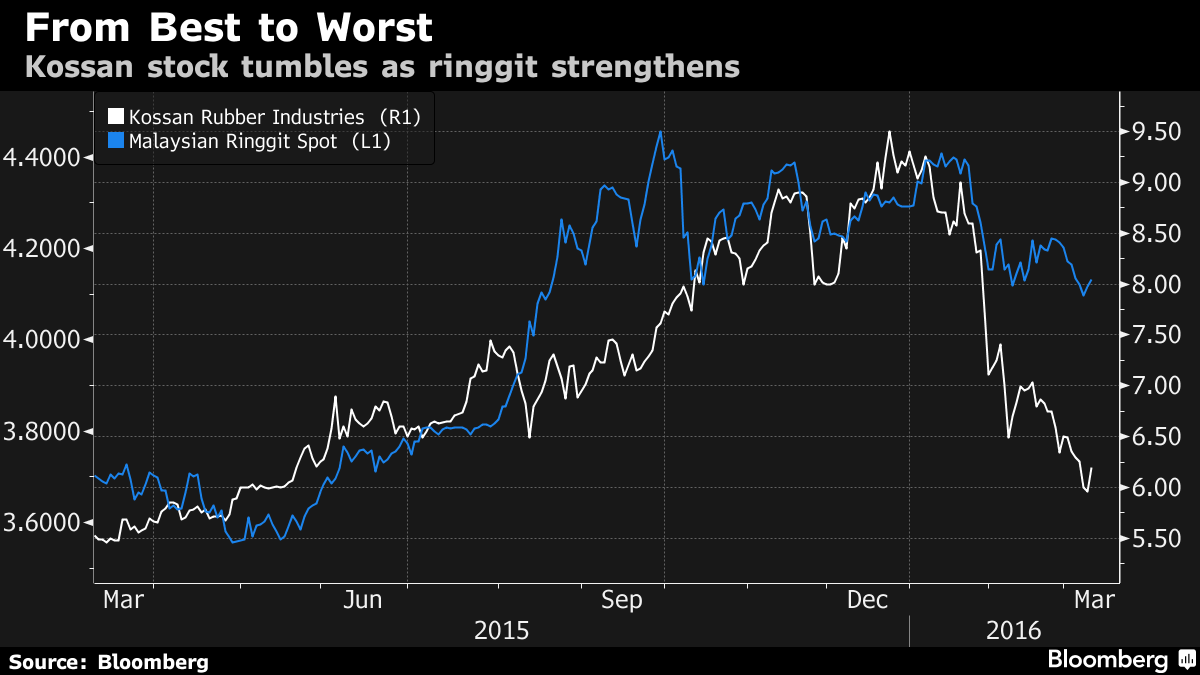

Kossan Rubber Industries Bhd., the world’s second-largest glove producer, is ready to buy back its shares for the first time in five years after a rebound in the ringgit sent the Malaysian exporter’s stock plunging from a record reached in December. The shares rallied.

The 35 percent slump in the shares has prompted the company to consider a buyback, and investors with a long-term horizon should also consider snapping up the stock as it is “already low right now,” Lim Kuang Sia, its founder and chief executive officer, said in an interview. The company is seeking acquisitions and expects another record profit this year, he said. The stock gained 4.8 percent at close in Kuala Lumpur, the most in seven weeks.

“Investors are worried that exporters will be in trouble because of the strengthening ringgit. To me, it’s a wrong message,” Lim, 63, said on Wednesday at the company’s headquarters in Klang, outside Kuala Lumpur. "Business is as usual. We already have a mandate for buybacks. In fact I can even buy if I want to tomorrow.”

Exporters from Kossan and Top Glove Corp. to Malaysian Pacific Industries Bhd. were the darlings of 2015, surging more than 100 percent, after the ringgit’s plunge to a 17-year low made their goods cheaper for international buyers and boosted the value of their overseas sales. As Asia’s worst-performing currency rebounded this year, investors who sought refuge in these companies bailed out, spurring a rout in the shares. Kossan is the worst performer among Malaysia’s 100 biggest companies this year.

Kossan posted a 40 percent surge in 2015 profit to a record 203.3 million ringgit ($49 million), while net income at Top Glove, the world’s biggest rubber-glove producer, jumped 55 percent to 280.1 million ringgit. The ringgit sank 19 percent last year, battered by slumping oil prices and China’s devaluation of the yuan. The Malaysian currency is up 3.9 percent this year.

The drop in Kossan stock has dragged valuations to 16.2 times its 12-month projected earnings, the lowest level in 14 months. “If you ask me, if investors are looking on a longer term basis, the share price is already low right now,” he said.

The company has 10 buy ratings out of 16 research houses tracked by Bloomberg. It is trading at the widest gap on record between its 12-month consensus target price of 8.46 ringgit, with a 37 percent upside.

Capacity Expansion

Kossan’s Lim downplayed the impact of the weaker ringgit on its surge in 2015 earnings, saying it benefited more from its new plant, which started in the third quarter and boosted capacity. The company “most likely will have another double-digit growth this year,” he said, referring to its profit prospects.

Kossan has a five-year plan to double its manufacturing capacity to 44 billion pieces of gloves a year by 2020 to meet growing demand, he said. The company will boost automation at its factories and cut the number of foreign workers it employs by about 70 percent in the next two years, he said, after the government froze the recruitment of workers from abroad in February.

The company is searching for acquisitions to complement its rubber-glove manufacturing business, he said. While there are potential targets, prices are still high, he said.

Bloomberg.com | 10 Mac 2016

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-07

KOSSAN2024-08-07

KOSSAN2024-08-07

KOSSAN2024-08-07

KOSSAN2024-08-07

KOSSAN2024-08-06

KOSSAN2024-08-06

KOSSAN2024-08-06

KOSSAN2024-08-06

KOSSAN2024-08-06

KOSSAN2024-08-05

KOSSAN2024-08-05

KOSSAN2024-08-02

KOSSAN2024-08-01

KOSSAN2024-08-01

KOSSAN2024-08-01

KOSSAN2024-08-01

KOSSAN2024-07-31

KOSSAN2024-07-31

KOSSAN2024-07-31

KOSSAN2024-07-31

KOSSAN2024-07-31

KOSSAN2024-07-31

KOSSAN2024-07-30

KOSSAN2024-07-30

KOSSAN2024-07-30

KOSSAN2024-07-30

KOSSAN2024-07-29

KOSSANMore articles on Kossan Rubber Industries

Created by ss20_20 | Oct 24, 2015