MBL - LOW price! LOW PE! Better PERFORMANCES EXPECTED!

jokerforever21

Publish date: Thu, 11 May 2017, 07:21 PM

WHY RECOMMEND BUY?????

1. Company pospect

In the article below it stated that MBL have decided to build a new factory to double its production capacity. This is mainly due to the current high demand which give it's existing factory almost 90% utilisation rate. Meaning said that the company have a thick order book!

Extracted: http://www.theedgemarkets.com/article/muar-ban-lee-double-output-amid-rising-demand

How to fund the expansion?

MBL have stated that their existing land would EASILY worth RM 15million as it is a very strategic location. With that, they would have sufficient cash flow for expansion or even EXCESS!

Extracted: http://www.theedgemarkets.com/article/muar-ban-lee-double-output-amid-rising-demand

On top of their local expansion of factory, MBL also actively looking out for opportunities in indonesia, as indonesia market for palm oil related business is very HUGE. This is evident that they have recently (Oct'16) purchase 33% stake in Indonesian PK crushing plant operator PT Banyuasin Nusantara Sejahtera and it has already POSITIVELY contributing to the company performance for the last QR 2016. As such we're expecting more to come.

Management define MBL product DEMAND as "very bright". As such, we are projecting that coming QR we can see strong performances deliver by the company. Besides, they also mentioned in the article that they are CONFIDENT that they are able to achieved DOUBLE-DIGIT GROWTH in revenue for year ending 2017.

Extracted: http://www.theedgemarkets.com/article/muar-ban-lee-double-output-amid-rising-demand

2. Newly acquired PT Banyuasin Nusantra Sejahtera - PK crushing plant operator

As evident of expansion, they have recently acquired new crushing plant in Indonesia. We expect this investment to positively contribute to MBL performances.

Extracted: http://www.theedgemarkets.com/article/muar-ban-lee-double-output-amid-rising-demand

Extracted from: MBL 3rd QR 2016.

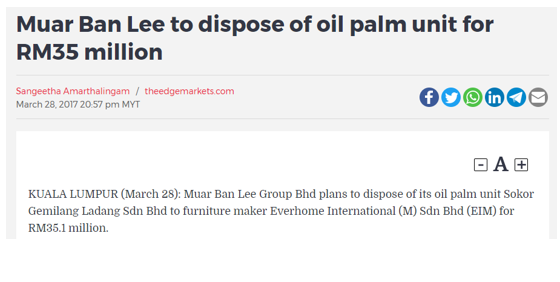

3. Recent sale of subsidiary - Sokor Gemilang Ladang Sdn Bhd

Recently, MBL have signed MOU to DISPOSE their oil palm unit Sokor Gemilang Ladang Sdn Bhd for a consideration of RM 35.1million.

With book value of RM 24.75mil, the disposal of subsidiary would give the company better cash flow in expansion and pairing down their borrowings.

Extracted:http://www.theedgemarkets.com/article/muar-ban-lee-dispose-oil-palm-unit-rm35-million

Extracted: http://www.mbl.com/pdf/MBL%20-%20Annual%20Report%202015.pdf

Extracted:http://www.mbl.com/pdf/28032017%20-%20MOU%20for%20propose%20disposal%20of%20SGLSB.pdf

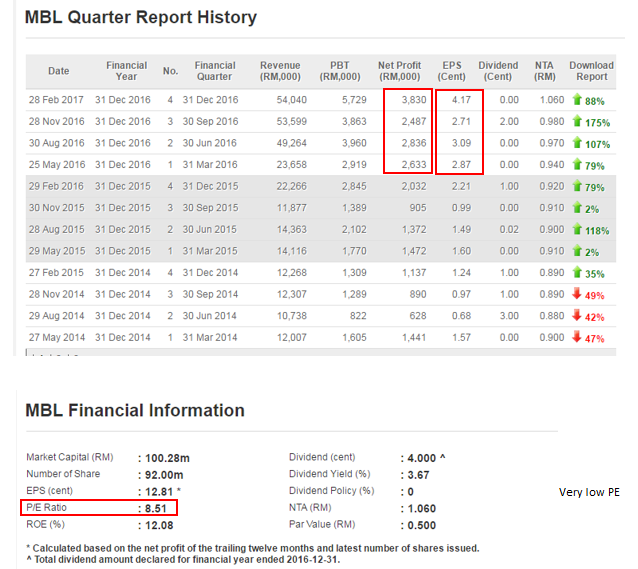

4. Financial Highlights

Conclusion:

To wrap up, MBL have showed signs of EXPANSION, PERFORMANCES and with low PE ratio, share price is trading at DISCOUNTED price.

With the recent plan of expansion and also strong order book as mentioned above, we expect company to deliver excellent results for FY 2017.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Tai KT

One problem , Palm kernel oil drop sharply since highest in Jan17 at Rm7864/tons to Rm5451/tons on Mar17.

2017-05-11 21:15