(StockPickKLCI) - HUAAN is worth at least 55 sen? > 70% UPSIDE

rookie8833

Publish date: Tue, 31 Oct 2017, 08:26 PM

1. Producer of metallurgical coke. Sino Hua-An International Berhad ("HUAAN") has been listed on the Main Board of Bursa Malaysia for more than 10 years. Its business is production and sale of metallurgical coke ("Coke"). Its website says that Coke contributes 79% to the revenue (21% from other by products). HUAAN business is supported by its 1.8 million tones per annum production plant in Linyi City, Shandong Province, China. It employs around 1500 workers.

To fully understand what HUAAN does you can visit their website here

http://www.sinohuaan.com/operations.html

2. What is Coke? This is the picture of Coke (from HUAAN website).

In this industry, the producer buys coal and process it into COKE. The demand for COKE is from the steel industry as it is an important input in the steelmaking process. The process is called blast furnace. Again, HUAAN website provides an excellent explanation to help investors understand its business as shown in the picture below.

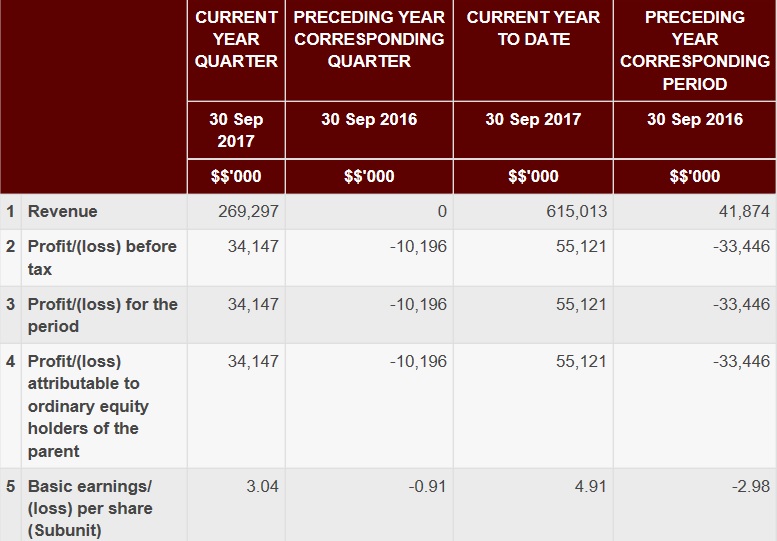

3. TURNAROUND STORY (3QFY17 Net Profit of RM55.1m vs. RM10.2m Loss last year). Accordingly, EPS is now at positive at 3.04sen (vs. negative 0.91 sen in 3QFY16). Reason for the earnings surge can be seen below. It is mainly due to better average coke price of RMB2,043 per tonne in 3QFY17 and higher sales volume of 210,000 tonnes.

4. The best has yet to come...up to the year 2030 due to OBOR! Do you believe that One Belt One Road (OBOR) will be successful? If YES, then HUAAN is definitely one of the direct beneficiary. The OBOR mega project will need RMB2 trillion steel for the highspeed rail project from the year 2017 to 2030. As it is, we are now in the 4th quarter of 2017 which is just the beginning of the steel demand pickup period. I take the view that OBOR will be successful and it is going to be fastest than expected (JUST LIKE HOW THINGS FROM CHINA ALWAYS COMPLETED FASTER THAN THE REST OF THE WORLD).

5. 70% Upside ??? Value > 55 sen per share. There is more than 70% upside that I am looking at. I think that the Company is worth at least 9x PE. The 9x PE is already at 25% discount against ANNJOO and MASTEEL (both trading at historical PE of 12x). The 25% discount is to account for the "China stock perception" in the near term (but I expect this to diminish once HUAAN starts giving dividend consistently over the next 2 years).

In 9M17, HUAAN already make 4.91 sen of EPS. How much are they going to make for full year?

I conservatively expect a full year FY17 EPS of 6.00 sen (Let's just assume a small 1.09 sen for 4Q17 which should be achievable).

What about FY18?

Most conservative scenario = 6.11 sen (assuming only 2% earnings growth in FY18)

Bullish scenario = 6.90 sen (assuming 15% earnings growth)

Value???

Most conservative scenario = 9x PE * 6.11 sen = 55 sen

Bullish scenario = 9x PE * 6.90 sen = 62 sen

HUAAN Share Price closed at RM0.31 as of 31-Oct-2017.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

You continue eating your durian. Don't ah chee ah chor. Haha.. I'm humble one.

2017-10-31 20:53

You chase u die ....... y? Coke price down sharply from peak 2500 during September to 1650 now ..... next q result .... one word for u all DIE

2017-11-01 06:09

Balance sheet shows accumulate loss up to almost half of the shareholder funds, how to use PE9??

2017-11-01 08:29

ilovehits

My very own TP $0.60 within 3 months.

2017-10-31 20:47